by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday @EquityClock

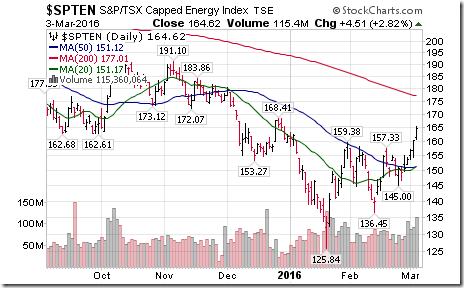

Energy and Financials break out as analysts adjust expectations.

Technical action by S&P 500 stocks to 12:30: Surprisingly bullish. 17 S&P 500 stocks broke resistance. 2 broke support: $CERN $MON.

Editor’s Note: After 12:30 PM, another 8 S&P 500 stocks broke resistance: AON, C, CVS, IP, LEG, LVLT, RIG and USB.

Notable among U.S. stocks breaking resistance were energy stocks: $APA, $BHI, $CHK, $COG, $MUR, $NFX, $OKE.

Energy stocks lead TSX higher. Breakouts: $CNQ.CA, $ECA, $PWT, $PPY.CA.

Nice breakout by Cameco $CCJ above $12.54 to complete a base building pattern.

Strength in Cameco $CCJ triggered completion of a base building pattern by the Uranium equity ETF $URA

Nice breakout by BMO Equal Weight Bank ETF ZEB.CA above $20.95 to complete a base building pattern!

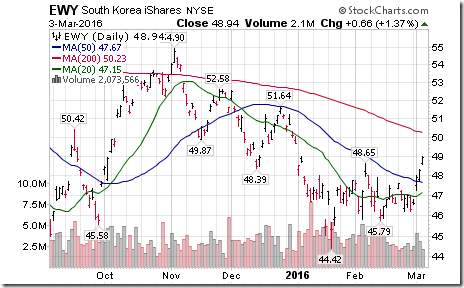

Nice breakout by South Korea iShares $EWY above $48.65 to complete a base building pattern!

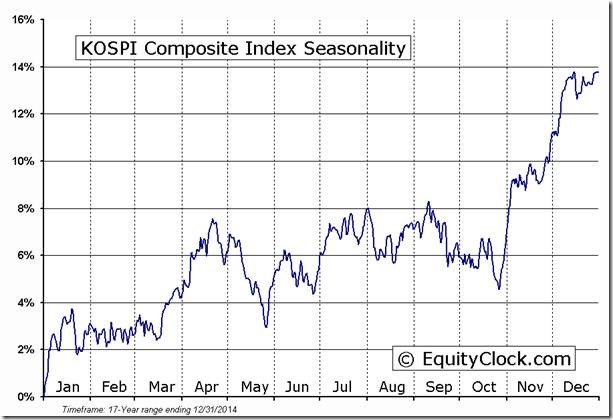

‘Tis the season for the South Korean Index KOSPI to move higher to mid-May!

Nice breakout by Europe 350 iShares $IEV above $38.02 to complete a double bottom pattern!

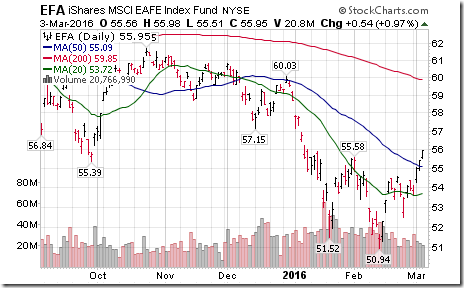

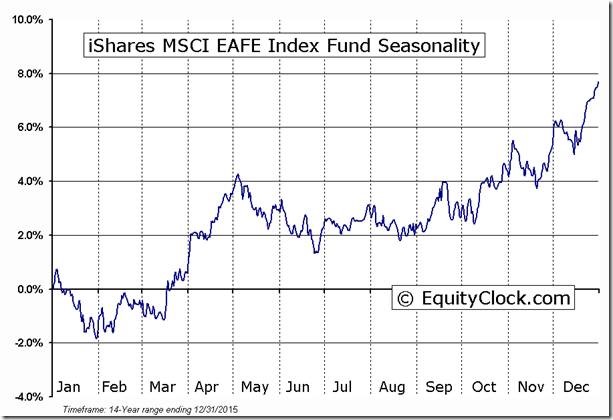

Equity markets outside of North America $EFA completed a double bottom pattern on a move above $55.58.

‘Tis the season for equity markets outside of North America $EFA to move higher to early May!

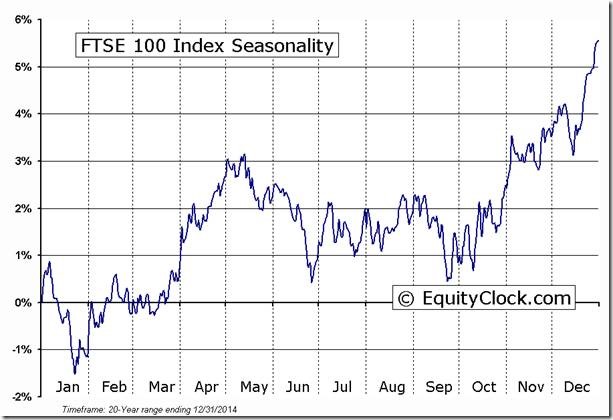

Nice breakout by United Kingdom iShares above resistance at $15.45 to complete a double bottom pattern!

‘Tis the season for the London FTSE Index to move higher into mid-May!

Keith Richards’ Globe and Mail Column

Headline reads, “An investment strategy for the financially fit”. Following is a link:

Trader’s Corner

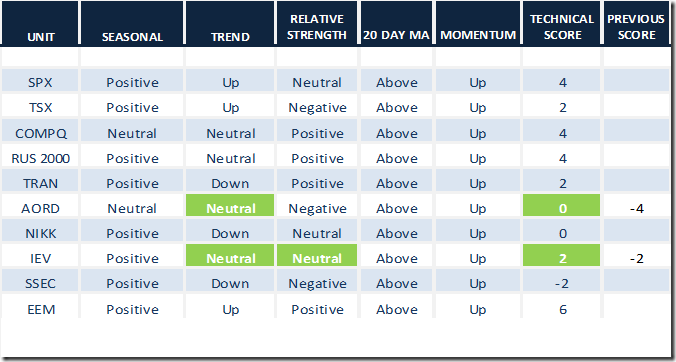

Daily Seasonal/Technical Equity Trends for March 3rd 2016

Green: Increase from previous day

Red: Decrease from previous day

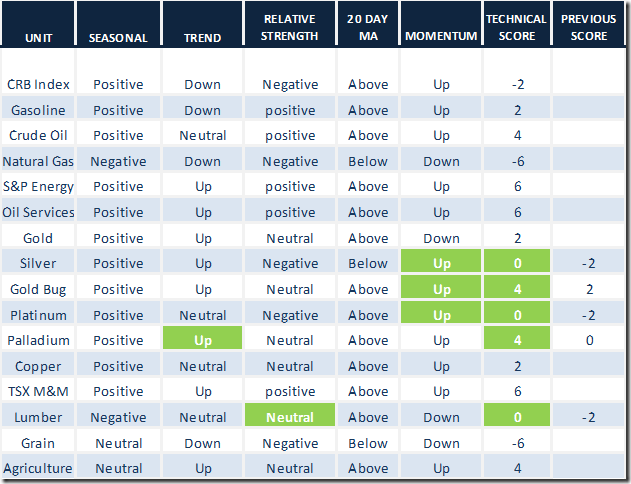

Daily Seasonal/Technical Commodities Trends for March 3rd 2016

Green: Increase from previous day

Red: Decrease from previous day

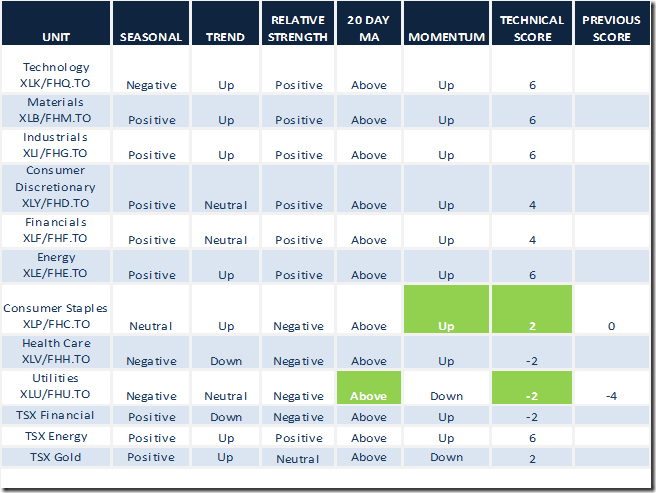

Daily Seasonal/Technical Sector Trends for March 3rd 2016

Green: Increase from previous day

Red: Decrease from previous day

Other Interesting Charts

Add French iShares to the list of European equity indices and related ETFs that are breaking above a base building pattern. ‘Tis the season for the Paris CAC Index to move higher!

Brazil iShares was the highlight gainer yesterday. ‘Tis the season for strength in the Bovespa!

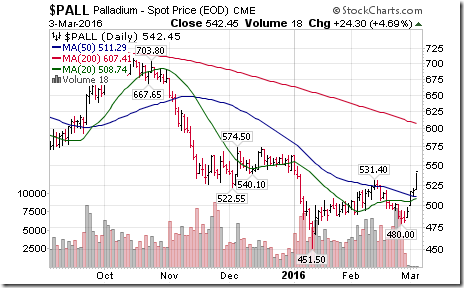

Growing demand for Palladium used in catalytic converters by the auto industry triggered a nice reversal pattern.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca