High-Yield Investors Face a Bigger Risk than Volatility

by Gershon Distenfeld, Senior VP, Director, High Yield, AllianceBernstein

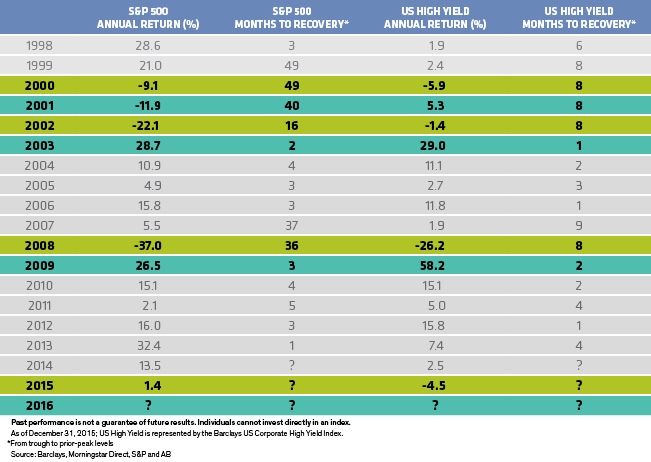

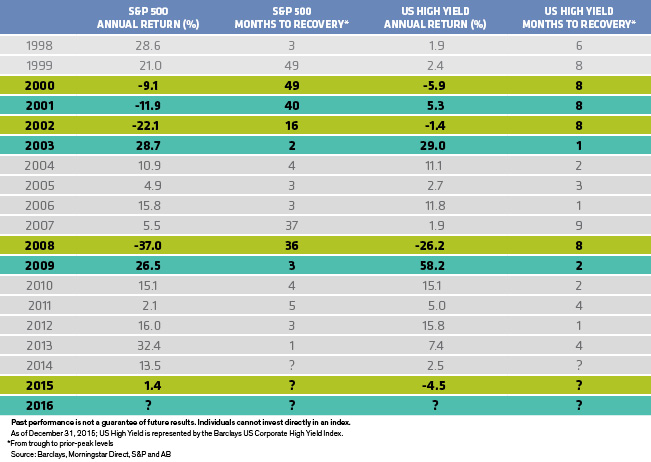

In 2016, pulling out of the market prematurely may be a bigger risk for high-income investors than ongoing volatility. Historically, speedy recoveries have followed US high-yield drawdowns.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Gershon Distenfeld, Director—High Yield

Gershon M. Distenfeld is Senior Vice President and Director of High Yield, responsible for all of AllianceBernstein’s US High Yield, European High Yield, Low Volatility High Yield, Flexible Credit and Leveraged Loans strategies. He also serves on the Global Credit, Canadian and Absolute Return fixed-income portfolio-management teams, and is a senior member of the Credit Research Review Committee. Additionally, Distenfeld co-manages the High Income Fund and two of the firm’s Luxembourg-domiciled funds designed for non-US investors, the Global High Yield and American Income Portfolios. He has authored a number of published papers and initiated many blog posts, including “High Yield Won’t Bubble Over,” one of the firm’s most-read blogs. Distenfeld joined the firm in 1998 as a fixed-income business analyst. He served as a high-yield trader from 1999 to 2002 and as a high-yield portfolio manager from 2002 until 2006, when he was named to his current role. Distenfeld began his career as an operations analyst supporting Emerging Markets Debt at Lehman Brothers. He holds a BS in finance from the Sy Syms School of Business at Yeshiva University and is a CFA charterholder. Location: New York

Related Posts

Copyright © AllianceBernstein