Directional Calls are a Waste of Time for Investors

by Michael Batnick, The Irrelevant Investor

Long before Jim Cramer’s record was being dissected, Alfred Cowles was skeptical of the claims made by stock market pundits. Cowles, who later founded the Cowles Foundation for Research and Economics, spent years working on a paper published in 1933, “Can Stock Market Forecasters Forecast?

His mission:

“It seemed a plausible assumption that if we could demonstrate the existence in individuals or organizations of the ability to foretell the elusive fluctuations, either of particular stocks, or of stocks in general, this might lead to the identification of economic theories or statistical practices whose soundness had been established by successful prediction.”

As you might imagine, results were mixed, showing that experts lacked the ability to predict the future. Consider that “In 1931, when the market decline 54 per cent, there were sixteen bullish forecasts to every three bearish.”

It appears that their abilities were no better than random.

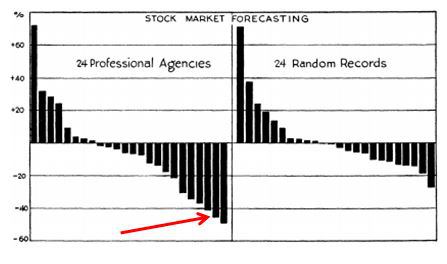

“The chart indicates that where forecasting agencies made gains, even the greatest of these lay within limits equalled by the best of our 24 imaginary records representing random action at random intervals. But the extremer losses of the forecasters tended to exceed the losses registered by the least successful of our 24 records of purely chance operations.”

Cowles concludes:

“Twenty-four financial publications engaged in forecasting the stock market during the 4 1/2 years from January 1, 1928, to June 1, 1932, failed as a group by 4 per cent per annum to achieve a result as good as the average of all purely random performances. A review of the various statistical tests, applied to the record of this period, of these 24 forecasters, indicates that the most successful records are little, if any, better than what might be expected to result from pure chance. There is some evidence, on the other hand, to indicate that the least successful records are worse than what could reasonably be attributed to chance.”

Of course we know that people claiming to consistently time the market are lying either to the public, or to themselves. But what usually gets lost in this type of analysis is that one does not need to make these sort of predictions to be a successful investor or to an have effective risk management strategy. In fact, I would argue that more active market participants would be the first to say that making directional calls is mostly a waste of time and energy.

Read the full piece here.