Leveraged Loans Betray The Rally In Stocks

On the puzzling divergence between leveraged loans and stocks

by Jesse Felder, The Felder Report

I’ve written a fair amount about bond market risk appetites over the past year or so. Today, I’m watching the leveraged loan market even more closely because it’s moving in the opposite direction of the stock market across a variety of time frames.

Typically, risk appetites for leveraged loans (as measured by prices relative to same duration treasuries) and stock prices, especially small caps, are very highly correlated. Because leveraged loans are many times a key component of mergers and acquisitions, it makes perfect sense that waning demand for this type of credit investment could make for waning corporate demand for equities (not to mention buybacks). And this is exactly what’s happening right now.

“Where we are seeing it impact behaviors is at the smaller and middle size end of the market so the mid market. Deals are getting to be more expensive. The flex terms in financings have gone up significantly. And our pipeline in private credit so mezzanine, direct lending, and special situations opportunity are up significant as a result of some of the dislocation we’re starting to see…. What has become interesting more recently is what’s happening within the liquid part of the leverage credit markets. So the bank loan, leverage loan market the high yield market…there is a significant reduction in liquidity…if you see a screen price, it doesn’t necessarily mean that that’s achievable on any volume whatsoever and that is creating quite a bit of interesting tension in the markets.” -KKR Head of Global Capital & Asset Management, Scott Nutgall (via Avondale)

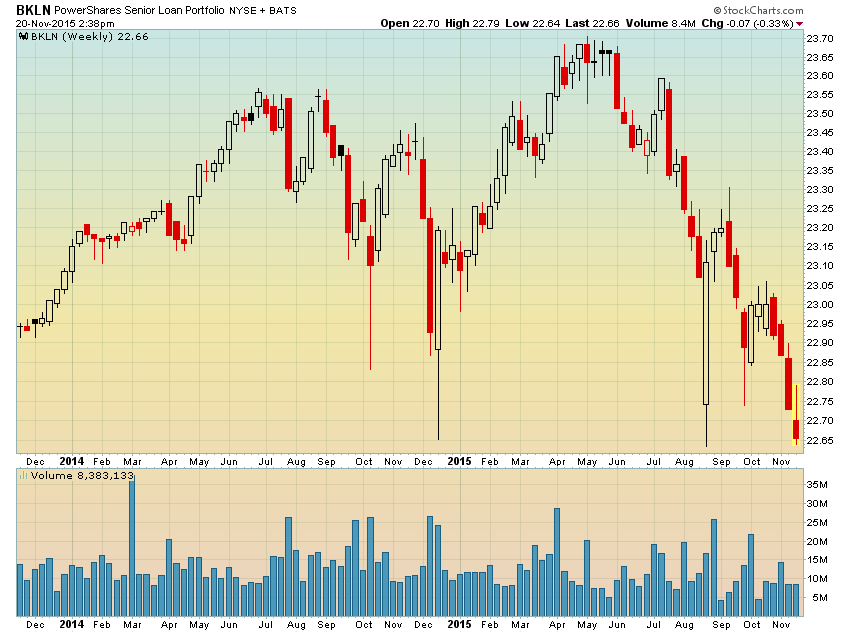

That reduction in liquidity is showing in the market right now as the Leveraged Loans ETF tests multi-year lows amid a modicum of selling pressure.

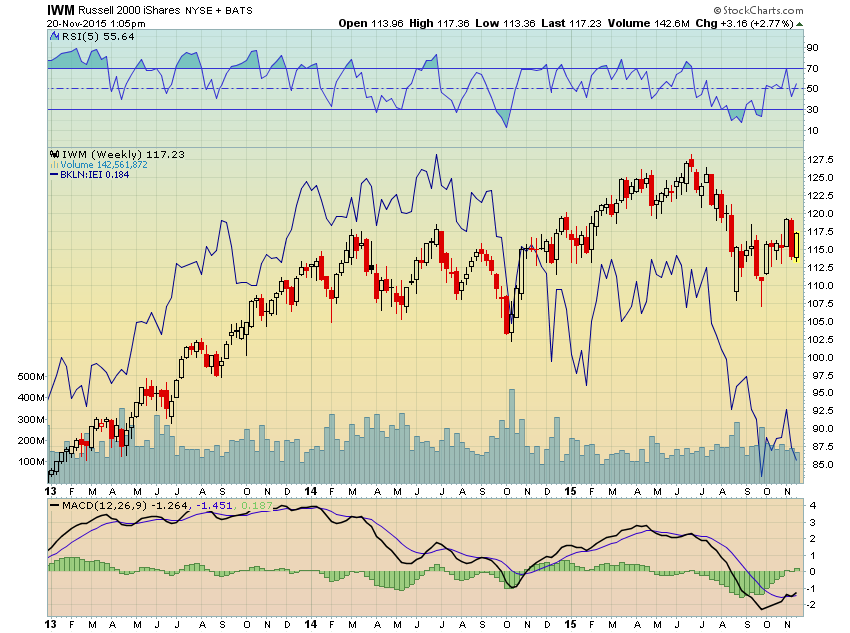

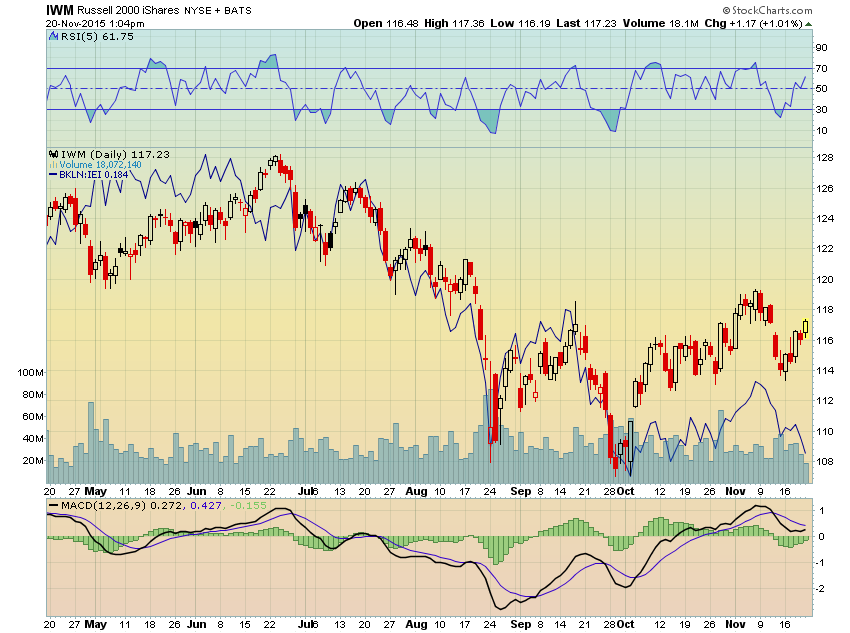

What I find striking is that even as risk appetites for leveraged loans (blue line in the chart below) have deteriorated, stocks have rallied this week:

But it’s not just this week. The entire rally that began in early October has not been confirmed by similar improvement in leveraged loan risk appetites:

In fact, leveraged loan risk appetites peaked over a year ago and have been falling since while stock prices went on to make new highs over the summer. That changed in August when stocks sold off pretty hard but the divergence is still very wide on this time frame:

Former Dallas Fed Chief, Richard Fisher, has warned about the growing risks in this area of the credit market for quite some time saying, “The big banks are lending money on terms and at prices that any banker with a memory cell knows from experience usually end in tears.” As the only member of the Fed with any experience managing risk, I value his opinion highly.

The recent action in the markets suggests we may be getting closer to the point of, “tears.” And because leveraged loans are so highly correlated to stocks, I think equity investors would do well to take notice.

For more on the interplay between stocks and bond market risk appetites subscribe to The Felder Report PREMIUM.