James Paulsen: A Shift in Market Mathematics

by James Paulsen, Ph. D., Chief Investment Strategist, Wells Capital Management

Historically, the stock and bond markets have done much better when the labor unemployment rate is above 5% (i.e., above full employment). Indeed, since 1948, annualized stock returns have been nearly twice as strong and long-term government bond returns have been almost four times greater compared to their respective returns when the unemployment rate is at or below 5%. Moreover, both stocks and bonds have tended to su! er more frequent monthly declines in fully employed economies. Finally, on average during the post-war era, once the unemployment rate reaches 5%, a recession has been less than two years away.

Maybe recent stock market struggles will continue or perhaps its impressive rally last week suggests the worst is over. Either way, since the U.S. unemployment rate is about to breach the 5% level, history suggests the mathematics surrounding this stock market are likely to be quite di! erent during the rest of this bull market. This short note o! ers a couple statistics illustrating just how much the investment climate historically has been altered once the economy has reached full employment.

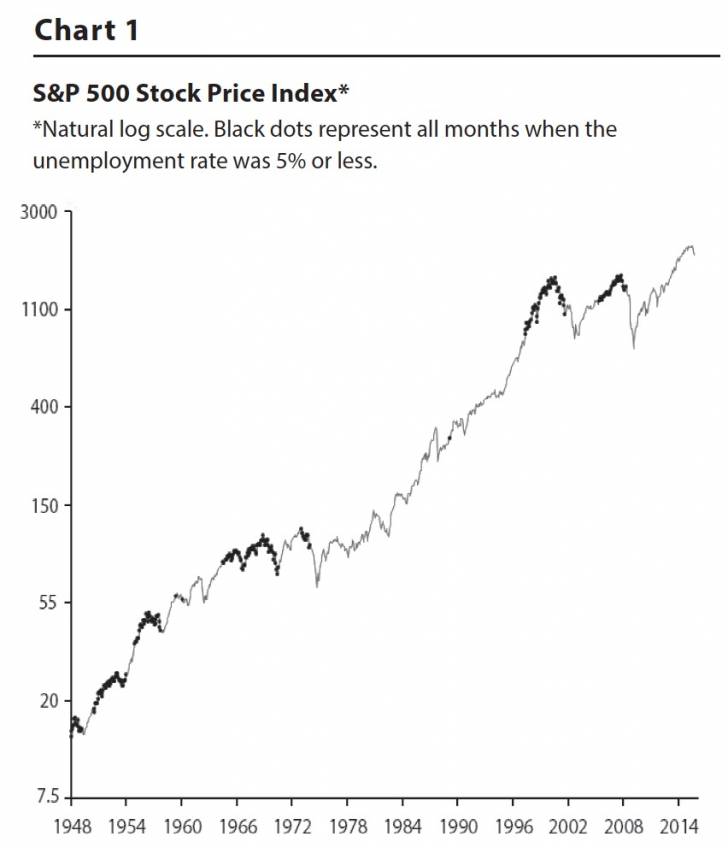

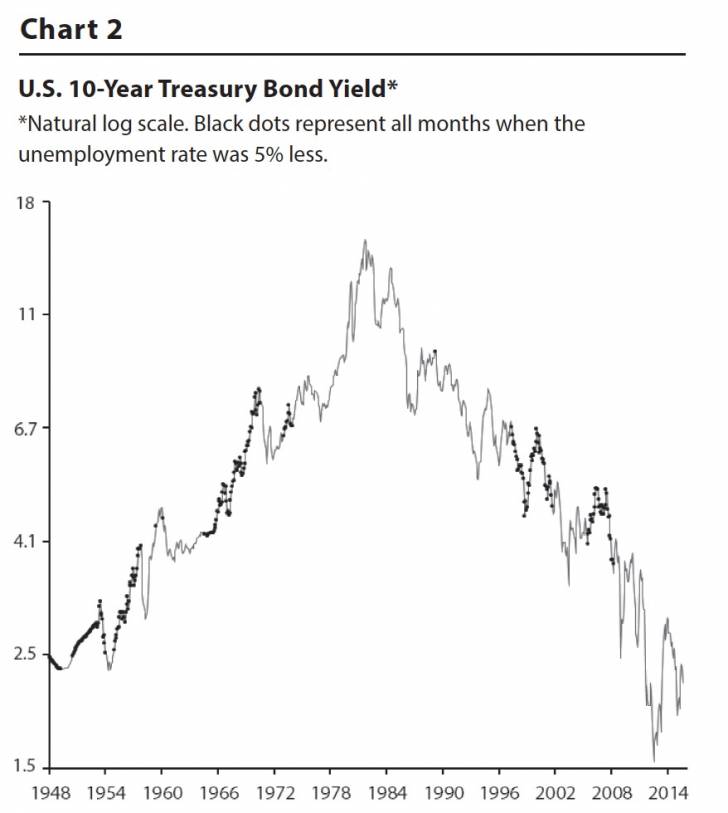

A 5% labor market and the financial markets Charts 1 and 2 show the U.S. stock market and the 10-year Treasury bond yield since 1948 highlighting all periods when the unemployment rate was 5% or less. For bonds (Chart 2), once a 5% unemployment rate is breached, historically yields have almost always risen unless a recession results. The most notable exception was during the late 1990s. Although yields did rise between 1998 and 2000 before the recession began, they declined between 1995 and 1998 even though the unemployment rate was below 5%. In our view, yields fell during this period even though the unemployment rate was below 5% because of strong productivity resulting from the tech investment era. Good productivity results can dampen the negative financial market consequences of full employment (which appears to have been the case in the late 1990s), but as shown, even strong productivity gains during the 1950s were not enough to keep yields from rising once the labor unemployment rate breached the 5% level.

As shown in Chart 1, the stock market has often achieved gains even with the unemployment rate below 5%, sometimes sharp gains. However, most significant gains in the stock market once the unemployment rate declines below than 5% have been associated with the early stages of a new economic recovery (clearly not where we are in the contemporary recovery). For example, the large gains in 1951 and in 1954- 1955 re# ected initial jumps in the stock market associated with the end of a recession.

DOWNLOAD PDF

Read/Download the complete report below:

Copyright © Wells Capital Management