Connecting the dots (10/08/15)

Erik Swarts, Market Anthropology

Expectations of a rate hike this year pulled back appreciably, following last Friday's lackluster pronouncement of just 142,000 jobs added for September - as well as disappointing downward revisions in both previous summer reports for July (-22K) and August (-37K). Through this week's trading, the Fed Fund futures market has essentially ruled out a hike for the upcoming October meeting and placed the probability that they will move in December at just over 35 percent. More importantly, the ballast in the futures market is now shifting to just one rate hike by the Fed through September 2016.

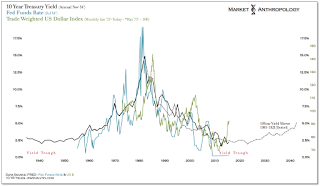

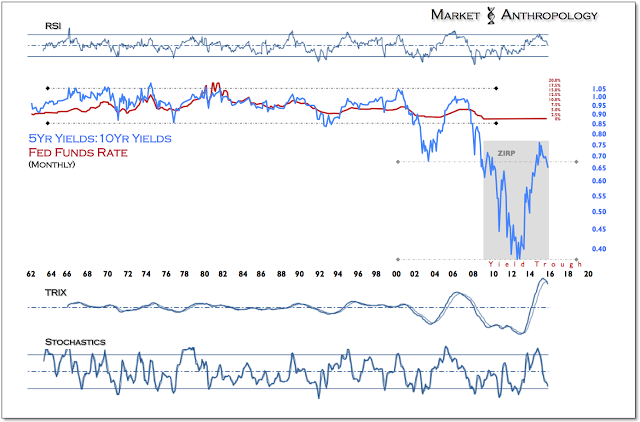

Although further wash-between in the futures market is to be expected, participants bipolar mentality of quickly falling two steps back on disappointing news, then crawling one step forward between signals, continues to work towards slowly narrowing the expectation gap that exists between comparisons to more contemporary tightening cycles (i.e. the FOMC's dot plot projections), and the realities of where the markets reside in the long-term yield trough (see Here).

|

| Figure 1 |

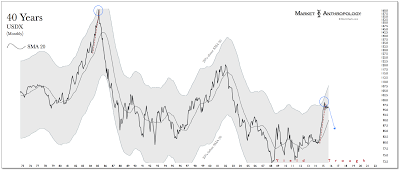

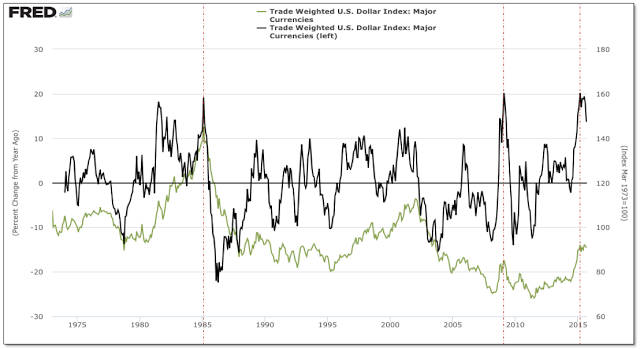

As a result, over the long-term we continue to believe the US dollar will be met with greater head than tailwinds, as ambitious expectations that had previously supported the currency and helped push the US dollar index to a relative performance extreme this March, dissipates.

This outlook is biased by our historic read of the long-term yield cycle, that implies that the potential reach of rate hikes will ultimately be realized to be much closer to current market conditions, than a return to normalcy achieved in previous cycles where the Fed and markets were not encumbered by the structural limitations inherent within the trough (i.e. destructive interference).

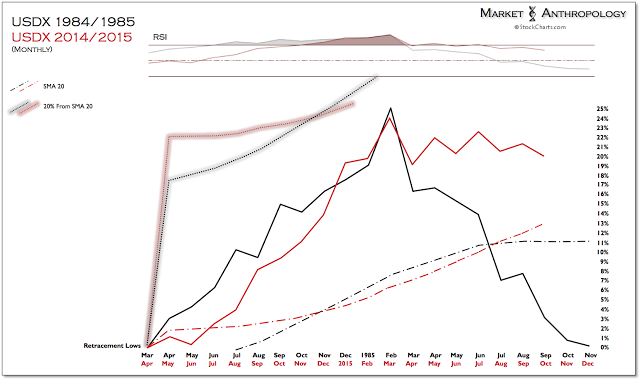

Similar to the "heads yields win, tails they rise" convictions prevalent by participants through the early downtrend in long-term yields in the first half of 2014; the dollar outlook has remained broadly bullish this year - despite the fact that the widely traded US dollar index peaked in early March and has retraced over 6 percent across the balance of the year.

|

| Figure 2 |

While the Fed's preferred measure of the US dollar (broad index) had continued to strengthen throughout the summer and into September; ergo, maintaining convictions and apprehensions within the analyst community that US dollar strength was here to stay - we find those concerns overstated and lacking context, as the broad index essentially just closed the performance gap with the other major dollar benchmarks, on the back of China's modest devaluation of the yuan this August.

|

| Figure 3 |

Along with weakness in the Mexican peso and the Canadian dollar, which together with the yuan made up a majority of the performance gains realized in the index through September, the broad dollar has still underperformed the leading waves of the trade weighted major currencies index, as well as the US dollar index - that naturally tracks the inverse performance between the exchange rate of the world's two largest reserve currencies (EURUSD).

|

| Figure 4 |

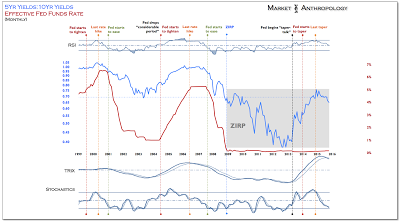

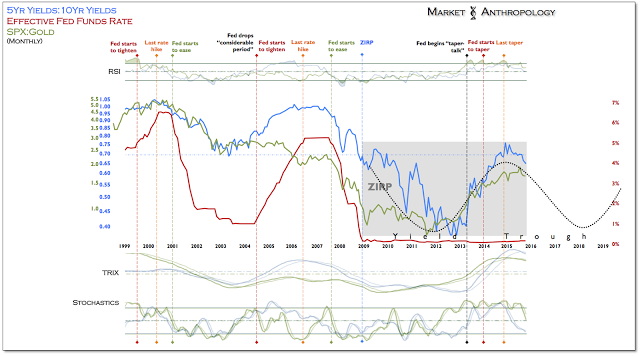

These dynamics are reminiscent of how the relative performance shift in the Treasury markets began to develop with the first mention of the taper in May 2013. As seen in previous tightening cycles, conventional wisdom influenced the markets from expectations of tightening by the Fed and the relative affect found shorter durations along the curve strongly underperforming longer-term Treasuries. The primary difference being that because of where the markets and Fed were situated (i.e the yield trough), the fed funds rate did not move higher with yields.

|

| Figure 5 |

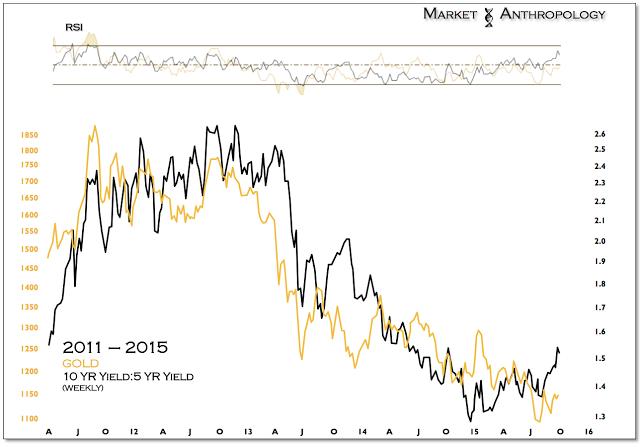

While the 10-year yield first achieved a relative performance extreme at the end of 2013 - and quickly began to retrace the move, shorter-term yields were buttressed by the fear of further actions by the Fed. This is somewhat similar to what transpired in the narrowing of the performance gap between the broad and US dollar indexes this summer, as the much greater weightings of higher beta and emerging market currencies within the broad index, became most susceptible to expectations of impending rate hikes from the Fed this fall.

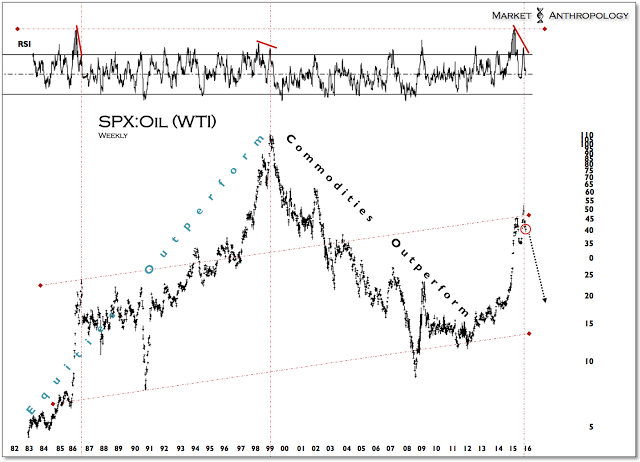

The bottom line, however, is that along with the Fed's completion of QE and the significant move in the dollar, financial conditions have already tightened considerably under the radar since May 2013. This discreteness is representative of the challenges facing participants today in the trough of the long-term yield cycle, where expectations have largely been built around more contemporary comparisons. As such, we find long-term macro opportunities in the markets today extending from exploiting the fallacies of these comparisons, which at the very least we expect will incite mean reversions on a relative basis for markets pushed to extremes on both sides of the performance continuum. I.e., buying emerging markets and commodities relative to US equities and selling the US dollar versus a broad basket of currencies. In addition, on a relative performance basis we believe 5 year yields relative to 10 year yields peaked at the end of 2014, which in the past has indicated that the Fed is much closer to the end of its tightening regime than the beginning (Figure 4 and 14).

|

| Figure 6 |

Moreover, from a big-picture intermarket perspective between the Treasury and currency markets, we've speculated that the significant move in the dollar over the past year will ultimately be confined by the shorter cyclical limitations inherent within the long-term yield trough. Considering the relative performance extreme achieved in the US dollar index this March, or the year-over-year performance of the trade weighted major currencies index (Figure 11) that typically marks exhaustion, we find greater probability that the dollar peaked this year and prefer a market posture that should benefit from what we expect will be another cyclical move lower.

|

| Figure 7 |

This of course will heavily affect commodities, where we continue to find great relative value in oil - as well as the asset class's more emotional proxy of gold. While both markets have yet to outperform US equities with any lasting durability, conditions in the currency and Treasury markets should continue to shift favorably towards sustaining these cyclical shifts for more than just a retracement rally within the trough.

|

| Figure 8 |

|

| Figure 9 |

|

| Figure 10 |

|

| Figure 11 |

|

| Figure 12 |

|

| Figure 13 |

|

| Figure 14 |