Is a double bottom at hand?

by Tiho Brkan, The Short Side of Long

Regular readers of the blog might remember our timely calls on the stock market of the last week of August. For those that have just started reading the blog or for those that might need a refreshment of the recent strategic opinions we wrote about, please refer to these posts:

- 25th of August 2015 – Capitulation Bottom!

- 26th of August 2015 – Bottoming Process

- 28th of August 2015 – Emerging Markets Bottom!

In all three articles, we pretty much noted a similar theme. We called a major low on 25th of August in real time, just as investors emotions clouded their intelligence and common sense. Our outlook was for a strong and sharp rebound, followed by a retest of the crash bottom sometime in September and/or October:

“Short Side of Long is calling a bottom on this stock market correction. We want to make it perfectly clear that there is a very good probability that one should expect a turbulent bottoming process with more selling. A retest of the lows will most likely be in the cards, as V trough bottoms are very rare. However, the panic has already happened as Volatility Index (VIX) jumped to almost 54 points. This was the highest reading since the Global Financial Crisis and second highest reading in almost three decades (’08 was the highest).

We want to repeat ourselves, there is real panic out there right now and contrarians should be ready to act on the buy side. Seasonality for equity markets is usually weak into September and October and we here at Short Side of Long expect either September or October to mark a major low this year. We saw similar outcomes in October 1987, October 1990, October 1998, September 2001, October 2002, October 2008 and October 2011.”

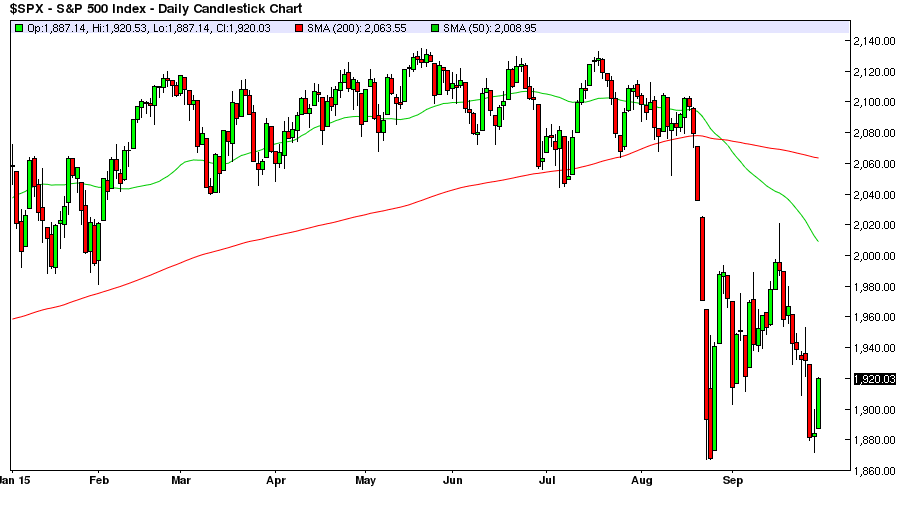

S&P 500 attempts to bottom with a potentially successful retest of lows

We are now potentially seeing a retest of those panic lows from late August, as S&P 500 (NYSE: SPY) came within a few points of the actual bottom. It is still hard to say whether the current bounce will hold, or if more selling will come in October. Sometimes, the bottoming process involves a lower low, which slightly undercuts the initial panic (also know as a bear trap). However, one thing is for sure – markets are very much oversold and sentiment remains bearish.

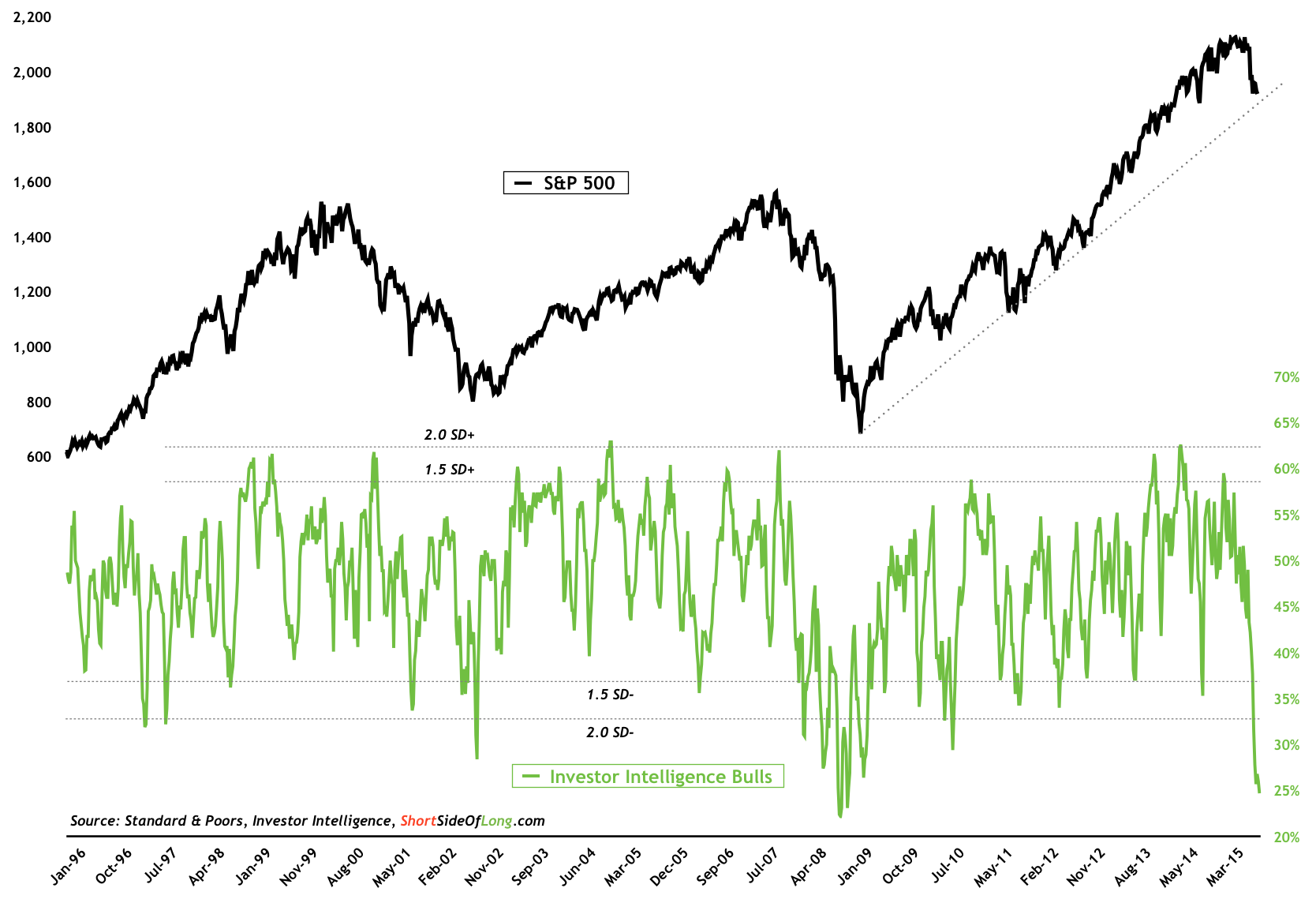

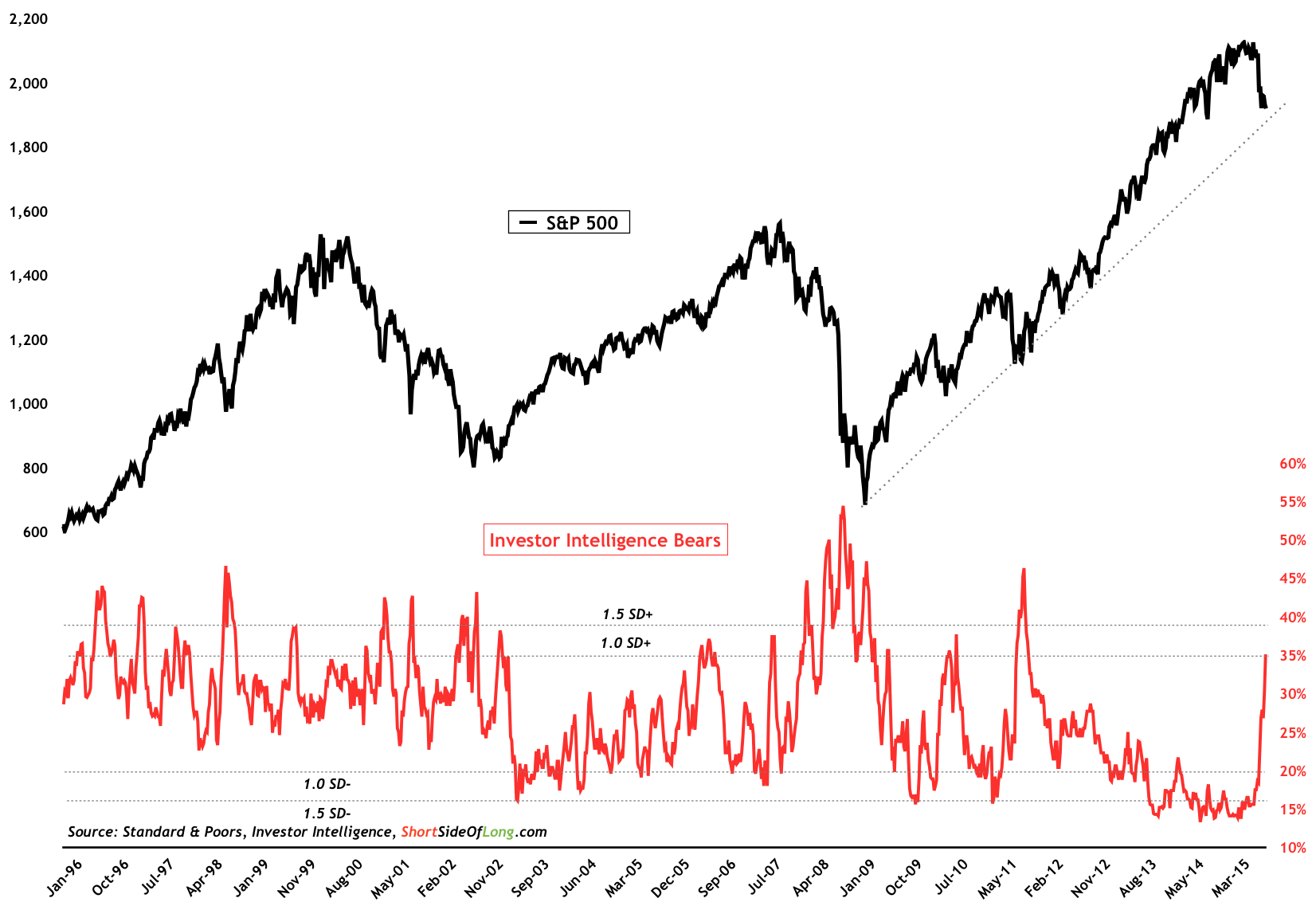

In the recent post we noted two breadth indicators which signal that a proper washout occurred in late August. Moreover, today’s indicator gives us an update on the sentiment via Investor Intelligence Survey. Professional advisors and newsletter editors are definitely running for the hills. Despite the fact that S&P 500 never took out the 25th of August lows, bullish sentiment has continued to drop and sits at some of the lowest levels in decades. Bearish sentiment has continued its rise since 25th of August as well, because it is just so much easier to be bearish when markets aren’t going up.

Despite no new lows in the index, bearish sentiment continues to increase

So have we been buying and what did we buy?

Yes, we have been very active on the bullish side since 25th of August, especially towards Emerging Markets (NYSE: EEM). Mind you, regular readers should remember we were correctly shorting the MSCI EM Index for months before we called the bottom. And yes, we are just about the only bulls on EM & Chinese stocks right now, especially Chinese banks (HSE: 939, 3988, 1398, 1288), which remarkably hold a dividend yield that is higher then their P/E ratio. I’ll tell you something very important, this type of a valuation s extremely rare and you might not see it again in your lifetime. Either earnings will collapse and with it dividends will be cut, or investors have totally overacted.