by Jeffrey Saut, Chief Investment Strategist, Raymond James

“It’s what you learn after you know it all that counts.”

. . . Earl Weaver, professional baseball player, author, TV broadcaster, manager of the Baltimore Orioles

Some of y’all know that I spent years working as the Director of Research and Director of Capital Markets for a Baltimore-based brokerage firm. Accordingly, I met a number of professional sports folks through the law firm Shapiro & Olander, which at the time were the attorneys of choice for a lot of professional athletes, as well as the firm I used for our investment banking department’s legal counsel. One of the folks I met was O’s manager Earl Weaver. When I met him the D-J Industrials were trapped between roughly 3000 and 4000 for a number of years, making for a tough investment environment, similar to what we have experienced year-to-date (YTD). It was during that difficult “upside” consolidation phase for the equity markets (like now, IMO) that Arthur Zeikel, who at the time was the president of Merrill Lynch Asset Management, penned a letter to his daughter about how to manage her portfolio. I like this letter:

Personal portfolio management is not a competitive sport. It is, instead, an important individualized effort to achieve some predetermined financial goal by balancing one’s risk-tolerance level with the desire to enhance capital wealth. Good investment management practices are complex and time consuming, requiring discipline, patience, and consistency of application. Too many investors fail to follow some simple, time-tested tenets that improve the odds of achieving success and, at the same time, reduce the anxiety naturally associated with an uncertain undertaking.

I hope the following advice will help:

A fool and his money are soon parted. Investment capital becomes a perishable commodity if not handled properly. Be serious. Pay attention to your financial affairs. Take an active, intensive interest. If you don’t, why should anyone else?

There is no free lunch. Risk and return are interrelated. Set reasonable objectives using history as a guide. All returns relate to inflation. Better to be safe than sorry. Never up, never in. Most investors underestimate the stress of a high-risk portfolio on the way down.

Don’t put all your eggs in one basket. Diversify. Asset allocation determines the rate of return. Stocks beat bonds over time.

Never overreach for yield. Remember, leverage works both ways. More money has been lost searching for yield than at the point of a gun (Ray DeVoe).

Spend interest, never principal, If at all possible, take out less than comes in. Then a portfolio grows in value and lasts forever. The other way around, it can be diminished quite rapidly.

You cannot eat relative performance. Measure results on a total return, portfolio basis against your own objectives, not someone else’s.

Don’t be afraid to take a loss. Mistakes are part of the game. The cost price of a security is a matter of historical insignificance, of interest only to the IRS. Averaging down, which is different from dollar cost averaging, means the first decision was a mistake. It is a technique used to avoid admitting a mistake or to recover a loss against the odds. When in doubt, get out. The first loss is not only the best, but is also usually the smallest.

Watch out for fads. Hula hoops and bowling alleys (among others) didn’t last. There are no permanent shortages (or oversupplies). Every trend creates its own countervailing force. Expect the unexpected.

Act. Make decisions. No amount of information can remove all uncertainty. Have confidence in your moves. Better to be approximately right than precisely wrong.

Take the long view. Don’t panic under short-term transitory developments. Stick to your plan. Prevent emotion from overtaking reason. Market timing generally doesn’t work. Recognize the rhythm of events.

Remember the value of common sense. No system works all of the time. History is a guide, not a template.

This is all you really need to know.*

Plainly, I like all of Arthur Zeikel’s fatherly investment advice, but if I had to pick just one of his rules it would be, “Don’t be afraid to take a loss. Mistakes are part of the game. The cost price of a security is a matter of historical insignificance, of interest only to the IRS.” This is why ever since the Dow Theory “sell signal” of September 1999 one of my main mantras has been, “Don’t let ANYTHING go more than 15% - 20% against you!” While admittedly I too on occasion have violated this rule, it has always cost me dearly. As Arthur notes, “The first loss is not only the best, but is also usually the smallest.”

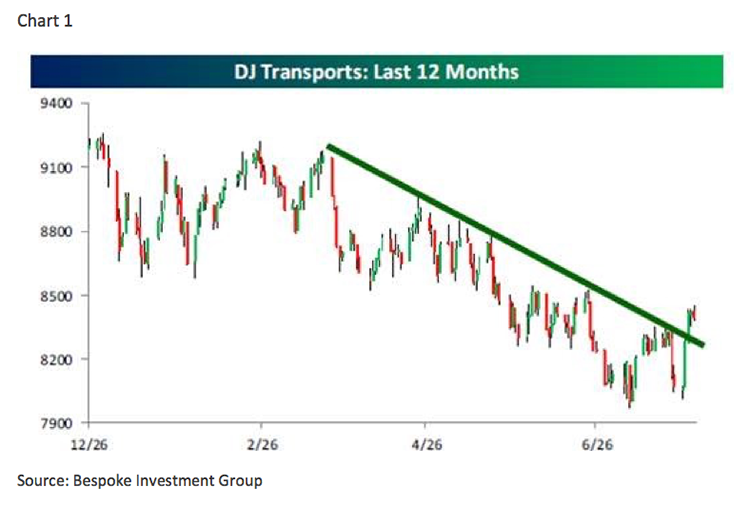

The call for this week: Another Earl Weaver quote is, “The key step for an infielder is the first one, to the left or right, but before the ball is hit.” That is reminiscent of Wayne Gretzky’s famous quote, “I skate to where the puck is going to be,” which is what we attempt to do in the equity markets. That’s true not just with individual equities, but with the overall stock market as well. So as anticipated, given last Monday’s deeply oversold condition, the S&P 500 (SPX/2103.84) bounced exactly off of its 200-day moving average (DMA), which happened to be the low of the week (2063.52). Not as anticipated, the SPX traveled back above where we thought it would stop in the 2080 – 2100 area. The rally, however, has corrected last Monday’s oversold condition, leaving the NYSE McClellan Oscillator now in a short-term overbought position. It is worth mentioning the much-watched D-J Transportation Average (TRAN/8391.96), in last week’s rally, broke out above its downtrend line (see chart on the next page), as well as its 50-DMA. Not to be outdone, the SPX travelled back across its respective 50-DMA for the 31st time this year, which is nearly a record, in what has been the narrowest trading band ever (YTD). Also of interest is that mutual fund “cash levels” are at their lowest level ever and that earnings continue to come in better than expected. Such “mixed metaphors” are what has kept Mr. Market in check, and confused, for most of this year (voilà: narrow range). This is why we continue to trust our “instruments” where our models still suggest lower prices in August. One thing for certain has been this year’s preference for large caps, as reflected by the outperformance of the S&P 500 Market Cap Weight Index (+2.18% YTD) versus the S&P 500 Equal Weighted index (+0.63% YTD); and, this is especially true for the NASDAQ 100 Index (+8.32% YTD) where roughly six large cap names are driving performance. I am writing this Sunday night because I will not be in Monday morning, so I do not have the benefit of looking at the preopening futures. I do see where the Greek stock market got killed on its reopening (-23%), but I doubt if that will have much effect on our markets. That said, if the models continue to be right the SPX should be lower by week’s end.

*When this article was originally published in 1995, Arthur Zeikel was president of Merrill Lynch Asset Management in New Jersey. Copyright 1995, CFA Institute. Reproduced and republished from Financial Analysts Journal, March-April. All rights reserved.

Copyright ©Raymond James