by Ben Carlson, A Wealth of Common Sense

The Barclays Aggregate Index is basically the S&P 500 of the bond markets. Formerly the Lehman Brothers Aggregate Index before 2008 (you can thank Dick Fuld for that), the Barclays Agg is the bond index that all total U.S. bond market index funds are benchmarked to for tracking purposes. The biggest bond fund in the world, the Vanguard Total Bond Market Index Fund, with well over $100 billion in assets is set up to track the Barclays Agg.

It’s a core holding for many investors, both large and small. In general, most broad index funds do a great job tracking their respective markets. This may not be the case with the Barclays Agg anymore. The following comes from a very interesting report on the bond market from Guggenheim Partners:

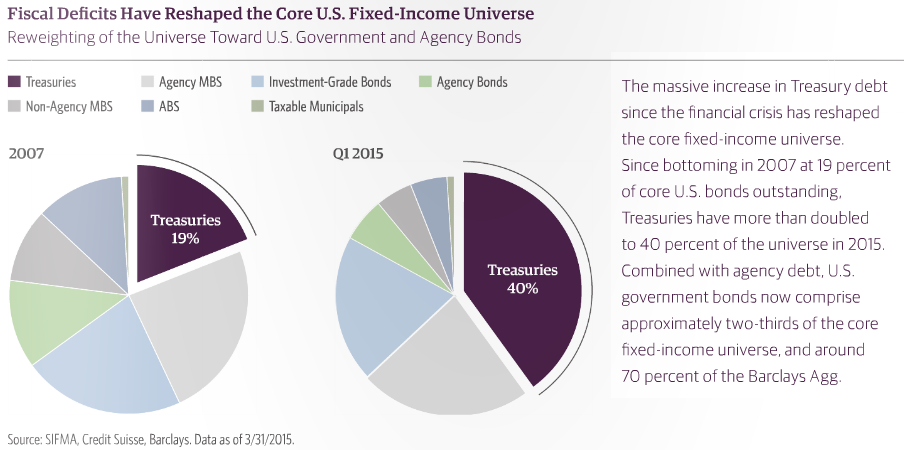

Since its creation in 1986, the Barclays Agg has become the most widely used proxy for the U.S. bond market, with over $2 trillion in fixed income assets managed to it. Inclusion in the Barclays Agg requires that securities are U.S. dollar-denominated, investment grade, fixed rate, taxable, and meet minimum par amounts outstanding. In 1986, the Barclays Agg was a useful proxy for the universe of fixed income assets, which primarily consisted of U.S. Treasuries, agency bonds, agency MBS, and investment-grade corporate bonds — all of which met these inclusion criteria. However, the fixed income universe has evolved over the past 30 years with the growth of sectors, such as ABS, non-agency MBS, originally issued high yield bonds, leveraged loans, and municipal bonds. While the fixed income universe becomes more diversified in structure and quality, the composition of the Barclays Agg is increasingly concentrated in Treasuries due to the massive issuance volume since the financial crisis.

You can see the dramatic shift in the total bond market in this chart from the report:

Treasuries now make up 36% of the Barclays Agg and when you include agency securities, the total U.S. government-related debt comes in at roughly 70% of the total index. The obvious issue here is that this index is heavily weighted in some of the lowest-yielding segments of the fixed income markets. This 70% currently yields just 2% while the overall index yields around 2.4%.

I wonder how many bond investors really know and understand their different risk exposures. Fixed income investors have had it fairly easy over the past few decades. It didn’t really matter where you invested your money in this asset class because you had a tailwind from falling interest rates.

A Guggenheim pointed out, a large number of mutual funds and separately managed fixed income accounts benchmark themselves to this index. Many of their mandates or investors don’t allow them much leeway for straying too far from benchmark weights in terms of duration or the different bond market segments. In a potential low return environment, this could be problematic for investors.

Here are a few thoughts and potential ramifications for investors to consider:

- Will this cause more investors to go further out on the credit risk curve to achieve their return targets? Or has this already happened? Do investors understand the potential risks involved in the more exotic bond market strategies?

- How many investors are not broadly diversified enough within the fixed income markets?

- How many unconstrained or liquid alt bond funds will benefit from this? And how many investors will be able to understand how these more exotic bond products really work?

- What’s more important to bond investors — targeting risk or targeting returns?

Portfolio decisions should always come down to understanding what you own and why you own it. With bonds, some are starved for yield while others are simply looking for a counterbalance when stocks take a dive. Others would like a balance of the two. Defining the needs from your fixed income bucket is more important than ever at current interest rate levels.

This information may not persuade some investors to make any changes from a total bond market index fund. It’s still a very simple approach and as long as you’re able to accept the trade-offs, it’s really up to the investor to make the determination for a potential shift away from the Barclays Agg. But it’s not something that investors can ignore as many have in the past. This is something that needs to be addressed within an overall portfolio construct.

I continue to believe that fixed income will be the most interesting asset class over the coming decade and that we will see a much wider gap between the winners and the losers in this once boring segment of the markets.

Source:

The Core Conundrum (Guggenheim)

Further Reading:

Not All Active Funds Consistently Underperform

The Most Interesting Asset Class Over the Next Decade

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.

Copyright © A Wealth of Common Sense