KEY TAKEAWAYS

• Better economic growth and higher inflation expectations are driving confidence in the trajectory of the global economy.

• Lower yields and lingering price pressures still point to a very low-return environment for high-quality bonds in 2015.

• The combination of corporate and Treasury supply may keep headwinds on bond investors.

by Anthony Valeri, Investment Strategist, LPL Financial

Bond markets continue to price in more economic growth and higher inflation as the bond sell-off resumed last week, pushing 10- and 30-year Treasury yields to new year-to-date highs. High-quality bond returns, as measured by the broad Barclays Aggregate Bond Index, are now in negative territory year to date (-0.23%) following renewed weakness. Better U.S. economic data, coupled with comments from European Central Bank (ECB) President Mario Draghi that some bond volatility is to be expected, led to the poor tone.

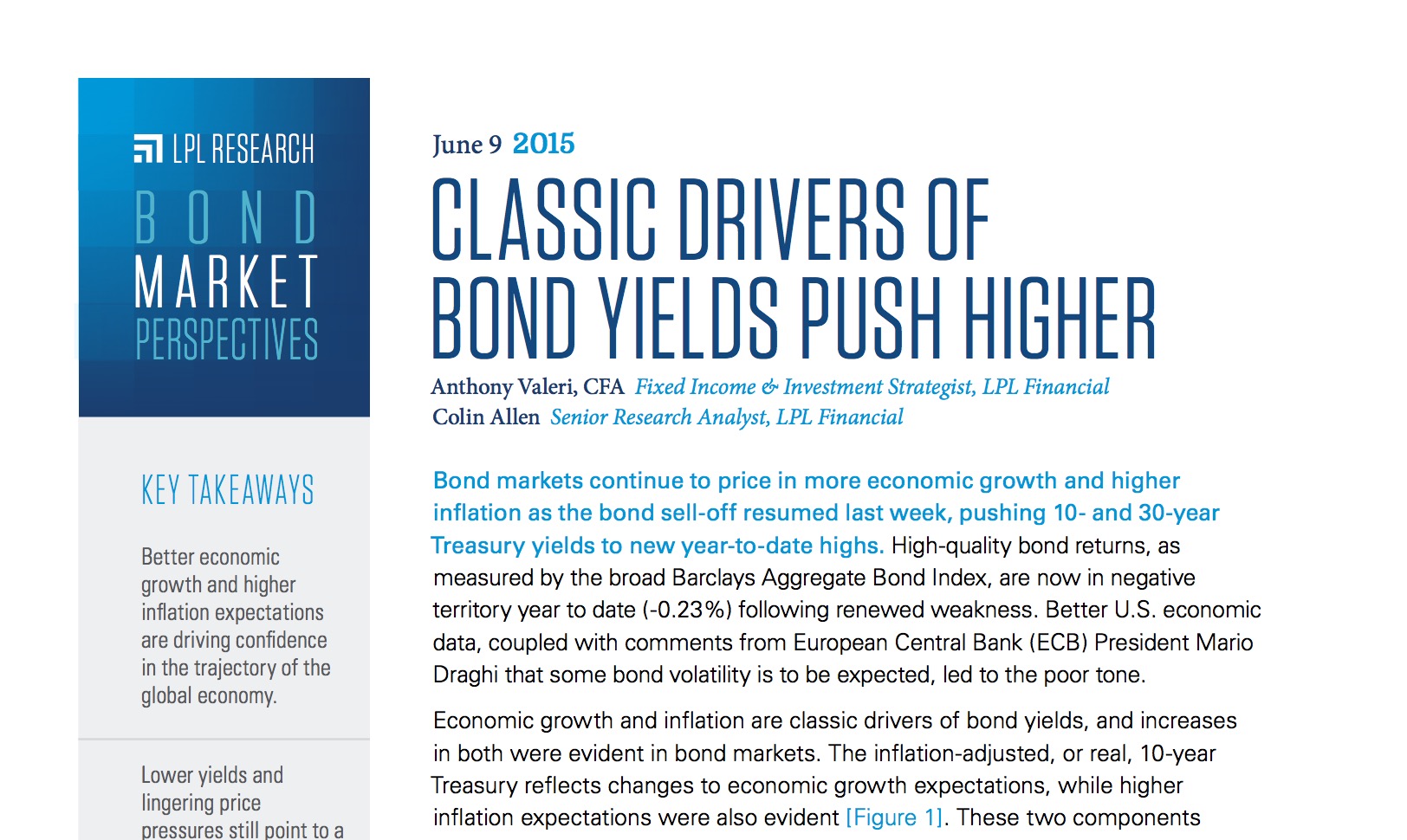

Economic growth and inflation are classic drivers of bond yields, and increases in both were evident in bond markets. The inflation-adjusted, or real, 10-year Treasury reflects changes to economic growth expectations, while higher inflation expectations were also evident [Figure 1]. These two components do not always move together and usually growth or inflation expectations alternate as yield drivers. Real yields and inflation expectations moving together reflects more confidence in the trajectory of the economy.

Even after last week’s increase, both real yields and inflation expectations remain low relative to long-term history. Over the past 10 years the real yield on the 10-year Treasury averaged 1.3% while inflation expectations, as measured by 10-year Treasury Inflation-Protected Securities (TIPS), averaged 2.2%. Both measures remain subdued relative to history and reflect a still expensive bond market.

A connected world

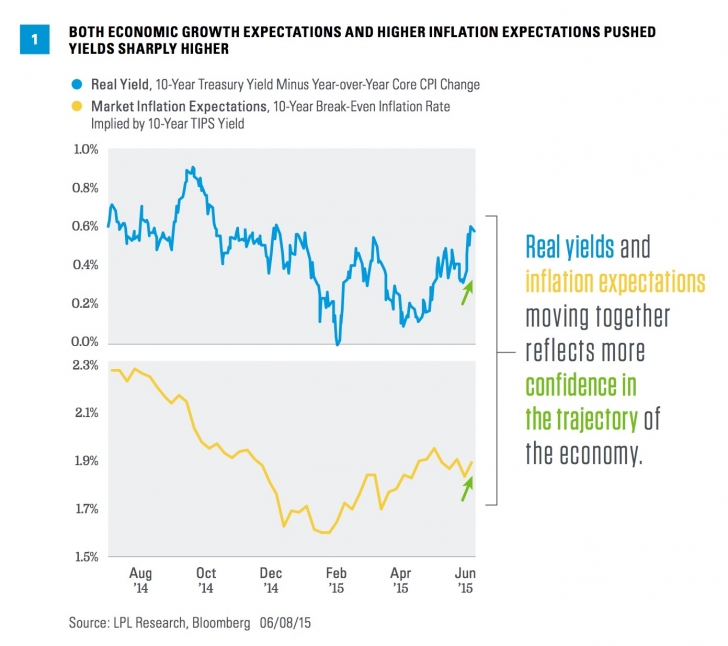

Improving and changing growth and inflation expectations also impact currencies. The improvement in European economic growth early in 2015, which picked up steam in April, contrasted to the weaker domestic economic results and helped put a stop to U.S. dollar strength in the first quarter of 2015. As European growth expectations improved, the euro began to appreciate versus the U.S. dollar. German yields, which reflect better European economic prospects, therefore remain correlated to changes in the U.S. dollar [Figure 2], as higher German yields reflect a weaker dollar and vice versa.

Domestic bond market weakness that began in April 2015 followed a pullback in Europe, led by German bunds. Since April 20, 2015, European government bonds, led by Germany, have underperformed their U.S. counterparts.[1] The 10-year German bund yield has increased by 0.8% versus a 0.5% increase in the 10-year Treasury yield from April 20, 2015, through June 8, 2015. The yield advantage of the 10-year Treasury versus the 10-year German Bund has narrowed from an all-time historic wide level of 1.9%, in March 2015, back down to 1.5%.

Pullback Perspective

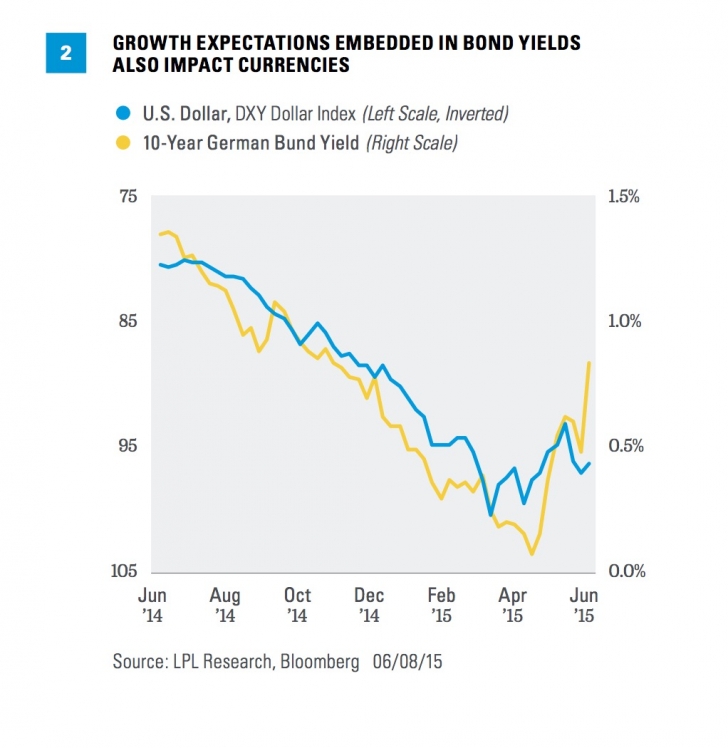

Compared with the most severe bond market pullbacks of the past 12 years, the current sell-off is more restrained but ranks similar to the 2010 QE2-inspired sell-off [Figure 3]. Prices declined quickly to start, but the lingering tug-of-war on bond prices led to stability in late May before last week’s strong jobs report. In our view, the pace of weakness is likely to be more moderate compared with prior sell-offs, due to the fact the Fed is likely to take a very gradual approach to raising interest rates and inflation is similarly likely to increase gradually. We therefore find it unlikely that the current sell-off reaches the magnitude of prior sell-offs; but nonetheless, the lower level of yields combined with lingering price pressures still augurs for a very low-return environment for high-quality bonds in 2015.

The current week of June 8, 2015, presents additional challenges to bond investors in terms of supply. Bond market sentiment remains fragile and must now contend with additional supply in the form of 3-, 10-, and 30-year Treasury auctions. Demand for the new Treasuries may indicate whether the recent rise in yields has gone far enough to help stabilize bonds. In addition to Treasury supply, investment-grade corporate bond issuance remains elevated and on a record pace. The combination of corporate and Treasury supply may keep headwinds on bond investors.

Read/Download the complete report below or here:

Bond Market Perspectives 06092015