by Jeffrey Saut, Chief Investment Strategist, Raymond James

“The Happening” . . . except in this case I am not referring to the 1967 movie, whose title song was sung by the Supremes, but last Thursday’s “Friends of Fermentation” (FOF) gathering at Bobby Van’s across from the NYSE. We actually parachuted into the city the afternoon before, just in time to have dinner with two portfolio managers (PMs) at one of my favorite Italian restaurants, Da Noi at 49th Street and 3rd Avenue. Following that were after dinner drinks at what is arguably the best Greek food in the city, Avra. Thursday morning was spent on the floor of the NYSE doing CNBC and then lunch at Circo with two investing veterans. After visiting with a number of other accounts, and a great discussion with Goldman Sachs’ John Tousley (and I apologize to all the portfolio managers I missed because this was such a short stay), “It Happened”; FOF began Thursday at 4:30 p.m. In attendance were the usual suspects, captained by none other than UBS’s Arthur Cashin. I was very sorry my friends Bob Pisani and Kelley Evans from CNBC could not make it, as well as my friend Rich Bernstein, but a few of my favorite associates from Raymond James did. Sonja White, a terrific portfolio manager in her own right, stole the show, as can be seen in the attendant picture with Arthur. At about 6:30 p.m. the party broke up and we traveled to a fabulous French restaurant named Picholine for a wonderful meal with the best MLP portfolio manager I know, Eric Kaufman, and his brilliant portfolio managing partner Victoria Crisologo, of the venerable money management firm VE Capital. Obviously I gleaned a number of interesting investment ideas during my New York stint, which I will be sharing in these missives.

Friday morning was a blur after the night before festivities, but I did have breakfast with a hedge fund and then spent two hours with the good folks at Blackrock. The first meeting was with Jeff Rosenberg, Chief Investment Strategist for Fixed Income, and we chatted about the Blackrock Strategic Income Opportunity Fund (BSIIX/$10.17), which is a true bond fund. Jeff opined, “Europe may be reflecting a fundamental turn in the economic outlook. To the extent it does, it underlines our view that rising European interest rates reduces the ‘low global yield’ argument, leaving the back-end of the U.S. yield curve vulnerable. As such, we continue to favor the belly of the yield curve exposures in the U.S. interest rate complex, with flatteners on the front end and steepeners in the long end.” For non-bond folks, that means he is anticipating higher long-term rates and flat short-term rates. A couple other interesting data points surfaced in our discussion. While I have argued the depth of the Financial Fiasco in 2008 – 2009, and the subsequent muted economic recovery, should extend the length of the mid-cycle recovery, Blackrock’s Rosenberg thinks we are in the late-cycle stage of the credit cycle. He also told me the credit cycle typically lasts seven years and in the high yield complex, over that seven-year cycle, there is a 30% default rate. Of course we talked about interest rates, the U.S. dollar, energy, international markets, Robo investors, inflation, et all.

Following that meeting, Blackrock’s Michael Fredericks, Head of Asset Allocation for the BlackRock Portfolio Strategies Group and lead PM for the Multi Asset Income Fund (BAICX/$11.23), arrived with some of his team. Their strategy is risk adverse, noting they have less risk than most of their competitors with similarly structured mutual funds. Their portfolio is roughly 30% comprised of dividend-paying stocks and 70% in shorter duration fixed income. I like the fact they sell out-of-the-money “call options” against many of their stock positions to help produce a current yield of more than 5%. One of Blackrock’s economists was in this meeting and said the Industrial sector’s business bottomed in 1Q15 and should come back to life in 3Q and 4Q of this year (I agree). He also stated consumer spending should snap back in that same timeframe after the 1Q15, and maybe 2Q, lag. We did touch on what they think is the best valued class of securities currently, namely preferred securities. They did share that an eye-popping $141 billion in stock “buybacks” took place in April, up a stunning 100% year-over-year. I discussed that topic with Craig Drill, at the firm that bears his name, late-day Friday (I wish I could have gone to the opera with Craig, his wife, and Mr. and Mrs. Paul Volcker that night, but I already had a dinner commitment with Mr. X, a guru who wants to remain unmentioned). Nevertheless, Craig said, “You need to deduct ‘option buying’ from that ‘buy back’ equation and the results are not nearly as overpowering,” which is a pretty insightful observation. Blackrock also said to expect a “material economic acceleration” in Europe, believing domestic consumption has returned, but that the “export shoe” has yet to drop despite the mini-crash in the euro currency.

So in Thursday’s CNBC interview I told the wicked smart Sara Eisen I thought Friday’s employment report would be stronger than most expect and – bingo – it was, with a concurrent explosion in equity prices. Unfortunately, the “explosion” stopped (once again) at the topside of the wedge formation in the chart of the S&P 500 (SPX/2116.10) that has been in existence since February around the 2120 level. I have written repeatedly that I think the SPX is going to make an upside breakout above the 2120 to 2126 level, leaving the biggest surprise for most investors/traders a resulting upside spurt to more than 2200, which has caused many pundits to think I am totally NUTS! Indeed, in this business I have been told for more than 40 years, “If you give ‘em a price, do not give ‘em a timeframe; and, if you give ‘em a timeframe, don’t give ‘em a price.” Alas, I have done both, or as my dearly departed father use to tell me, “Jeff, please take a stand. Too many Wall Street wags write/talk in such a way that no matter what happens they can say they were right. Please take a stand, and if you are wrong, say you are wrong and readjust, but for God’s sake . . . take a stand.” I miss my dad!

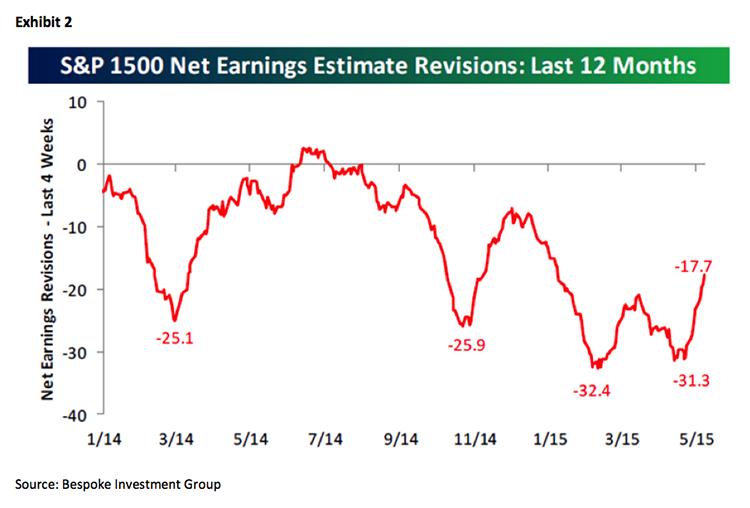

So Sara asked me twice, “What do you think about Janet Yellen’s statement that stocks are overvalued?” My response (twice) was, “Janet Yellen is an economist, not a strategist.” You can see the details in the aforementioned video from CNBC. As for this reporting season, unfortunately the percentage of companies beating earnings estimates has fallen to 60.3% this quarter with revenue “beats” declining to 49.7% for the S&P 1500. The readings are much better for the smaller sample of S&P 500 companies, but I prefer to use the broader 1500-stock sample. Does the earnings dirge deter me from my bullish tilt? Absolutely not! I would also note that earnings estimate revisions have hooked up over the past month (see chart on next page).

The call for this week: I should mention that both of the discussed Blackrock funds have a Highly Recommended rating from our Mutual Fund Research Department, which has certainly taken a stand on these two funds. “Taking a stand,” what a novel concept in this business where few actually make a “call.” My colleague Andrew Adams and I took a stand during the bottoming process in crude oil between January and March of this year, often stating, “Crude oil is/has bottomed,” while many seers were calling for $20 to $30 per barrel oil. Near-term crude oil is overextended and should attempt to pullback, especially if there is a deal with Iran. Andrew and I also “took a stand,” and did a special strategy call on October 15, 2014 commenting, “If you didn’t raise cash on a trading basis when we suggested last June/July, you DO NOT sell stocks here. This is how bottoms are made.” We are taking a stand again, believing an upside breakout is coming. If we are wrong, we will adjust, but at least we are taking a stand and making a “call!” Can you hear me now?!

Copyright © Jeffrey Saut, Chief Investment Strategist, Raymond James