by Ben Carlson, A Wealth of Common Sense

Brett Arends from MarketWatch has an interesting piece out this week that looks at the historical returns on the U.S. stock market. He goes through some research that shows some damning evidence about the long-term returns in U.S. stocks:

Since 1982, for example, the stock market has gone up by an average of 6.5% a year, on top of inflation.

But prior to 1982, over a long stretch of history, it went up by one-tenth as much. That’s right. From 1915 through 1982, the average annual rise of the stock market, after accounting for inflation, was just 0.6%. Yikes.

[…] But, astonishingly, 95% of that gain has come since 1982. From 1915 to 1982, over almost 70 years, the market ended up going virtually nowhere. Capital gains — before taxes and costs — amounted to just 50%, in total, over 67 years.

Yikes indeed. But is this correct? Are stock market returns since the early 1980s an aberration? Being a market history buff I had to look into the numbers on these claims because it just didn’t sound right to me.

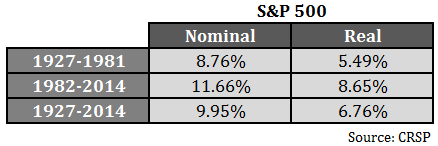

I have the S&P 500 return numbers from the Center for Research in Security Prices (CRSP), the gold standard when it comes to historical market data, going back to 1927. Here’s what I found when I ran those numbers:

Returns since 1982 are definitely above average. There’s no denying that. But the after-inflation returns from 1927-1981 are still pretty respectable. And you have to remember that these performance numbers include the Great Depression, which saw the market fall by over 80% at the start of this period. I looked at the results from 1933-1981, which exclude the Great Depression, and they look pretty good — 10.92% nominal and 6.52% real. You could play that game all day with different variations and periods, but it still appears that pre-1982 returns actually offered a very good return over the rate of inflation.

So I figured the returns from 1915-1926 must have been horrendous to cause the terrible long-term performance Arends listed. Actually, those returns were better than average. I looked at Robert Shiller’s long-term data on real returns, and including dividends, stocks were up nearly 170% or more than 8.5% per year after inflation in that time. Combining those two data sets gives us a real return of almost 6% per year from 1915-1981, just shy of the long-term average.

So why the difference in performance numbers? I can’t say for sure without looking at the methodology used. It’s possible the returns Arends is using don’t include reinvested dividends, which make up the bulk of your returns over the long haul. Dividends yields were also much higher in the past. I suppose certain historical data sets use different assumptions on which companies they include.

Regardless, it appears that stock returns since the early 1980s are just above average, not some historical quirk. Investors do need to understand that it’s highly unlikely that the stock market will have a repeat of those same returns going forward. But the U.S. stock market has been a compounding machine since the early-1900s. As long as people continue to innovate and set out to improve their lives I see no reason why stocks can’t give investors a decent return above the rate of inflation in the future.

Betting against human ingenuity has always been a bad idea.

Source:

Here’s why expecting U.S. stocks to make you rich would be a mistake (MarketWatch)

Further Reading:

What Are Your Actual Returns?

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense