Since mid-January Large Cap stocks (i.e. the S&P 500) have been nipping at the heels of Mid Cap Stocks (i.e. Russell 2000). In 2014 many traders and market commentators pointed to the major under-performance as a big concern for the market as a whole. But it seems that notion as been left in the rear view mirror as stocks have continued to march higher and mid caps ($IWM) have improved. The conversation has now shifted from “look how bad they are doing!” to “look how much stronger they are!” Oh how things change.

I often focus on price charts below is a chart of the Advance-Decline Line for the S&p 500 (top panel in red) and the S&P Mid Cap Index (bottom panel in black). While breadth for the S&P 500 has been rising right along with price, lately it has begun to put in a set of lower highs. While this is occurring the Mid Cap A-D Line has been setting new highs, keeping its up trend alive. I’m not using this chart to make a market call, but to simply point out an interesting development taking place.

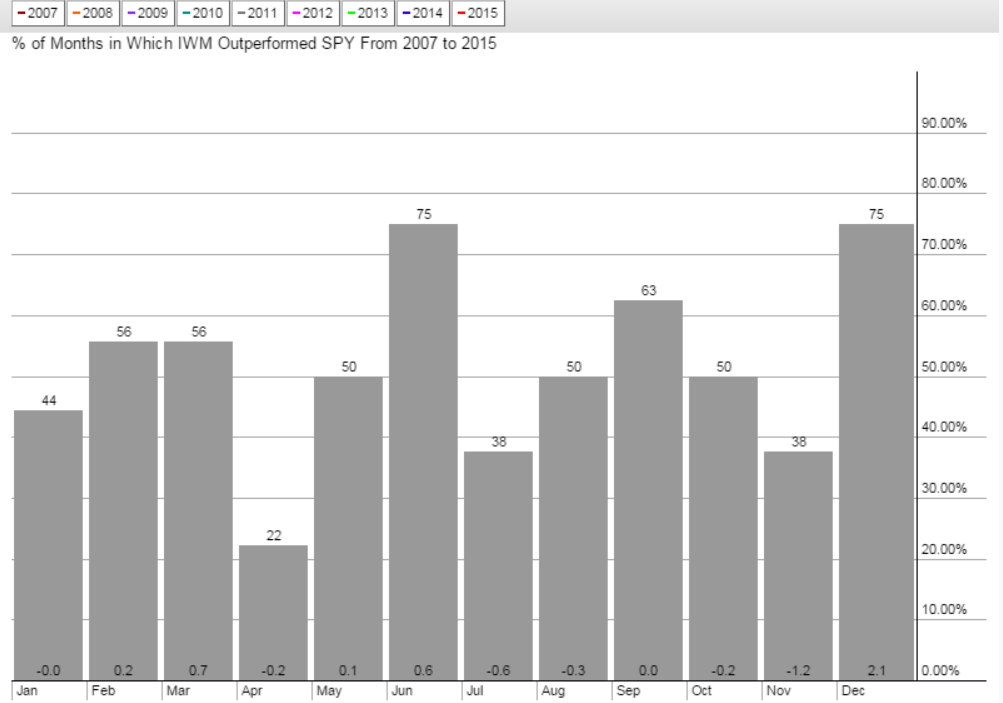

So is this occurring because it’s historically a strong time period for mid cap stocks? Actually no. April is one of the worst months for out-performance by $IWM over $SPY. Since 2007, as this next chart show, $IWM has only outpaced it’s larger cap counterpart 22% of the time (2009 and 2010).

So is this occurring because it’s historically a strong time period for mid cap stocks? Actually no. April is one of the worst months for out-performance by $IWM over $SPY. Since 2007, as this next chart show, $IWM has only outpaced it’s larger cap counterpart 22% of the time (2009 and 2010).

If the Russell 2000 can keep its party alive and continue to lead the S&P 500 during one of its historically weakest periods of time then that would be a pretty big achievement in my eyes and one that would be tough to ignore. So far $IWM has begun to lag $SPY during the first week of trading in April, starting the Russell 2000 in a hole for it to dig out of. Will it be able to do it? We’ll see.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer. Connect with Andrew on Google+, Twitter, and StockTwits.