by Cullen Roche, Pragmatic Capitalism

I’ve discussed my general disdain for the idea of “value investing” at some length (see here and here), but it’s worth reiterating at times because it’s such a common theme in the investment world. “Value investing” is generally an approach that is applied to stock picking, but has garnered increasing attention in the macro world as well. That is, we tend to often look at the aggregate markets as either being “undervalued” or “overvalued”. I just don’t see how this concept has much value to an investor who thinks in a macro indexing sense.

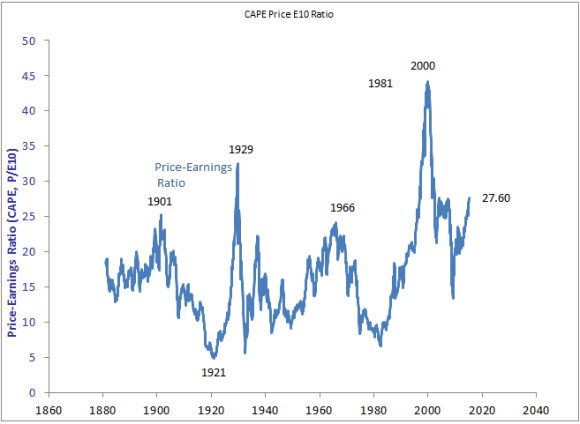

The most common example of how misleading this perspective can be is Robert Shiller’s CAPE ratio. This index is at its highest level since 2007 and at 27.6 is at a very high historical level:

The only problem here is that the average CAPE ratio since 1880 has been 16.5, however, since 1990 it has averaged 25.25. As I’ve described before, the concept of value is dynamic. That is, you could go decades believing the market is “overvalued” when the market itself actually perceives valuations as being perfectly rational. The market is a beauty contest and no matter how ugly you think it might be, if the other voters think the market is beautiful then you’re on the losing side of the trade. There is no hard and fast rule that says that just because the market was “undervalued” at 16.5 for 100 years that it can’t be “undervalued” at 20 in a new regime. The markets change, its participants change and perceptions change. So the concept of what is beautiful could change over time. Yes, the “new normal” of market valuations could very well be 20 or 25 now. We just don’t know.

This makes the concept of value a very tricky indicator in a macro sense. And as we’ve transitioned into the world where asset picking is the new stock picking some of the old stock picking concepts have filtered into the world of indexing. The problem is, many of them aren’t nearly as useful for macro indexing as they are at the individual stock picking level. So beware the fallacy of composition here – what works at the individual stock level doesn’t necessarily work in the aggregate.

Copyright © Pragmatic Capitalism