by Don Vialoux, EquityClock.com

Economic News This Week

Greece’s parliamentary elections were held on Sunday

December Durable Goods Orders to be released at 8:30 AM EST on Tuesday are expected to increase 0.5% versus a decline of 0.9% in November. Excluding transportation, Orders are expected to increase 0.6% versus a decline of 0.7% in November

November Case/Shiller 20 City Price Index to be released at 9:00 AM EST on Tuesday is expected to slip to 4.4% on a year-over-year basis from 4.5% in October.

December New Home Sales to be released at 10:00 AM EST on Tuesday are expected to increase to 450,000 from 438,000 in November

January U.S. Consumer Confidence Index to be released at 10:00 AM EST on Tuesday is expected to increase to 95.0 from 92.6 in December.

FOMC rate decision to be released at 2:15 PM EST on Wednesday is expected to remain unchanged at 0.0-0.25%. No change in policy is expected.

Weekly Jobless Claims to be released at 8:30 AM EST on Thursday are expected to dip to 300,000 from 307,000

Canada’s November month-over-month GDP to be released at 8:30 AM EST on Friday is expected to drop 0.2% versus a gain of 0.3% in October.

Preliminary U.S. Fourth Quarter real GDP to be released at 8:30 AM EST on Friday is expected to increase 3.0% versus a gain of 5.0% in the third quarter

January Chicago PMI to be released at 9:45 AM EST on Friday are expected to dip to 58.0 from 58.3 in December

January Michigan Consumer Sentiment Index to be released at 10:00 AM EST on Friday is expected to remain unchanged from December at 98.2.

Earnings News This Week

The Bottom Line

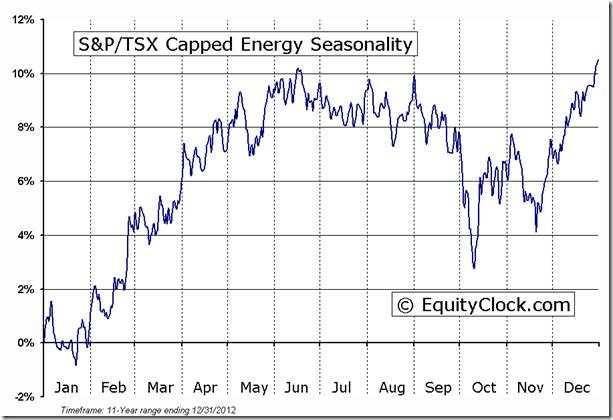

North American equity markets entered into a short term corrective phase on December 29th. The corrective phase is expected to continue until end of the fourth quarter earnings report period (i.e. late January/early February). Thereafter, North American equity markets are expected to resume an intermediate uptrend as they normally do during a U.S. Presidential Pre-election year. Equity markets around the world are expected to be exceptionally volatile again this week due to a series of economic/political news events. New opportunities have surfaced. International market ETFs including Emerging Markets and European equity market led world equity markets on the upside last week. In addition, the energy sector has shown technical signs of recovery just as it enters its period of seasonal strength. Weakness is an opportunity to add to positions for the seasonally strong period between February and July during U.S. President Pre-election years.

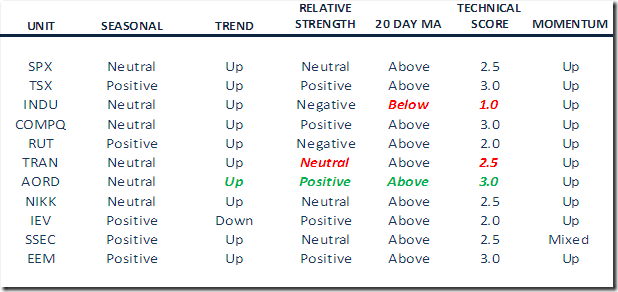

Daily Seasonal/Technical Equity Trends for January 23rd

Green: Increase from the previous day

Red: Decrease from the previous day

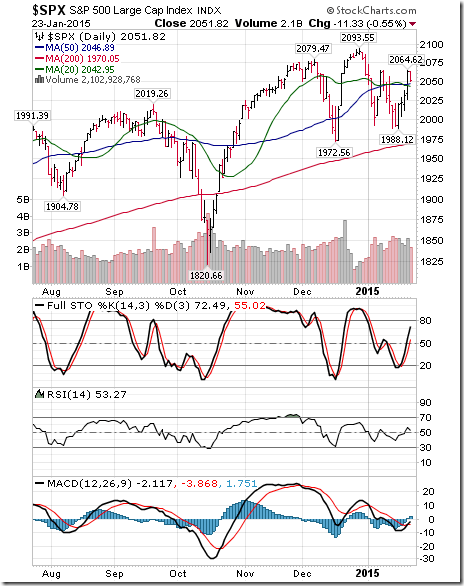

S&P 500 Index gained 32.40 points (1.60%) last week. Intermediate trend remains up. The Index moved above its 20 day moving average. Short term momentum indicators are trending up.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 54.20% from 43.80%. Despite the gain, intermediate trend remains down.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 69.40% from 65.00%. Percent remains intermediate overbought and trending down.

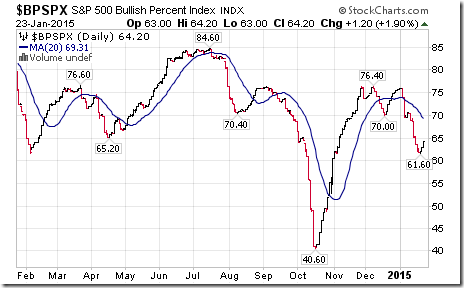

Bullish Percent Index for S&P 500 stocks increased last week to 64.20% from 62.00%, but remained below its 20 day moving average. Percent remains intermediate overbought and trending down.

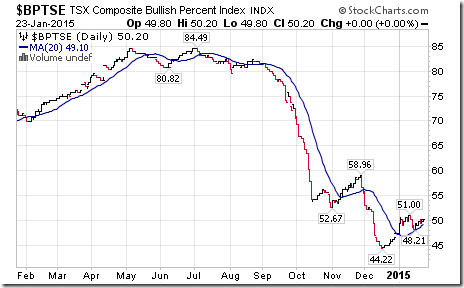

Bullish Percent Index for TSX Composite stocks increased last week to 50.20% from 49.00% and remained above its 20 day moving average. The Index continues to recover from an oversold level.

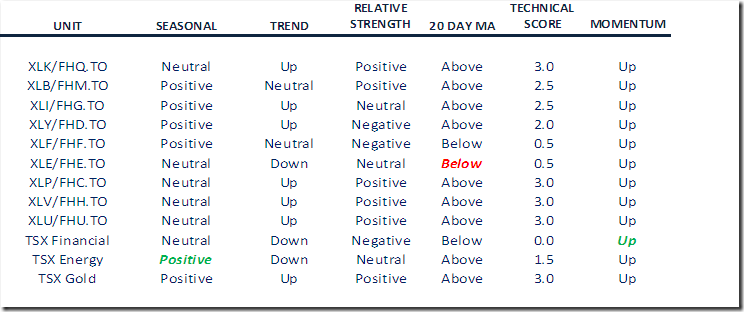

The TSX Composite Index jumped 469.94 points (3.28%) last week. Intermediate trend changed to up from down on a move above 14,756.30 (Score: 1.0). The Index moved above its 20 day moving average (Score: 1.0). Strength relative to the S&P 500 Index changed to positive from neutral (Score: 1.0). Technical score improved to 3.0 from 1.5 out of 3.0. Short term momentum indicators are trending up.

Percent of TSX stocks trading above their 50 day moving average increased last week to 50.80% from 43.20%.

Percent of TSX stocks trading above their 200 day moving average increased last week to 43.60% from 39.60%.

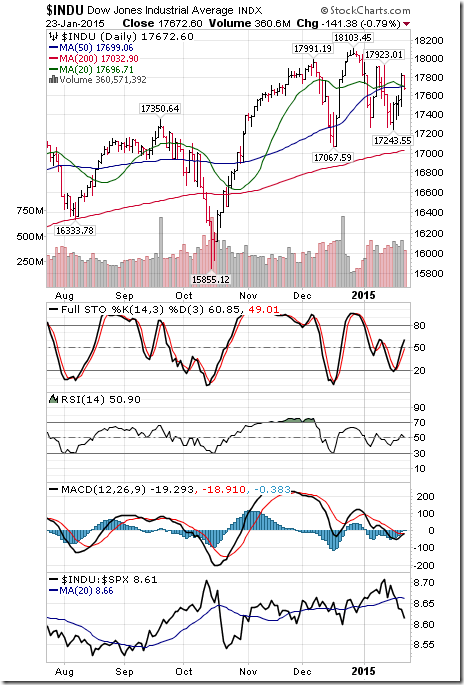

The Dow Jones Industrial Average added 161.03 points (0.92%) last week. Intermediate trend remains up. The Average remains below its 20 day moving average. Strength relative to the S&P 500 Index changed to negative from positive. Technical score dipped to 1.0 from 2.0 out of 3.0. Short term momentum indicators are trending up.

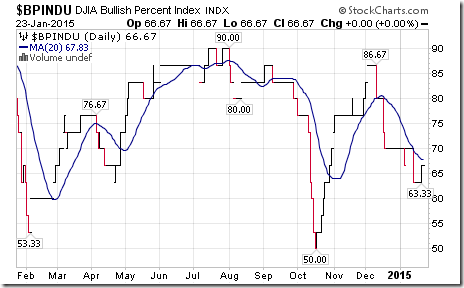

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 66.67% from 63.33%, but remained below its 20 day moving average. The Index remains intermediate overbought and trending down.

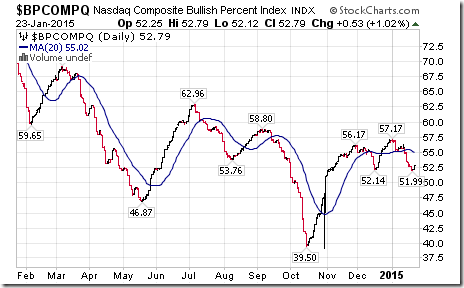

Bullish Percent Index for NASDAQ Composite stocks was unchanged last week and remained below its 20 day moving average. Intermediate trend remains down.

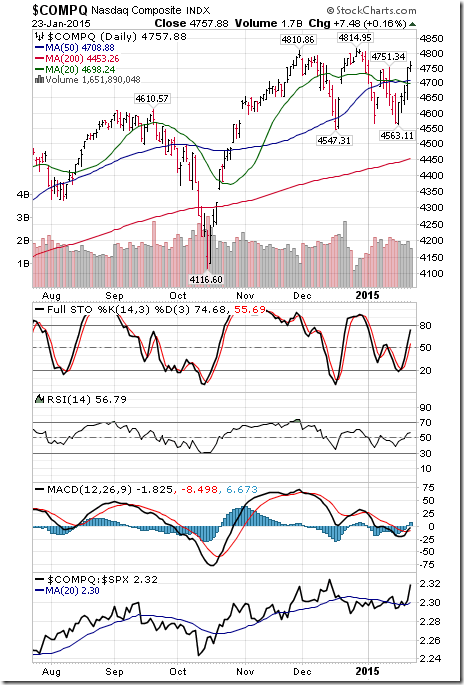

The NASDAQ Composite Index gained 123.50 points (2.66%) last week. Intermediate trend remains up. The Index moved above its 20 day moving average. Strength relative to the S&P 500 Index changed to positive from negative. Technical score improved to 3.0 from 1.0 out of 3.0. Short term momentum indicators are trending up.

The Russell 2000 Index added 12.28 points (1.04%) last week. Intermediate trend is up. The Index moved above its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score improved to 2.0 from 1.0 out of 3.0. Short term momentum indicators are trending up.

The Dow Jones Transportation Average added 217.82 points (2.49%) last week. Intermediate trend remains up. The Average moved above its 20 day moving average. Strength relative to the S&P 500 Index changed to neutral from negative. Technical score improved to 2.5 from 1.0 out of 3.0. Short term momentum indicators are trending up.

The Australia All Ordinaries Composite Index jumped 189.40 points (3.59%) last week. Intermediate trend changed to up from down on a move above 5,458.30. Technical score improved to 3.0 from 1.0 out of 3.0. Short term momentum indicators are trending up.

The Nikkei Average gained 647.59 points (3.84%) last week. Intermediate trend remains up. The Average moved above its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score improved to 2.5 from 1.5 out of 3.0. Short term momentum indicators are trending up.

iShares Europe 350 units added $0.55 (1.30%) last week Intermediate trend remains down. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remained at 2.0 out of 3.0. Short term momentum indicators are trending up.

The Shanghai Composite Index slipped 24.74 points (0.73%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to neutral from positive. Technical score slipped to 2.5 from 3.0. Short term momentum indicators are mixed.

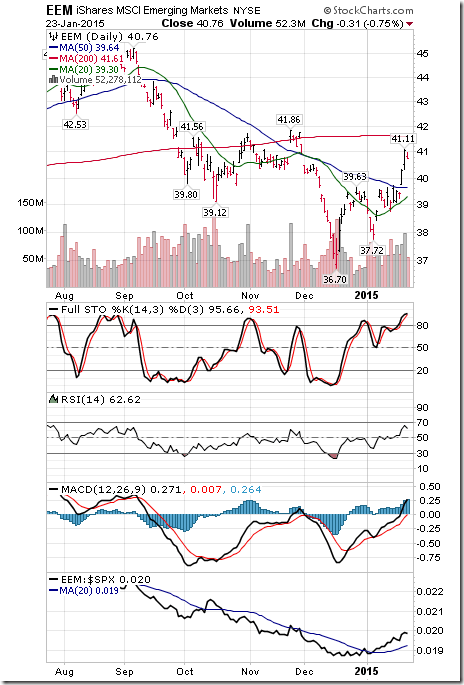

iShares Emerging Markets gained $1.27 (3.22%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up.

Currencies

The U.S. Dollar Index jumped 2.25 (2.42%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Short term momentum indicators are trending up, but are overbought.

The Euro plunged 3.55 (3.07%) last week. Intermediate trend remains down. The Euro remains below its 20 day moving average. Short term momentum indicators are trending down, but are deeply oversold.

The Canadian Dollar fell another US 3.12 cents (3.74%) last week. Intermediate trend remains down. The Canuck Buck remains below its 20 day moving average. Short term momentum indicators are trending down, but are deeply oversold.

The Japanese Yen slipped 0.15 (0.18%) last week. Intermediate trend remains down. The Yen remains above its 20 day moving average. Short term momentum indicators are mixed.

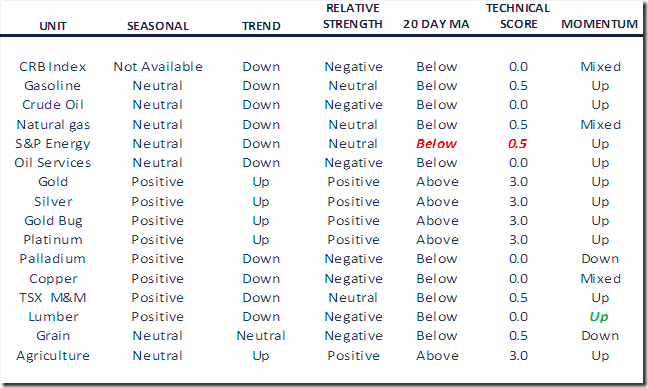

Daily Seasonal/Technical Commodities Trends for January 23rd

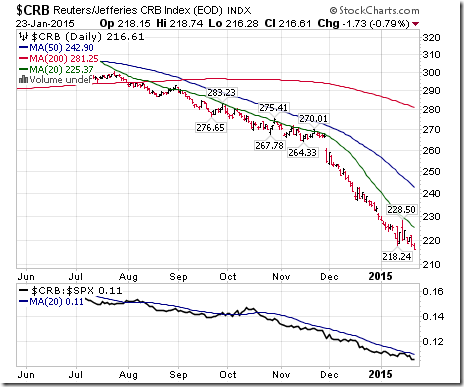

The CRB Index dropped another 3.76 points (1.71%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains at 0.0 out of 3.0. Short term momentum indicators are mixed. Technical score remains at 0.0 out of 3.0.

Gasoline added $0.01 per gallon (0.74%) last week. Intermediate trend remains down. Gas remains below its 20 day moving average. Strength relative to the S&P 500 Index changed to neutral from negative. Technical score increased to 0.5 from 0.0 out of 3.0. Short term momentum indicators are trending up.

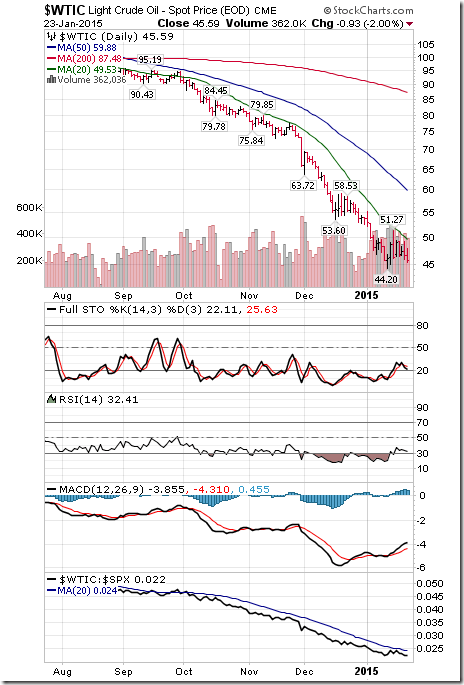

Crude Oil fell $3.54 per barrel (7.21%) last week. Intermediate trend remains down. Crude remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending up.

Natural Gas fell $0.14 per MBtu (4.47%) last week. Intermediate trend remains down. “Natty” fell below its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score fell to 0.5 from 1.5. Short term momentum indicators are mixed.

The S&P Energy Index added 8.92 points (1.59%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index changed to neutral from negative. Technical score improved to 0.5 from 0.0 out of 3.0. Short term momentum indicators are trending up.

The Philadelphia Oil Services Index added 1.69 points (0.88%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending up.

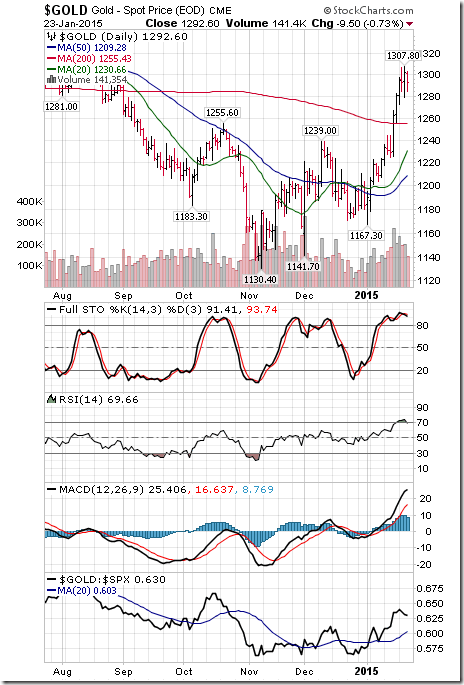

Gold lost $4.50 per ounce (2.24%) last week. Intermediate trend remains up. Gold remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

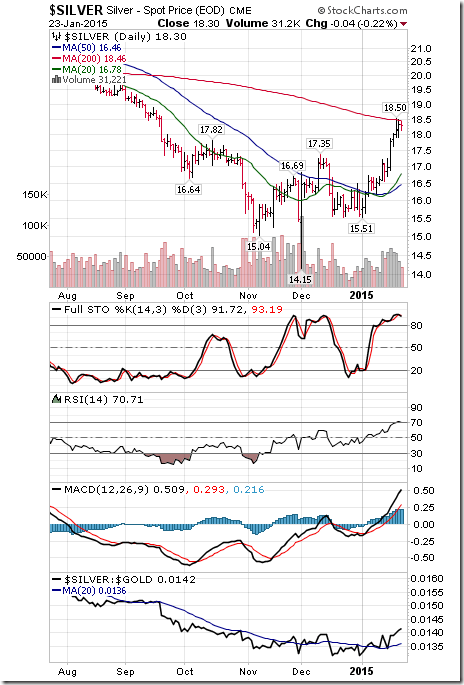

Silver added $0.55 per ounce (3.10%) last week. Intermediate trend remains up. Silver remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Shor term momentum indicators are trending up, but are overbought. Strength relative to Gold remains positive.

The AMEX Gold Bug Index slipped 4.50 points (2.24%) last week. Intermediate trend remains up. The Index remains above their 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought and showing early signs of rolling over. Strength relative to Gold remains positive.

Platinum slipped $0.70 per ounce (0.06% last week. Intermediate trend remains up. PLAT remains above its 20 day MA. Strength relative to S&P: Positive. Relative to Gold: Negative

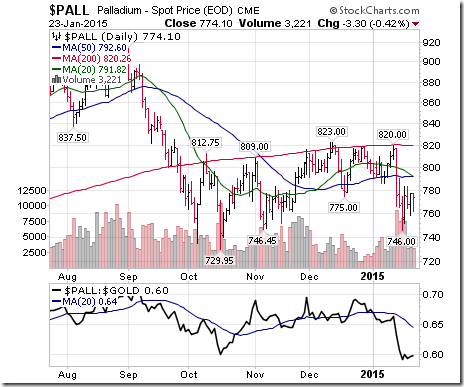

Palladium gained $19.80 per ounce (2.62%) last week. Intermediate trend remains down. PALL remains below its 20 day MA. Strength relative to the S&P 500 Index remains negative. Technical score remained at 0.0 out of 3.0. Strength relative to Gold remains negative.

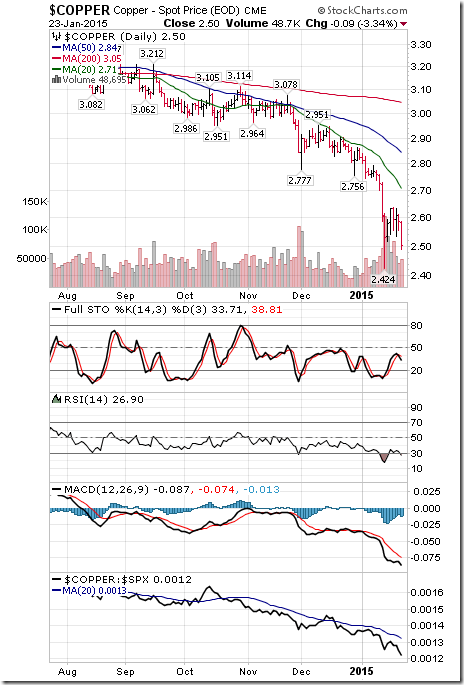

Copper dropped $0.12 per lb. (4.58%) last week. Intermediate trend remains down. Copper remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are mixed.

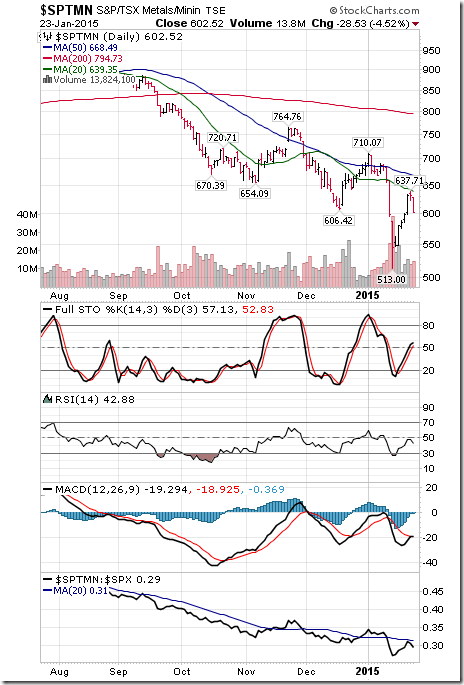

The TSX Metals & Mining Index added 22.25 points (3.83%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index improved to neutral from negative. Technical score improved to 0.5 from 0.0 out of 3.0. Short term momentum indicators are trending up

Lumber slipped $0.40 (0.13%) last week. Intermediate trend remains down. Lumber remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative.

The Grain ETN slipped $0.27 (0.74%) last week. Trend remains neutral. Units remain below their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.5 out of 3.0. Short term momentum indicators are trending down.

The Agriculture ETF added $0.65 (1.23%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up.

Interest Rates

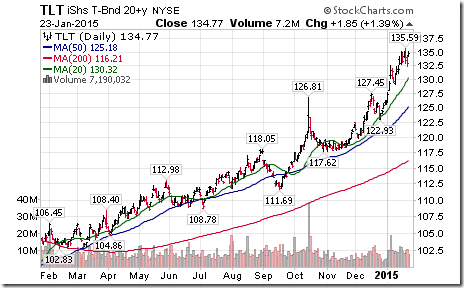

The yield on 10 year Treasuries fell 15.6 basis points (7.91) last week. Intermediate trend remains down. Yield remains below its 20 day moving average. Short term momentum indicators are trending up.

Conversely, price of the long term Treasury ETF gained $2.12 (1.62%) last week. Intermediate trend remains up. Units remain above their 20 day moving average.

Other Issues

The VIX Index fell 4.41 (20.93%) last week. Intermediate trend remains up. The Index fell below its 20 day moving average.

Economic news this week is expected to confirm slow, but steady U.S. economic growth. Focus is on the FOMC meeting on Wednesday when the Federal Reserve is expected to show a “steady as it goes” monetary stance.

Fourth quarter reports will flood in this week. Focus this week in on technology and energy companies. Cash flow and earnings released to date generally are slightly higher than consensus, but responses to reports have been negative/neutral when companies lower first quarter/2015 guidance. Strength in the U.S. Dollar frequently is mentioned as a major reason for reducing guidance.

Short term technical indicators (mainly momentum) for most equity indices and sectors changed last week from “trending down and oversold” to trending up and approaching overbought levels.

Intermediate technical indicators (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) show that equity markets and many sectors have returned to an overbought level, but have yet to show signs of peaking.

Beyond January, the outlook for world equity markets is positive. Historically, the best time during the four year Presidential cycle to own equities is from the beginning of November in a mid-term election year to July in a pre-election year.

International uncertainties remain high. Notable is the Greek election on Sunday, growing political interference in Ukraine and the near collapse of the regime in Venezuela.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

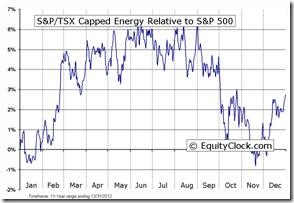

Below is an example:

^SPTTEN Relative to the S&P 500 |

Daily Seasonal/Technical Sector Trends for January 23rd

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

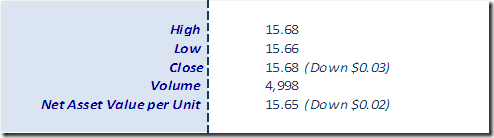

Horizons Seasonal Rotation ETF HAC January 23rd 2015

Copyright © EquityClock.com