by Ben Carlson, A Wealth of Common Sense

One of the reasons the past couple of years have frustrated so many professional investors is because of the lack of volatility. For most investors, volatility is a four letter word that should be avoided at all costs. But for others, volatility acts as a form of opportunity.

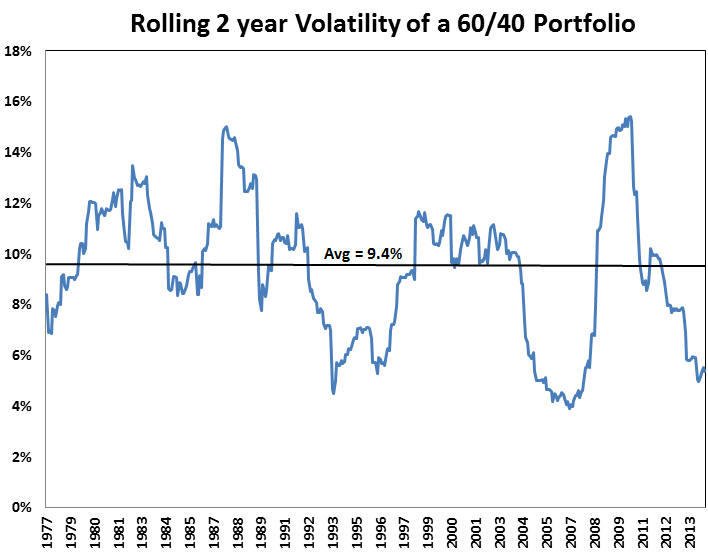

If you rely exclusively on volatility to find opportunities it’s probably been a tough stretch for your strategy. Here’s the rolling two year standard deviation for a 60/40 portfolio made up of the S&P 500 and Barclays Aggregate Bond Index going back to the mid-1970s:

We’re not quite back to the lows seen in the 2005-2007 cycle, but it’s getting close.

It’s easy to blame the Fed’s low interest rate policies for these subdued numbers, but it’s also worth noting that volatility isn’t the be-all, end-all of statistics. The 80s and 90s had fantastic returns, but volatility was still elevated from current levels. There were periods of unrest during that bull market, but volatility isn’t a one way street. It can be seen on both the upside and the downside.

After the crash from 2007-2009 the biggest risk on every investor’s mind was tail risk and downside protection. What many failed to recognize is that there are two tails on a probability distribution. The tail risk for a crash is ever present, but so is the tail risk for a melt-up.

Some might look at these numbers and assume that holding a portfolio of stocks and bonds has been easy over the past few years, but investors that actually did hold on know that it’s never easy. We’ve been bombarded with crash calls and double-dip recession predictions the entire way up. Not only is volatility seen as a huge risk, but a lack of volatility leads to warnings as well.

Like everything else in the markets, volatility is cyclical. Those patiently waiting for opportunities will see them eventually, but these things can always overshoot in either direction. Eventually things will go wrong. They always do. Something will cause volatility to flare up once again. Successful investors understand that it’s not the volatility itself that matters, but how you react to it.

Further Reading:

Volatility is not your enemy

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © Ben Carlson, A Wealth of Common Sense