by Don Vialoux, TimingTheMarket.ca

Pre-opening Comments for Friday October 3rd

U.S. equity index futures were higher this morning. S&P 500 futures gained 15 points in pre-opening trade.

Index futures added to gains following release of encouraging economic news released at 8:30 AM EDT. Consensus for September Non-farm Payrolls was 215,000 versus an upwardly revised 180,000 in August. Actual was 248,000. Consensus for September Private Non-farm Payrolls was 205,000 versus upwardly revised 210,000 in August. Actual was 236,000. Consensus for the September Unemployment rate was unchanged from August at 6.1%. Actual was a drop to 5.9%. Consensus for September Hourly Earnings was an increase of 0.2% versus a gain of 0.2% in August. Actual was unchanged. Consensus for the August Trade Deficit was an increase to $40.9 billion from $40.5 billion in July. Actual was a decline to 40.1 billion.

Apple slipped $0.45 to $99.45 after Deutsche Bank downgraded the stock from Buy to Hold. Target is $102.

Cliff Natural Resources fell $0.28 to $9.72 after Nomura downgrade the stock.

Salesforce.com added $0.86 to $57.50 after Sterne Agee and Societe Generale initiated coverage with a Buy rating.

EquityClock.com’s Daily Equity Market Comment

Following is a link:

http://www.equityclock.com/2014/10/02/stock-market-outlook-for-october-3-2014/

Note information about a new service on the seasonality of individual equities that has been introduced to the site.

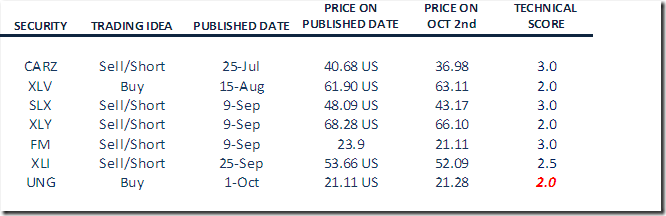

Changes in the Monitored Technical/Seasonal Trade Ideas List

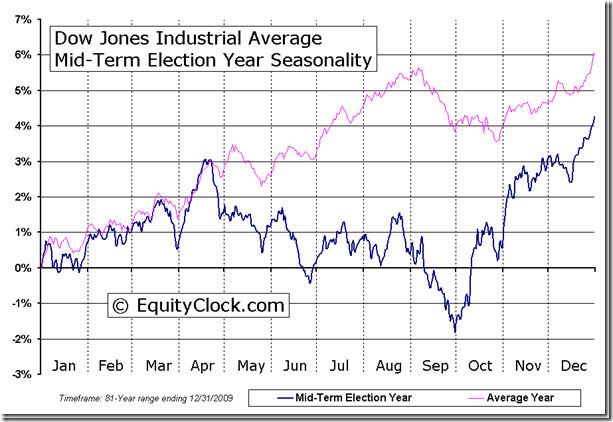

The report on U.S equity markets showing seasonality during mid-term election years shows that U.S. equity markets have a history of bottoming in early October. In addition, all positions indicated as Sell/Short are oversold with Technical scores for short positions at 2.0 or 3.0.

CARZ recorded a profit of 9.1% since recommended on July 25th. SLX recorded a profit of 10.2% since recommended on September 9th. XLY recorded a profit of 3.2% since recommended on September 9th. FM recorded a profit of 11.7% since recommended on September 9th XLI recorded a profit of 2.9% since recommended on September 25th .

Interesting Chart

The S&P 500 Index bounced from near its critical 125 day moving average.

StockTwits Yesterday

Technical action by S&P stocks to 10:30: Bearish. Breakouts: $ADSK, $MYL. Breakdowns: $QEP, $XYL, $APD, $GRMN, $APC, $NBL. $PSX, $HPQ.

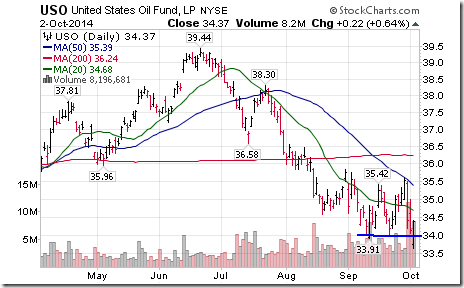

Notable on the breakdown list were energy stocks after USO broke support at $33.91

Selling pressure at 12:00: accelerating. Another 16 S&P 500 stocks broke support.

Notable on the list of stocks breaking support were Industrials: $XYL, $BA, $COL, $DE, $RHI, $EMN

Technical Action by Individual Equities

By the close yesterday, two S&P 500 stocks broke resistance and 31 stocks broke support.

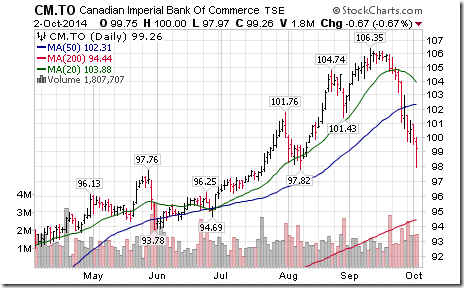

Among TSX 60 stocks, financial serve stocks dominated the list of stocks breaking support: Royal Bank, Commerce Bank and Sun Life broke support. None broke resistance.

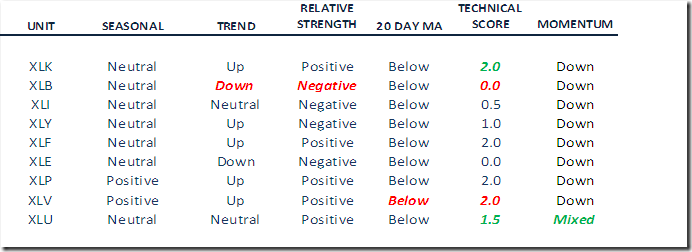

Weekly Technical Review of Select Sector SPDRs

Summary of Weekly Seasonal/Technical Parameters for SPDRs

Key:

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Twenty Day Moving Average: Above, Below

Green: Upgrade from last week

Red: Downgrade from last week

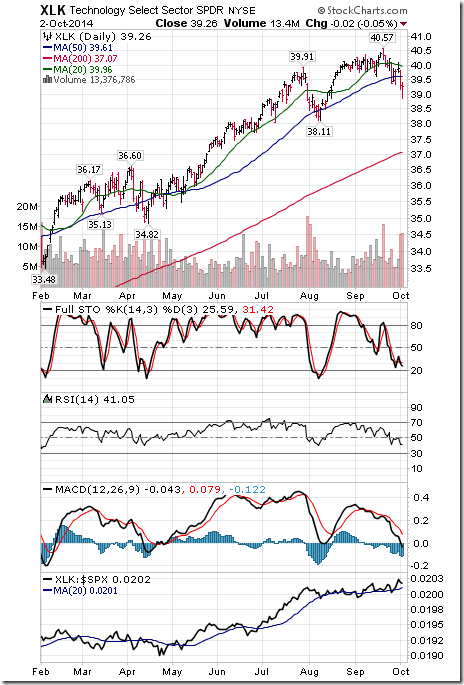

Technology

· Intermediate trend remains up (Score: 1.0)

· Units remain below their 20 day moving average (Score: 1.0)

· Strength relative to the S&P 500 Index changed to positive from negative (Score: 1.0)

· Technical score improved to 2.0 from 1.0 out of 3.0

· Short term momentum indicators are trending down

Materials

· Intermediate trend changed from up to down on breaks below support at $49.33 and $48.16

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index changed to negative from positive

· Technical score fell to 0.0 from 2.0 out of 3.0.

· Short term momentum indicators are trending down.

Industrials

· Intermediate trend remains neutral

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 0.5 out of 3.0

· Short term momentum indicators are trending down.

Consumer Discretionary

· Intermediate trend remains up

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 1.0 out of 3.0

· Short term momentum indicators are trending down

Financials

· Intermediate trend remains up

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score remains at 2.0 out of 3.0.

· Short term momentum indicators are trending down.

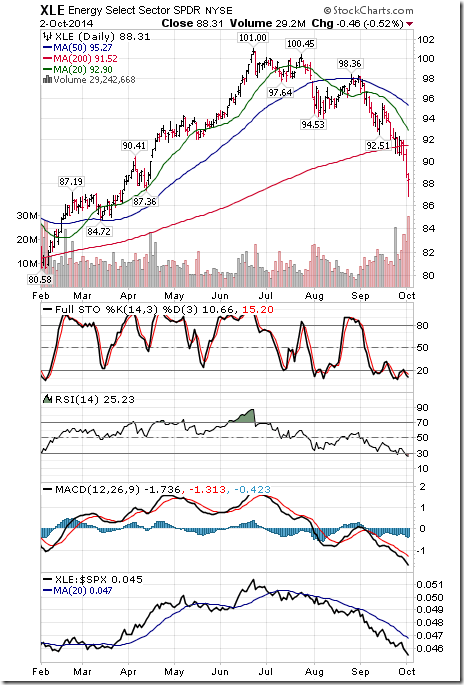

Energy

· Intermediate trend remains down

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 0..0 out of 3.0

· Short term momentum indicators are trending down, but are deeply oversold.

Consumer Staples

· Intermediate trend remains up

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score remains at 3.0 out of 3.0.

· Short term momentum indicators are trending down.

Health Care

· Intermediate trend remains up

· Units fell below its 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score slipped to 2.0 out of 3.0

· Short term momentum indicators are trending down.

Utilities

· Intermediate trend remains neutral.

· Units remain below their 20 day moving average

· Strength relative to the S&P 500 Index changed to positive from neutral.

· Short term momentum indicators are mixed.

Monitored Technical/Seasonal Trade Ideas

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC October 2nd 2014

Copyright © TimingTheMarket.ca

![clip_image002[1] clip_image002[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/5087741ff89b98c941cd755fd3efb223.png)