by Don Vialoux, Timing the Market

Technical action plus concerns about an

escalating conflict in Ukraine contributed to weakness in

equity markets yesterday.

· The S&P 500 Index closed below 1,921, a long term

uptrend. The Index also completed a bearish rising wedge

pattern

· The VIX Index spiked again. ‘Tis the season!

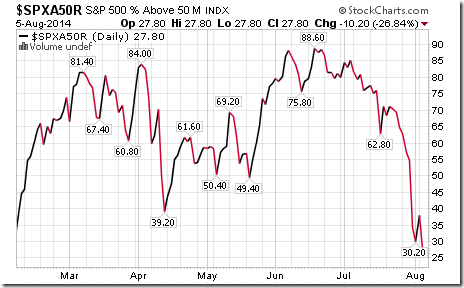

· Percent of S&P 500 stocks trading above their 50 day

moving average reached a new low. Percent already is

intermediate oversold, but has yet to show signs of bottoming.

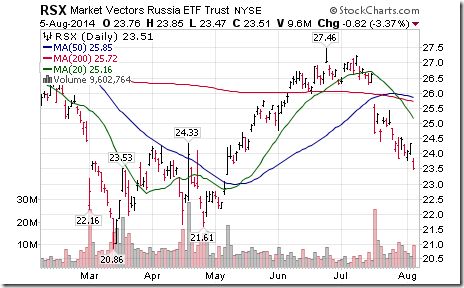

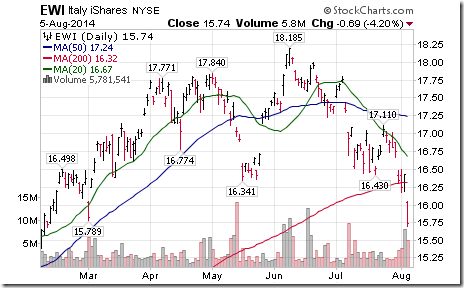

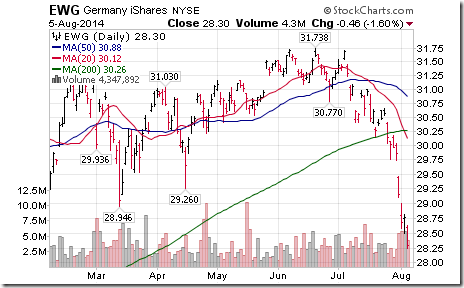

· European equity markets led world equity markets on the

downside. The Russian ETF already is down more than 14% from

its recent high.

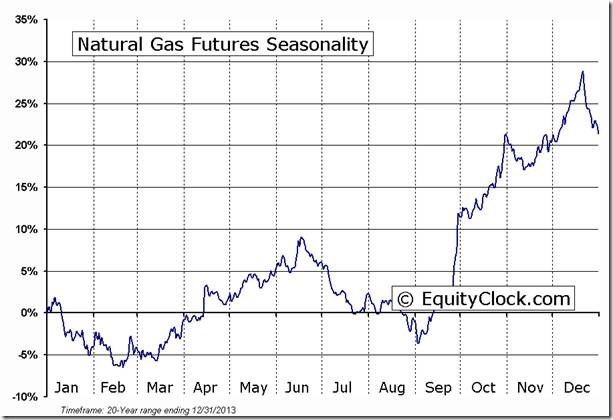

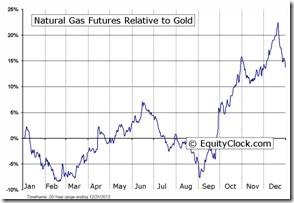

Natural gas is showing early signs of bottoming prior to start

of its period of seasonal strength at the end of August.

Hurricane season is approaching, a frequent trigger for higher

natural gas prices. It’s too early to make the call, but a

potential seasonal trade should be put on the radar screen.

Current technical positives include:

· A move above a three week trading range

· Short term momentum indicators (Stochastics, RSI, MACD) that

have bottomed and starting to roll up.

· Trades just below its 20 day moving average

· Strength relative to the S&P 500 Index has changed from

negative to at least neutral

Spot Uranium Prices

Early signs that they have bottomed! They reached a four month

high when officially reported yesterday. Uranium stock prices

also have bottomed and have started to outperform the S&P

500 Index

Special Free Services available

through www.equityclock.com

Equityclock.com is offering free access to a data base showing

seasonal studies on individual stocks and sectors. The data

base holds seasonality studies on over 1000 big and moderate

cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example

FUTURE_NG1 Relative to the S&P 500 |

FUTURE_NG1 Relative to Gold |

Horizons/Tech Talk Weekly Seasonal/Technical

Sector Review

Following is a link:

http://www.horizonsetfs.com/campaigns/TechnicalReport/index.html

StockTwits released yesterday

Available through twitter @equityclock

Charts have been updated to the close

Quiet action in S&P stocks to 10:45. Three stocks broke

support: $AGN, $PFE, $DNB

Editor’s Note: Massive Head & Shoulders pattern!

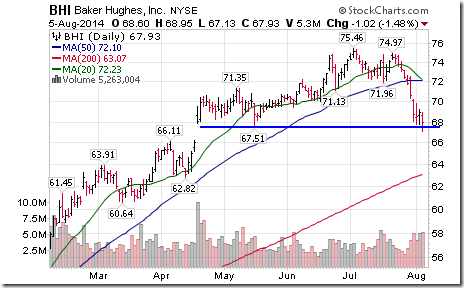

Growing Ukraine concerns has prompted added S&P breakdowns

including $BHI, $KR and $VTR

Editor’s Note: BHI filling the gap?

Technical Action by Individual S&P 500

stocks

By the close yesterday, another 11 S&P 500 stocks had

broken support and none had broken resistance.

No TSX 60 stocks broke support or resistance yesterday.

Mark Leibovit Tutorial on the S&P 500

Index

Following is a link:

https://www.youtube.com/watch?v=tKG3x8fHJNo&feature=youtu.be

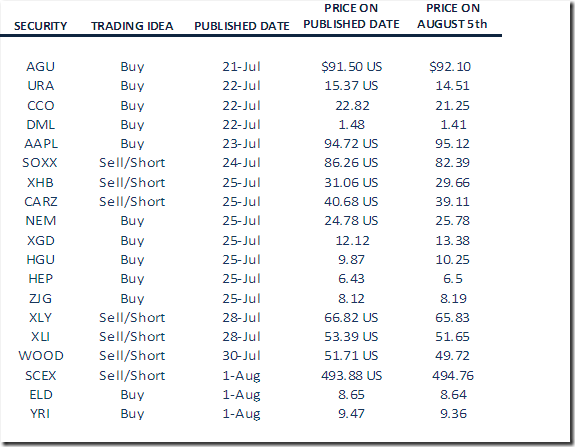

Monitored Technical/Seasonal Trade

Ideas

Disclaimer: Comments, charts and opinions

offered in this report by www.timingthemarket.ca

and www.equityclock.com

are for information only. They should not be

considered as advice to purchase or to sell mentioned

securities. Data offered in this report is believed to be

accurate, but is not guaranteed. Don and Jon Vialoux are

Research Analysts with Horizons ETFs Management (Canada) Inc.

All of the views expressed herein are the personal views of the

authors and are not necessarily the views of Horizons ETFs

Management (Canada) Inc., although any of the recommendations

found herein may be reflected in positions or transactions in

the various client portfolios managed by Horizons ETFs

Management (Canada) Inc.

Individual equities mentioned in StockTwits are not

held personally or in HAC.

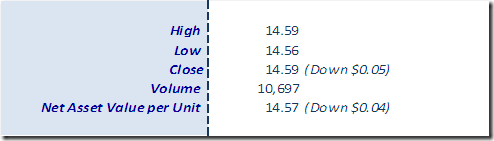

Horizons Seasonal Rotation ETF HAC August

5th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray