With each passing day it seems the bearishness towards bonds refuses to ease. The survey’s of economists still show a heightened distrust for the Treasury market, even though prices have marched higher for the bulk of 2014. When we look at the weekly chart of the 10-year Treasury Yield ($TNX) we can see that support may be under 2.4%, and if prices do in fact break 2.4% that may open the next wave of shorts to get squeezed.

Below is a weekly chart of $TNX going back to 2008. I’ve included the 200-week Moving Average as it has been an important level of support and resistance for the 10-year Yield. In 2010 and 2011 we saw the 200-week MA act as resistance when bond prices were falling prior to the corrections in equities that took place each of those years. In 2013 we saw this long-term Moving Average act as support when yield was falling in October. And once again this MA acted as support in late May of this year when $TNX last approached the 2.4% level.

Once again we see yield approaching this critical level of support that currently sits at 2.38%. A break under 2.4% would shock a lot of traders. If we look at momentum, using the Relative Strength Index (RSI) we aren’t even close to seeing oversold conditions. During past bottoms in yield the 14 week RSI dropped to under 30. Of course it’s not a requirement for momentum to become ‘oversold’ on this weekly chart for yield to rise, but that’s been the case during previous intermediate-term bottoms.

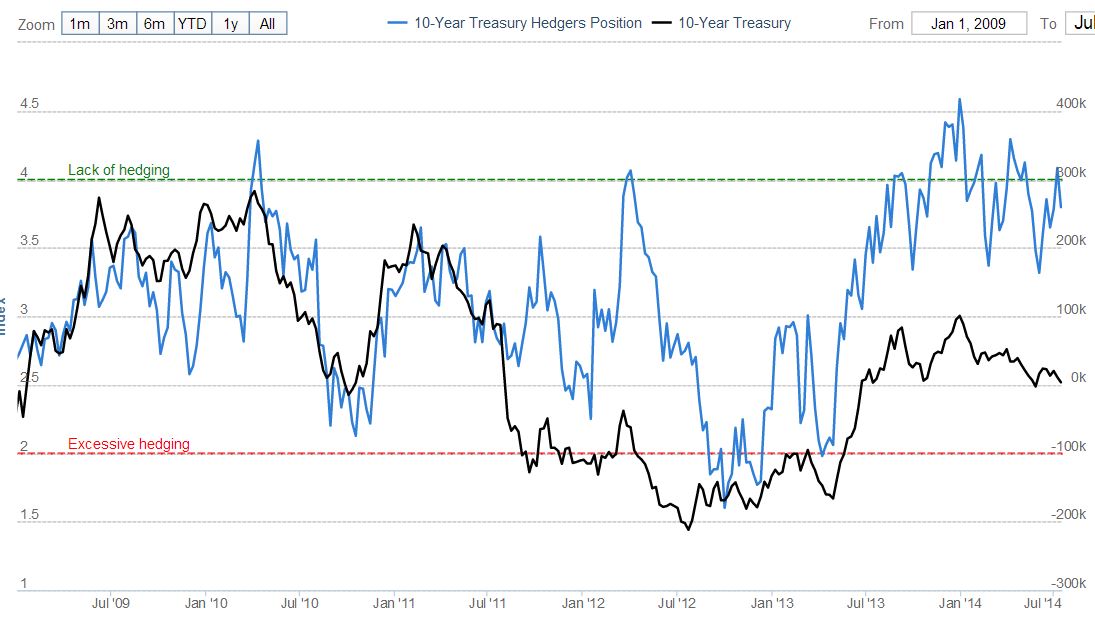

When we look at the latest batch of Commitment of Traders (COT) data in a chart from SentimenTrader we can see a lack of concern for Treasury yields continuing to fall, with over 3,000 contacts net-long. While the previous three bounces in yield have occurred when traders lessened their bets in favor of a higher yield down to under 200,000 contracts. There appears to still be too much optimism for yields to rise for them to actually do so.

When we look at the latest batch of Commitment of Traders (COT) data in a chart from SentimenTrader we can see a lack of concern for Treasury yields continuing to fall, with over 3,000 contacts net-long. While the previous three bounces in yield have occurred when traders lessened their bets in favor of a higher yield down to under 200,000 contracts. There appears to still be too much optimism for yields to rise for them to actually do so.

Going forward I’ll be watching to see how the $TNX reacts if it makes it back to 2.4% and the prior May low. If we do break under 2.4% then the 200-week Moving Average may come into play as the next possible level of support.

Going forward I’ll be watching to see how the $TNX reacts if it makes it back to 2.4% and the prior May low. If we do break under 2.4% then the 200-week Moving Average may come into play as the next possible level of support.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer. Connect with Andrew on Google+, Twitter, and StockTwits.