by Don Vialoux, Timing the Market

Jul 24

Interesting Charts

Nice move by the Shanghai Composite Index above resistance at

2087.32!

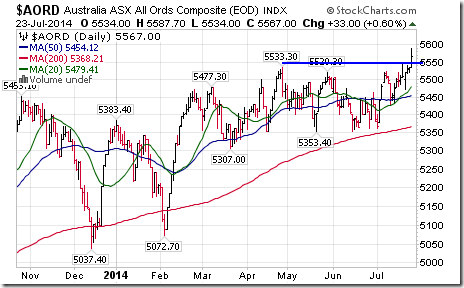

Ditto for the Australia All Ordinaries Composite Index! It is

the equity index that is most influenced by strength in the

Chinese equity market.

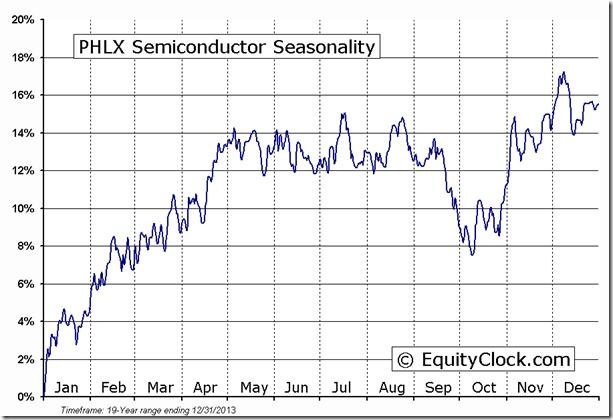

Early signs that seasonal strength in the Semiconductor

sector has ended!

Responses to Second Quarter

Results

Once again, reporting companies saw extraordinary price moves

(in both directions) following release of results. Of the 18

S&P 500 companies that reported before the opening

yesterday, nine rose strongly, two were virtually unchanged

(Microsoft and Northrop) and seven dropped sharply. Following

is a summary:

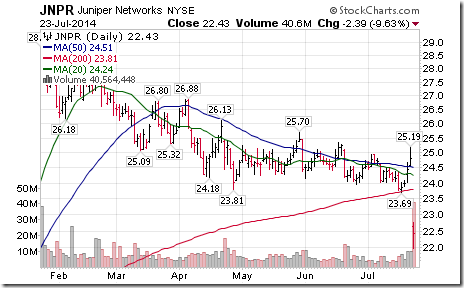

Following are examples:

Special Free Services available

through www.equityclock.com

Equityclock.com is offering free access to a data base

showing seasonal studies on individual stocks and sectors.

The data base holds seasonality studies on over 1000 big and

moderate cap securities and indices. To login, simply go to

http://www.equityclock.com/charts/

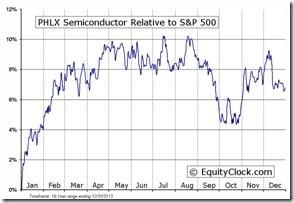

Following is an example:

^SOX Relative to the S&P 500 |

Disclaimer: Comments, charts and opinions

offered in this report by www.timingthemarket.ca

and www.equityclock.com

are for information only. They should not be

considered as advice to purchase or to sell mentioned

securities. Data offered in this report is believed to be

accurate, but is not guaranteed. Don and Jon Vialoux are

Research Analysts with Horizons ETFs Management (Canada) Inc.

All of the views expressed herein are the personal views of

the authors and are not necessarily the views of Horizons

ETFs Management (Canada) Inc., although any of the

recommendations found herein may be reflected in positions or

transactions in the various client portfolios managed by

Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not

held personally or in HAC.

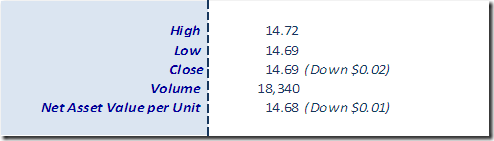

Horizons Seasonal Rotation ETF HAC July

23rd 2014

Leave a Reply

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/a092200123200781f1a429799a6dee9d.png)