by Ben Carlson, A Wealth of Common Sense

“Job one for the investor, then, is to learn as best she can, to ignore the day-to-day and year-to-year speculative return in order to earn the fundamental return.” – William Bernstein

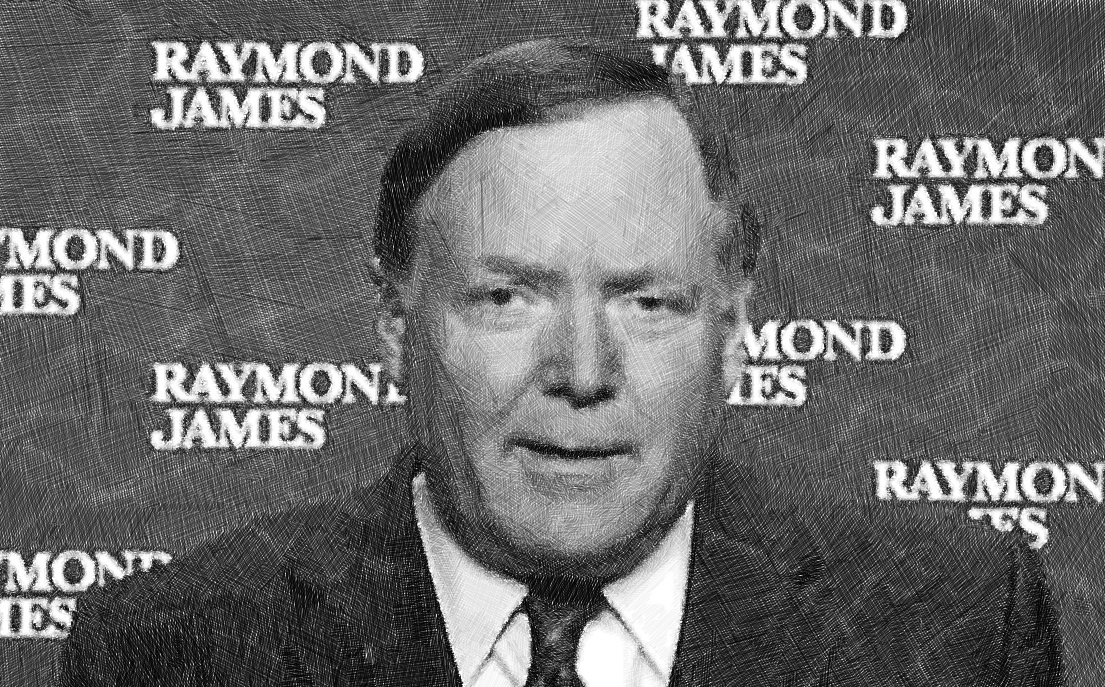

William Bernstein continues to put out thought-provoking, no-nonsense books on investing. Rational Expectations: Asset Allocation for Investing Adults is his latest and it didn’t disappoint.

I just love how straightforward Bernstein is with his approach to investing and portfolio management. No punches are pulled, no silly theories are spared.

His message always comes across as the old adage that investing can be extremely simple yet maddeningly difficult at the same time.

While he uses plenty of data to back up his claims, Bernstein also focuses on the important behavioral issues that are the real problem for most investors. In Rational Expectations, he broadly defines three groups of investors by their behavior:

Group 1: The average small investor, who does not have a coherent asset-allocation strategy and who owns a chaotic mix of mutual funds and/or individual securities, often recommended to him or her by a broker or advisor. He or she tends to buy near bull market peaks and sell near bear market troughs.

Group 2: The more sophisticated investor, who does have a reasonable-seeming asset-allocation strategy and who will buy when prices fall a bit (“buying the dips”), but who falls victim to the aircraft simulator/actual crash paradigm, loses his or her nerve, and bails when real trouble roils the markets. You may not think you belong in this group, but unless you’ve tested yourself and passed during the 2008–2009 bear market, you really can’t tell.

Group 3: Those who do have a coherent strategy and can stick to it. Three things separate this group from Group 2: first, a realistic appraisal of their true, under-fire risk tolerance; second, an allocation to risky assets low enough, or a savings rate high enough, to allow them to financially and emotionally weather a severe downturn; and third, an appreciation of market history, particularly the carnage inflicted by the 1929–1932 bear market. In other words, this elite group possesses not only patience, cash, and courage, but also the historical knowledge informing them that at several points in their investing career, all three will prove necessary. Finally, they have the foresight to plan for those eventualities.

Group 1 usually finds out the hard way that financial markets can be unforgiving. These are most likely the people that have completely given up on investing at his point after blow-ups from the tech bust or the great financial crisis. They assume the markets are rigged or function like a casino. Most people in this group try to make money through lottery ticket-style speculation. It never ends well and the psychological scars can endure for a very long time.

For the more sophisticated investors, Group 2 probably dwarfs Group 3 by a wide margin even though many would have a hard time admitting this fact. It’s easy to estimate your tolerance for risk and assume you will be able to rebalance and buy when everyone else is selling.

Unfortunately, a crash is much different than a correction and investors in this category tend to find out the hard way. This group capitulates by selling out of stocks after they have dropped by a substantial amount or ramping up their equity exposure after a large run-up in prices.

It’s easy to be a long-term investor during a bull market. Everyone’s making money and it feels like you can do no wrong. It’s when things don’t go as planned that this group loses control.

Bernstein says as much in the book when he observes, “If you began your investing journey after 2009 or haven’t yet started, then you’re an investment virgin.”

Your willingness to take risk will change much more often with the movements of the markets than your actual ability or need to take risk. Therefore a sensible long-term asset allocation is paramount to your success as an investor. Typically your broader asset allocation shouldn’t change all that much until your circumstances change (or when you need to rebalance).

It will feel like you should change your allocation weights between stocks, bonds and cash based on the most recent market performance, but most of the time it’s just performance chasing.

You can tilt your portfolio to certain sub-strategies within asset classes, but figuring out the mix between risky and safer investments is one of the keys to sticking with your investment plan.

That means you need an asset allocation that either includes investments such as high quality bonds to be able to rebalance when stocks fall or enough human capital in the form of savings that can be used to deploy at lower prices.

This is an important, often overlooked point, which Bernstein brings up in his Group 3 description that can play a huge role in determining your risk tolerance – having a high enough savings rate.

It’s not enough to say you will buy when fear is high and stock prices are low. You also have to have the necessary funds available to make purchases during times of maximum pessimism.

How you feel right now about the markets and your own portfolio probably has a lot to do with your investment stance over the past five years. If you have a healthy allocation to stocks, you feel like a genius. If you’ve been sitting in cash after selling out a few years ago you don’t feel so great.

It’s important to remember both your feelings during the crash and those in the subsequent recovery to new all-time highs. To be included in Group 3 you have to find a way to balance the emotional highs and lows to find your happy place in the middle.

Source:

Rational Expectations: Asset Allocation for Investing Adults

Further Reading:

The four abilities every investor needs to be successful

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense