Who doesn’t like to be diversified? It’s one of the easiest words to throw around when pitching an investment product or process because the word has an almost perfectly positive connotation. I am guilty of overusing the term because it’s just so easy to throw around.

But diversification isn’t all peaches and cream. There is such a thing as being overdiversified. Take an index fund. It owns tons of stocks that will stink over the next year. Apple last year is a great example. It was the biggest stock in the S&P 500 (and therefore most impactful on returns), and had a relatively weak year.

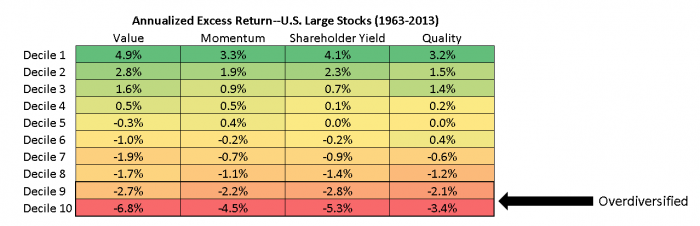

Owning everything means you will always own certain types of stocks that tend to perform poorly. Let’s look at four such types, and then see how an index would perform if it first stripped out the worst stocks by these measures. Because market indexes are weighted by capitalization, I’ll focus on large stocks here.

Value

Expensive stocks—those trading at high multiples of their sales, earnings, and cash flows—have been very poor performers historically. These are usually exciting companies, but the market expects too much of them, and when reality sets in, the stocks underperform. The most expensive stocks in the large stock universe (the worst 10%, rebalanced annually) have underperformed by 6.8% annually since 1963.

Momentum

Same story for the falling knives out there. Stocks whose recent returns have been among the worst in the market tend to continue to lose over the next year. Stocks with the worst momentum have underperformed by 4.5% annually since 1963.

Quality

Stocks with suspicious earnings quality—which tend to have very high accruals and weak cash flows—have also gotten beaten up over the years. Stocks with the worst earnings quality have underperformed by 3.4% annually since 1963.

Shareholder Yield (Dividends + Buybacks)

Stocks with the worst shareholder yield (meaning they are issuing shares and typically not paying a dividend) have also underperformed, by 5.3% annually.

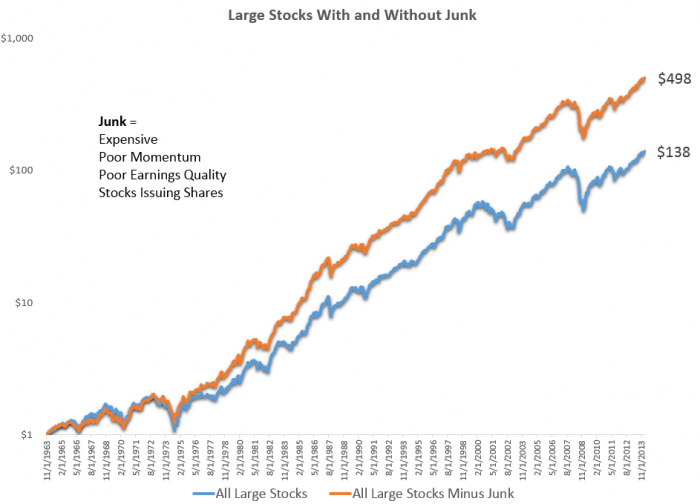

An Index without the Crap

So what would happen if we just refused to invest in expensive stocks, low quality stocks, stocks with poor price momentum, or stocks issuing shares? The results below illuminate what I mean by overdiversification. An equal weighted basket of all large stocks (junk included) has grown at an annual rate of 10.3% with an annual standard deviation of 15.9%, since 1963. If, instead, you stripped out stocks (annually) in the worst 20% of the market by value, momentum and quality, and also stripped out any stocks that were net issuers of shares (issuance – buybacks > 0), then you’d have achieved a much better result. This modified index would have grown at a 13.1% annual rate and done so with less volatility, with a standard deviation of 14.6%. You’d still own several hundred stocks, and be very diversified, but you’d have a smarter portfolio. Here is the historical growth of the two strategies. Diversification is good…to a point. But owning everything—even the junk—can be a drag on returns over the long term.