by Don Vialoux, Timing the Market

Interesting Charts

The TSX Composite Index continues to struggle at a time when the S&P 500 Index is touching all-time highs. The Index peaked on May 2nd at 14,765.15, moved sideways, fell below its 20 day moving average yesterday, has underperformed the S&P 500 Index during the past two weeks and shows declining momentum indicators from overbought levels.

Here’s a surprise! Chinese equities and related ETFs are showing signs of recovering from oversold levels.

Another surprise! Long term Treasuries are outperforming the S&P 500 Index

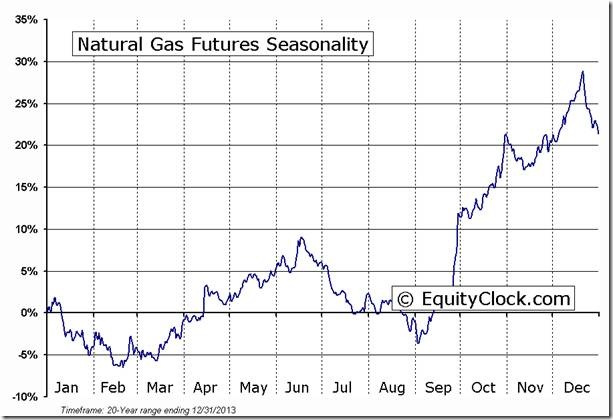

New encouraging technical signs for Natural Gas have surfaced despite a neutral trend during the past two months:

· Natural Gas moved above its 20 and 50 day moving averages yesterday

· Short term momentum indicators changed from mixed to up yesterday

· Strength relative to the S&P 500 Index is just turning positive

Reminder: Seasonal influences currently are positive, but only until mid-June. Strength is related partially to weather forecasts for higher than average temperatures in much of the U.S. during the next two weeks at a time when natural gas inventories are recovering from near record lows. Higher than average temperatures will prompt greater demand for natural gas to generate additional power for air conditioning.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2009 through 2013. Source: Form EIA-912, "Weekly Underground Natural Gas Storage Report." The dashed vertical lines indicate current and year-ago weekly periods.

Stock Tweets Yesterday

Technical action by S&P 500 stocks remained bullish this morning despite no change by the Index. 15 S&P 500 stocks broke resistance

Technical Action by Individual Equities Yesterday

By the close, a few more S&P 500 stocks broke resistance for a total of 17 stocks. One stock broke support on a downgrade: Dollar General.

Three TSX 60 stocks broke support: Power Corp, Yamana and Eldorado. None broke resistance

Adrienne Toghraie’s “Trader’s Coach Column

|

Stuff and It’s Influence on Trading By Adrienne Toghraie, Trader’s Success Coach

Are you overwhelmed by the stuff in your life to the point where you choose to ignore it? The fact is that it is there all around you, and it will affect the decisions you make in your life. Until you get to the point of having control over your stuff, you will dissipate your energy. Dissipating energy means dissipating focus. Dissipating focus means not getting the best out of yourself and your trading.

Eric the color-coded, itemized and place for everything trader

When I worked with Eric several years ago, he was one of the most disorganized traders I ever met. As a result of my influence, Eric let go of all of his trash, garbage and much of his memorabilia. He grouped, categorized and filed the rest of his stuff. With all of the worked we accomplished, plus this big change in Eric’s organization his trading profits were impressively improved.

I kept in touch with Eric over the years, and he recently asked if we could go deeper into why his trading was not as good as it could be. One of my conclusions was that Eric was still holding on to all of his organized stuff. Such as:

· Trading magazines that he had not looked at for twenty years

· Research of strategies that he did not use

· Tax information since he started earning money

· Catalogues, newspapers

· Many tools of the same category, six hammers, twenty screwdrivers

· Hundreds of spices almost all over one year old

· Clothing that he had not worn for over two years

All in all, Eric lived in a six thousand square foot home by himself that was neat and clean, but full of stuff that he never used. One of the conclusions that I came to was that Eric felt uncomfortable if a space was not filled. Stuff for him was like a warm hug as he explained it, but that same hug was also smothering.

Eric’s next evolution to becoming a better trader was to clear out all of the organized stuff by going through every paper in every nook and cranny and deciding if he would ever use it again. One of his tasks was that he was required to take out everything from a room and make the room comfortable with only one chair.

Eric chose a room in his house that had a view of the lake. He had a large picture window installed and put a recliner in the center of the room, so that he could look out over the lake. This is now Eric’s favorite space, he is now engaged and his trading is the best it has ever been. They added another lounge chair to the room with the view.

Other stuff that can smother

In this day and age of computer information it is also easy to accumulate other stuff that smothers your focus such as:

· Too much information in your computer that you have to file

· Too many web sites and news sites that you have bookmarked to keep up with

· Too much social media

· Too much junk emails to sift through

While some might argue this makes life easier, it is also true that when you have too much of it, it can become overwhelming.

Conclusion

While we all enjoy the accumulation of stuff, it can get to the point where your stuff takes over your life, your thinking and your focus. It is not only a matter of organizing it – too much is too much. For a trader, this is another issue that can sabotage a trader’s potential in earning the profits his strategy will allow.

Free Newsletter

More Articles by Adrienne Toghraie, Trader’s Success Coach

Sign Up at – www.TradingOnTarget.com

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

FUTURE_NG1 Relative to the S&P 500  |

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Horizons Seasonal Rotation ETF HAC May 28th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray