Horizons ETFs' 2014 Q2 Advisor Sentiment Survey

Number of advisors bearish on Canadian equities more than doubles for Q2

TORONTO, April 22, 2014 — Canadian investment advisors are predicting negative stock returns for Canadian stock markets and 11 other asset classes for the second quarter of this year, a dramatic departure from the positive outlook they shared in the first quarter of 2014. The change in sentiment was reported in the second quarter edition of the 2014 Advisor Sentiment Survey (“Q2 Survey”), conducted by Horizons ETFs Management (Canada) Inc. (“Horizons ETFs”).

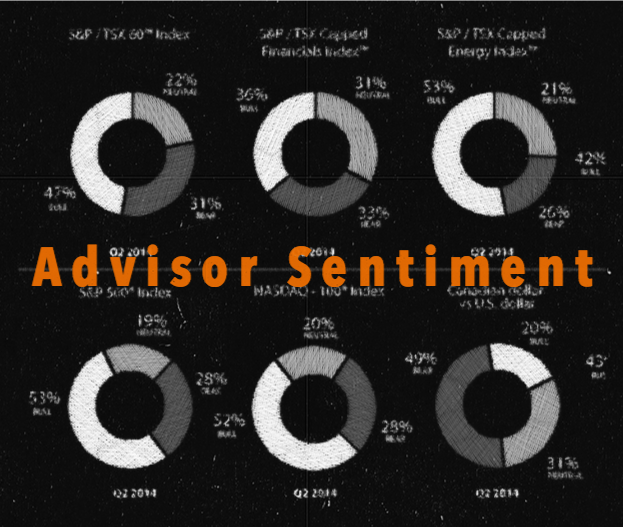

The Q2 Survey asked Canadian advisors to share their outlook on 15 distinct asset classes and express their sentiment — bullish, bearish or neutral — on the anticipated returns for these asset classes in the upcoming calendar quarter (Q2). Collectively, advisors were over 50 per cent bullish on only three of the 15 asset classes surveyed, which were S&P/TSX Capped Energy Index™, S&P 500® Index and NASDAQ–100 Index.

In the Q2 Survey, less than half (47 per cent) of the Canadian advisors surveyed expect Canadian stocks to deliver a positive return over the next quarter. This is a stark turnaround in sentiment compared to the onset of 2014, in which 74 per cent of advisors stated they were bullish on the S&P/TSX 60™ Index’s performance for the first quarter (Q1), as measured in the first quarter edition of the 2014 Advisor Sentiment Survey (“Q1 Survey”).

A similar turnaround in outlook expectations was also seen in relation to U.S. stocks. Bullish sentiment on the S&P 500® for Q2 dropped to 53 per cent from 74 per cent in the Q1 Survey. For the first quarter ended March 31, 2014, the S&P 500® delivered a modest 1.3 per cent return versus the 4.7 per cent the S&P/TSX 60™ returned. While almost every equity category saw big declines in bullish sentiment, emerging markets experienced the most severe decline, where bullish sentiment dropped to 32 per cent from 71 per cent in the previous quarter.

“Advisors are adopting a ‘buyers beware’ attitude towards Canadian and U.S. equities since their current valuations remain on the high side after last year’s market rally,” said Howard Atkinson, President of Horizons ETFs. “With growing credit concerns and slower than expected economic growth, their skepticism carries over to emerging markets, which have been an unloved asset class over the last 18 months. While sometimes this could indicate the potential for buying opportunities, this is the not the case — advisors clearly expect emerging market stocks to decline further.”

Typically, when advisors have been bearish on stocks, they werebullish on gold. Bullish sentiment on gold bullion increased this quarter to 43 per cent from 32 per cent, following a 6.5 per cent return last quarter. Bullish sentiment on gold stocks saw a similar uptick rising to 42 per cent from 32 per cent following first quarter performance of theS&P/TSX Global Gold Index™, which rose 15.6 per cent.

“Since precious metals and stocks have a history of inversely correlated performance, you expect to see advisors increase their bullish attitude on gold when they are bearish on equities,” said Mr. Atkinson. “The relative outperformance of gold bullion and gold stocks last quarter is likely an indicator that sentiment on the broader stock market is declining.”

Bullish sentiment on energy stocks did hold relatively steady this quarter, after the S&P/TSX Capped Energy Index™ returned 8.8 per cent last quarter. Energy and gold stocks outperformed the financial sector, as represented by the S&P/TSX Capped Financials Index™, which was only up 1.4 per cent. Sentiment on the financial index declined to 36 per cent for Q2 from 56 per cent in Q1.

“The Canadian equity market seems to be going through a period of sector rotation that favours energy and gold stocks over the financial sector,” said Mr. Atkinson. “Canadian investors may be well served by taking an alternative approach to their Canadian equity investing and overweighting materials and energy stocks versus financials. For index investors, this may mean looking beyond the S&P/TSX Composite or S&P/TSX 60 and focusing on other products that offer equal-weight exposure.”

Advisors have become much more positive about the future performance of the Canadian dollar versus the U.S. dollar. For Q2, one fifth of advisors were bullish about the Canadian dollar, whereas only 12 per cent were in Q1. Many more advisors stated they were neutral, which resulted in bearishness falling 30 per cent in Q2 to 49 per cent from 70 per cent.

“This suggests advisors believe the decline of the loonie has followed its course; from our results, we’ve observed that advisors have about a 10-cent valuation band for the loonie, as it nears 90 cents they get bullish, and as it nears par value with the U.S. dollar, they get bearish,” said Mr. Atkinson.

About the 2014 Advisor Sentiment Survey

Horizons ETFs conducts the only quarterly sentiment survey of Canadian investment advisors. The survey quantitatively measures advisors’ quarterly outlook as it relates to key benchmarks covering equities, bonds, currencies and commodities. For full survey results, visit http://www.HorizonsETFs.com/sentimentsurvey.

About Horizons ETFs

Horizons ETFs Management (Canada) Inc. and its affiliate AlphaPro Management Inc. are innovative financial services companies offering the Horizons ETFs family of exchange-traded funds. The Horizons ETFs family includes a broadly diversified range of investment tools with solutions for investors of all experience levels to meet their investment objectives in a variety of market conditions. With approximately $4.1 billion in assets under management and 69 ETFs listed on the Toronto Stock Exchange (as at March 31, 2014), the Horizons ETFs family makes up one of the largest families of ETFs in Canada. Horizons ETFs Management (Canada) Inc. and AlphaPro Management Inc. are members of the Mirae Asset Financial Group.

SOURCE: Horizons ETFs Management (Canada) Inc.

******

For more information:

Howard Atkinson, President

Horizons ETFs Management (Canada) Inc.

(416) 777–5167

hatkinson@horizonsetfs.com

Commissions, trailing commissions, management fees and expenses all may be associated with an investment in exchange traded products managed by AlphaPro Management Inc. (the “Horizons Exchanged Traded Products”). The Horizons Exchange Traded Products are not guaranteed, their values change frequently and past performance may not be repeated. Certain Horizons Exchange Traded Products may have exposure to leveraged investment techniques that magnify gains and losses and which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. The prospectus contains important detailed information about each Horizons Exchange Traded Product. Please read the applicable prospectus before investing.