Pre-opening Comments for Wednesday April 9th

U.S. equity index futures were higher this morning. S&P 500 futures were up 4 points in pre-opening trade.

The first quarter earnings report season is off to a good start. After the close yesterday, Alcoa reported better than expected first quarter earnings. Alcoa added $0.47 to $13.00.

International Paper (IP $45.34) is expected to open higher after Credit Suisse initiated coverage with a Buy rating. Target is $67.

Kellogg (K $64.34) is expected to open higher after Nomura initiated coverage with a Buy rating. Target is $75.

NASDAQ OMX Group fell $0.50 to $34.31 after Bank of America/Merrill downgraded the stock from Buy to Neutral. Target is $39.

Hershey fell $1.22 to $100.50 after Goldman Sachs downgraded the stock from Neutral to Sell. Target is $90.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/04/08/stock-market-outlook-for-april-9-2014/

Interesting Charts

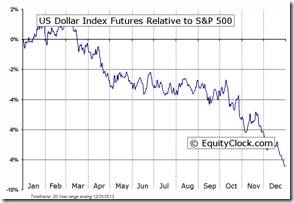

Weakness in the U.S. Dollar was a focus yesterday. The U.S. Dollar Index fell below its 20 and 50 day moving average and once again is testing long term support near 79.

The Canadian Dollar benefited yesterday from weakness in the U.S. Dollar Index as well as results from the Quebec election. Nice breakout above US91.41cents! ‘Tis the season for Canadian Dollar strength!

Weakness in the U.S. Dollar triggered strength in a variety of material ETF and their related equities including Aluminum, Crude Oil, Gasoline, Base Metal equities, Coal equities and Steel equities. All have turned positive relative to the S&P 500 Index and recently have moved above their 20 day moving average

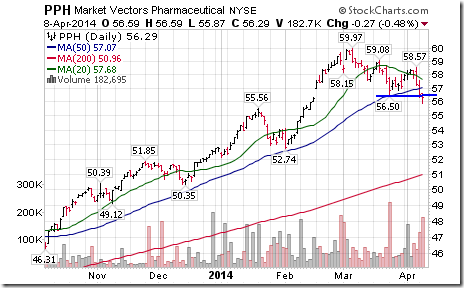

Other sectors continued to struggle. Pharmaceutical equities and related ETFs were notably weaker.

Equity markets outside of North America and their related ETFs have maintained upside momentum despite recent weakness in U.S. equity indices.

Technical Action by Individual Equities Yesterday

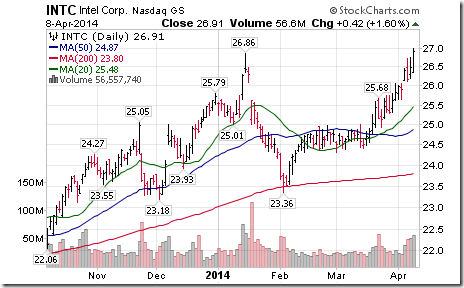

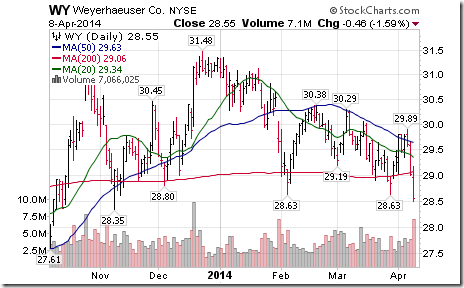

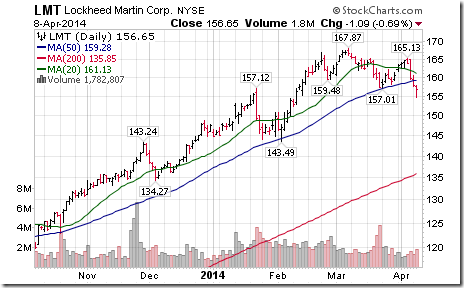

Technical action by S&P 500 stocks remained bearish yesterday. Eleven S&P 500 stocks broke support and four broke resistance. Notable on the list of stocks breaking resistance were Intel and Diamond Offshore. Notable on the list of stocks breaking support were Lockheed Martin and Weyerhaeuser.

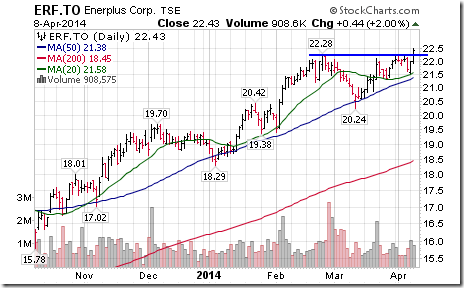

Among TSX 60 stocks, the energy sector leads on the upside with more equities in the sector breaking to new highs. ‘Tis the season!

FP Trading Desk Headline

FP Trading Desk headline reads, “Japanese stocks poised to outperform other developed markets”. Following is a link:

Special Free Services available through www.equityclock.com

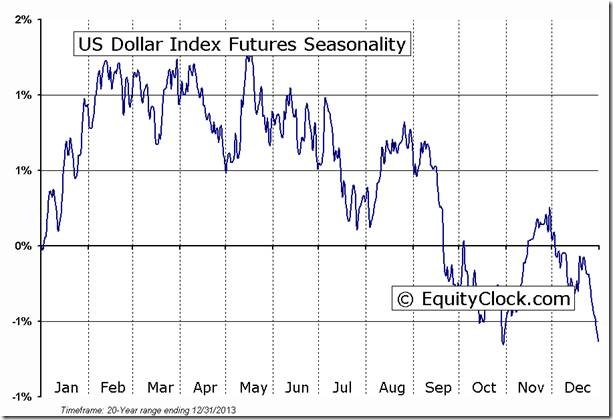

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

US Dollar Index Futures Seasonal Chart

DX.FUT Relative to the S&P 500 |

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

|

Fertilizing Trader Success

By Adrienne Toghraie, Trader’s Success Coach

A trader’s transformation can be extraordinary when he achieves success. What very often follows is that success breeds success. For a trader this can be the turning point in his career.

What happens just after a success?

· You feel good

· You think positive thoughts

· Your behavior is better towards yourself and others

· You notice that you have more energy

· Other people treat you differently because of how you behave towards them

Also notice that the reverse is true for those who experience failure. This is why it is important that I recommend a trader has a balanced life where all parts of his life are rewarding. Each area of life where a trader feels he has success will fertilize the other areas of life to produce successful results.

Anchoring the past to the present

A simple anchoring exercise to fertilize success is when you bring into mind your sense memories of the experience of past successes.

· Write down all of the success experiences in your life chronologically backwards leaving out the times you were successful in your trading results

· Take time to think about each one noticing where you feel the feelings of each time you were successful (It is extremely important that you allow the feeling before you go to the next step)

· Use one word or clap your hands when you feel the feeling of each experience

· Now that you have your success anchor established, write down all of the individual trades that were successful as a result of following your rules (it is important that you only give value to where you were disciplined)

· When you review each experience and create a feeling as a result of thinking about a success in trading trigger the anchor you have set

Anchoring new experiences

Intentionally create as many new experiences of success in all areas of your life.

· Do the tasks necessary to become a disciplined, profitable trader

· Budget yourself and your family to secure the future

· Look for opportunities to enrich other people’s lives

· Choose good habits for making yourself healthier

· Read non fiction books to increase your knowledge

· Volunteer to assist or help others in need

· Play online games and get proficient in one or more of these games

With each new anchor where you feel successful, trigger your anchor.

Jubilant Joe

When I first met Joe, he was a very sad individual. He had not achieved trading success, his business was falling apart and he did not have a social life. He was tired, disorganized and did not find life worthwhile.

Joe took my Trader’s Evaluation. One of the things I learned about Joe was that when he was a child he had a coach who gave him guidance and direction, which resulted in Joe getting a college education and becoming successful in business. When Joe heard that his coach had died, his life started to deteriorate.

I said that he needed to honor his coach’s life by being the person his coach wanted him to be. I proceeded to give Joe ten tasks. Within two weeks Joe called me to let me know that he had completed all the tasks that I gave him. He sounded like a new man. I was happy to give him more tasks. Long story shorter, Joe’s business is once again successful, his trading is profitable and he is happily married.

Conclusion

When a trader experiences the benefits of success in any area of life, it is an opportunity to fertilize success in other areas. Good feelings are the natural state for your body, mind and spirit. When you allow the experience of the benefits of success to be enhanced, you create the environment for increasing more success.

| Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading Email Adrienne@TradingOnTarget.com Visit www.TradingOnTarget.com |

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Investment Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Investment Management (Canada) Inc.

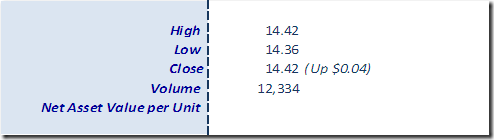

Horizons Seasonal Rotation ETF HAC April 8th 2014