by Cullen Roche, Pragmatic Capitalism

I had to chuckle at this recent research report out of the Federal Reserve on the efficacy of QE. These researchers cited broad success from the program. A big chunk of their conclusions comes from the “novel” approach of studying intraday price responses to specific Fed announcements.

As a market practitioner this looks like a nice case of data mining. I am nowhere near the camp that thinks markets efficiently digest information or even interpret Fed decisions in an appropriate manner so studying intraday movements on or around Fed movements appears pretty useless to me. The market is simply too complex, too filled with irrational participants, too multi-temporal and too uninformed to respond in any manner which might be deemed “right” most of the time. So I don’t see how any conclusions from such data could be considered valid. Naturally, lots of people will probably disagree with me….

What’s even stranger about this research paper is how much of it conflicts with earlier Fed findings showing that QE doesn’t do much at all outside of extraordinary circumstances. The Fed itself doesn’t even seem to agree on what QE does or how well it works. So who really knows if QE does anything good or if it’s all just a mirage to a large degree? I certainly think there’s a lot of gray area in how QE works, how it can be implemented and in what type of environment it functions or not. But it does strike me as very odd how much mystery continues to surround this policy.

This was all particularly interesting given the recent discussion on high frequency trading. I mean, is it just me or does it seem like no one knows what the hell is going on with this stuff? I see experts every day disagreeing on what HFT does, how it works and what its impact is. And just when you think you have your head wrapped around this stuff a new twist or turn gets embedded into the thinking.

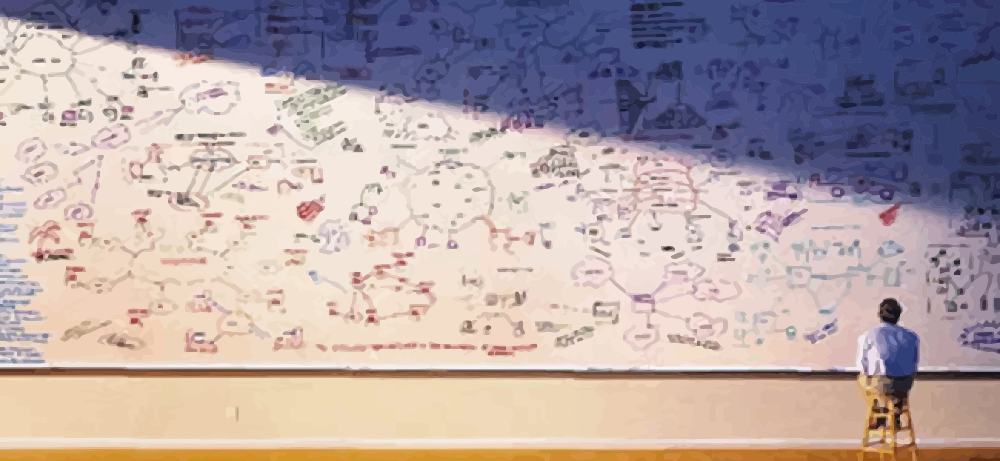

But I guess that’s really what our financial system is. It’s this crazy construct of the human mind. And it’s always evolving and adapting with the times depending on how our minds perceive it, how we utilize it and how we alter its state in any given environment. And our limited minds are constantly trying to keep up with it all and understand the many different ways in which it impacts our world. It kind of makes one wonder – does anyone really know what’s going on?

Copyright © Pragmatic Capitalism