by Don Vialoux, Timing the Market

Pre-opening Comments for Tuesday April 8th

U.S. equity index futures were higher this morning. S&P 500 futures were up 2 points in pre-opening trade.

The Canadian Dollar gained US0.37 to 91.54 cents following election of a majority government in Quebec

Cisco slipped $0.10 to $22.75 after Wunderlich downgraded the stock from Buy to Hold. Target is $24.

Dr. Pepper Snapples (DPS $53.87) is expected to open lower after Wells Fargo downgraded the stock from Market Perform to Underperform.

Nike added $1.17 to $72.00 after Stifel Nicolaus upgraded the stock from Hold to Buy. Target is $87.

Eli Lilly (LLY $58.00) is expected to open higher after BMO Capital upgraded the stock from Underperform to Market Perform.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/04/07/stock-market-outlook-for-april-8-2014/

Interesting Charts

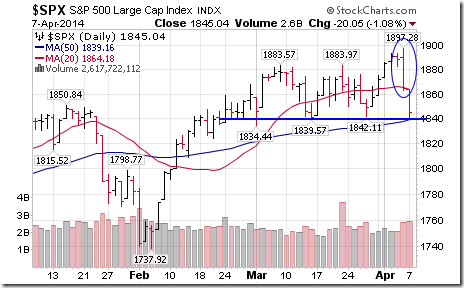

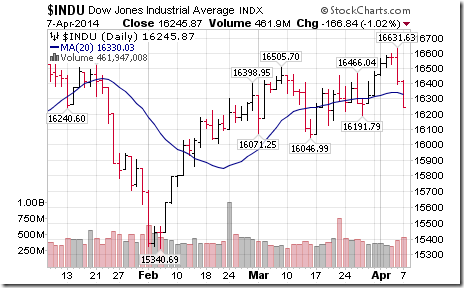

North American equity markets followed through on the downside following bearish Key Outside Reversal Patterns recorded on Friday by the S&P 500 Index and the Dow Jones Industrial Average.

· The S&P 500 Index also broke below its 20 day moving average on Friday and now is testing short term support at 1839.57 and its 50 day moving average at 1,839.16. A move below these levels is expected to trigger additional short term technical weakness.

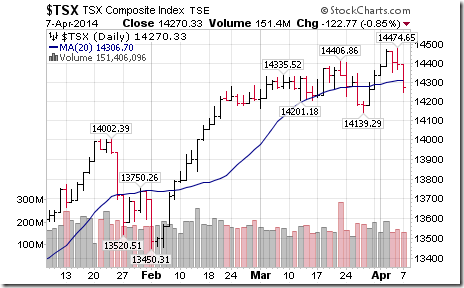

· Several North American equity indices broke below their 20 day moving average yesterday including the TSX Composite Index, the Dow Jones Industrial Average and the Dow Jones Transportation Average.

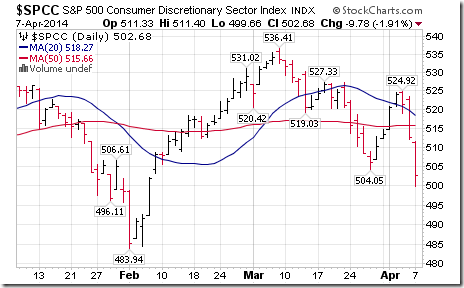

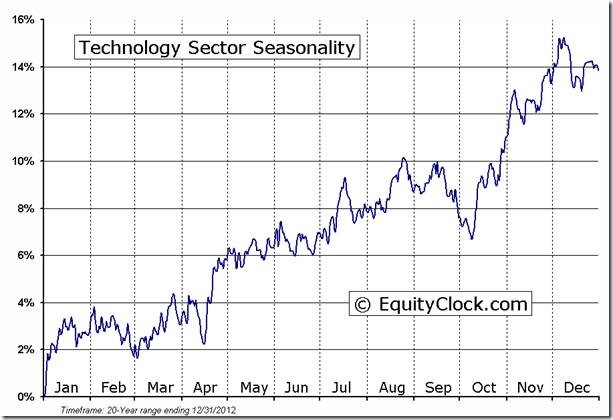

Economic sensitive sectors (Financials, Materials, Industrials, Consumer Discretionary and Technologies) were the weakest.

Technical Action by Individual Equities Yesterday

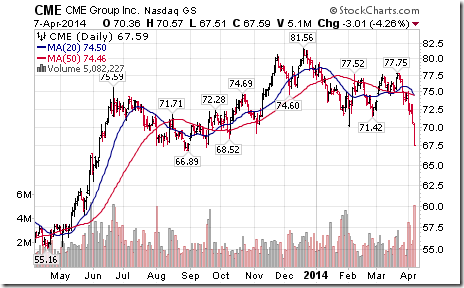

Technical action by S&P 500 stocks was exceptionally bearish yesterday. Twenty S&P 500 stocks broke support and four stocks broke resistance. Consumer Discretionary stocks (e.g. Chipotle, Carmax, Omnigroup) topped the list with seven breakdowns. Other notable breakdowns included CME Group and Goldman Sachs. Stocks breaking resistance were Peabody, Public Storage, Ventas and Pepco Holdings.

CSTA News

Don Vialoux is presenting to the Oakville chapter of the Canadian Society of Technical Analysts on Wednesday April 9th. The Meeting starts at 7:00 PM and is held in at the Queen Elizabeth Park Centre. Everyone is welcome. Register at www.csta.org

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

TECHNOLOGY Relative to the S&P 500 |

FP Trading Desk Headline

FP Trading Desk headline reads, “Earnings surprises likely after analysts set bar low for the first quarter”. Following is a link:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Investment Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Investment Management (Canada) Inc.

Horizons Seasonal Rotation ETF HAC April 7th 2014

Copyright © Timing the Market

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/34528835f2acd1d65c5792c6b0a76369.png)