via CitiFX Technicals,

What do we believe for 2014?

- The USD bullish trend remains intact and the DXY Index should set new trend highs (90+).

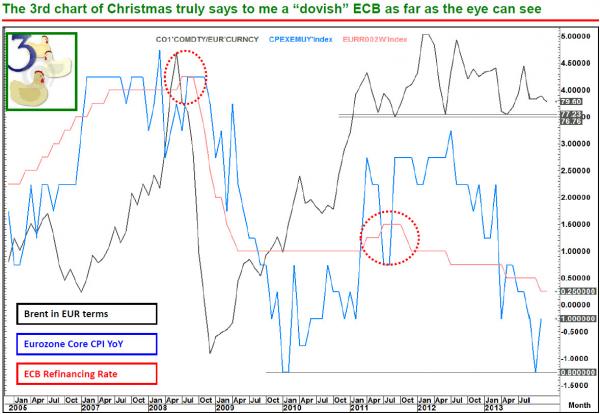

- EURUSD: We expect a sharp turn lower that could see EURUSD in the 1.18-1.22 range in 2014. A very easy ECB policy will likely be a contributing factor here.

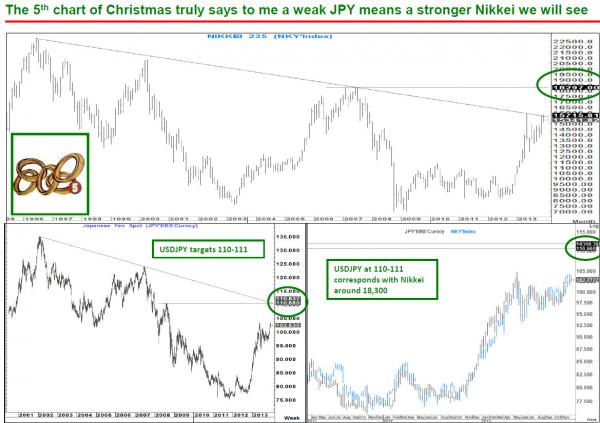

- USDJPY: Remains in a broad uptrend and we would expect a move towards at least 110-111 this year. This should continue to be supportive of the Nikkei.

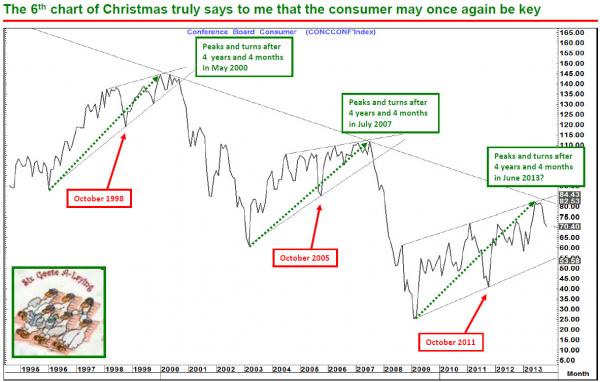

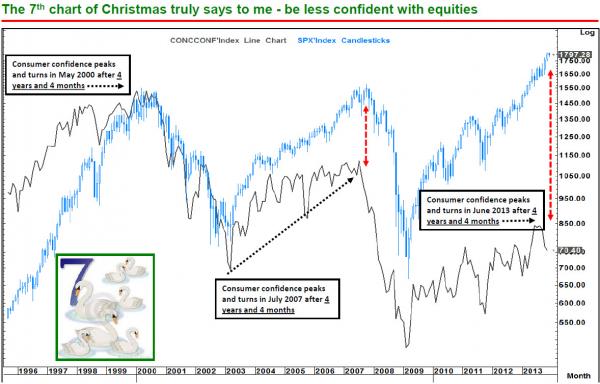

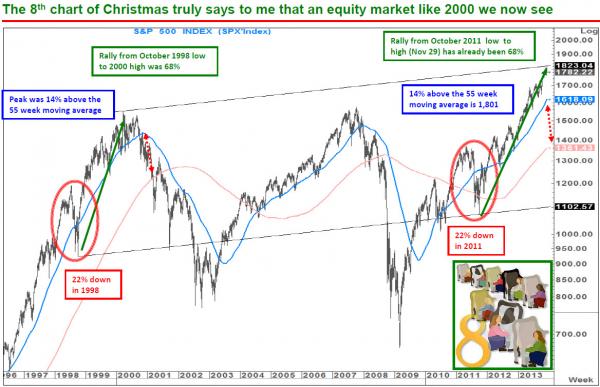

- Consumer Confidence: Looks set to “roll” lower in a fashion similar to 2000 and 2007. This may have implications for the U.S. Equity market which looks stretched at this point in a fashion similar to 2000.

- Housing looks better than it was at the lows but nowhere near the traditional recovery/escape velocity of prior cycles. In 2014 we may even see a pause in its improvement.

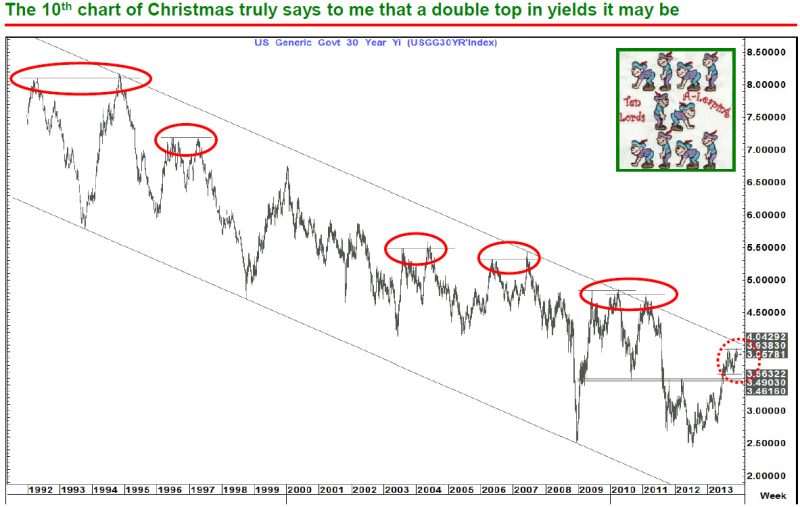

- US yields: Similar to last year we suspect that an initial move lower may well emerge towards at least 2.40% (10 year) and 3.50% (30 year) and possibly lower. This is within a longer trend dynamic where they will likely move higher again thereafter. We would expect significantly higher yields in the next few years to materialise.

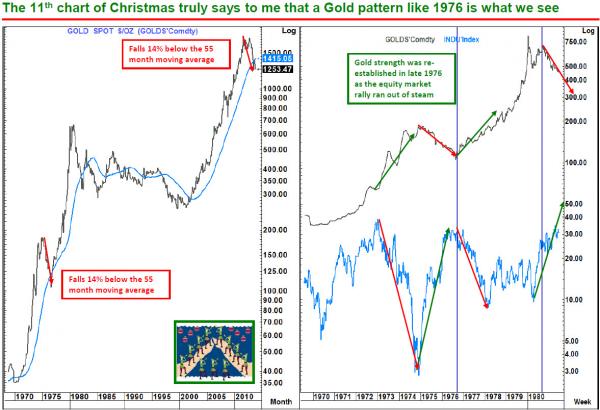

- Gold finally looks to be forming a base for a move higher. However we need both more convincing price action and likely a struggling equity market to solidify this potential.

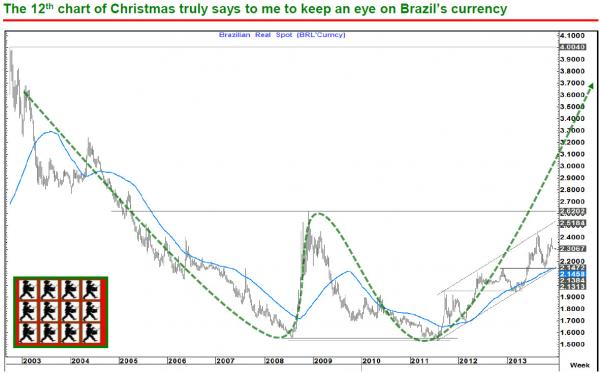

- In Local Markets the USDBRL chart is one of the more convincing pictures and suggests a much weaker BRL is in prospect in 2014.

Overall: We see a backdrop where the “repair process” of recent years continues at a slow pace but where the US continues to look like the “best house on a bad street” when it comes to the major developed nations. This should also benefit the USD and keep the relative picture for yields (monetary policy) in favour of the US.

The corrective platform could be the “launch pad” for a move to new highs in the trend and a stronger USD all the way to 2016 as per previous post housing collapse cycles.

EURUSD turning lower like it did in 1998? A move towards 1.20 this year and much further over the next 2+ years looks likely.

A move similar to 1978-1982 could see USDJPY as high as 118 eventually while a repeat of 1995-1998 would suggest as far as 139. An average of the two could see USDJPY close to 130 by 2015. For 2014 we would expect a move to at least 110-111

Another 4 year and 4 month trend coming to an end?

The last 2 peaks in Consumer Confidence led the S&P by 3-4 months. That pretty much takes us to now... big divergence between the Equity market and the real economy.

Peak in the 1,820-1,830 area? Prior peaks have seen pretty quick falls to the 200 week moving average.

Is the US 30 year yield double topping as it has done so many times before?

The potential double bottom will target 3.70 with a break above 2.62. Beyond there the all-time USDBRL high at 4.00 could well be eventually tested.

And summarising their strong conviction 2014 views: