by Ryan Lewenza, North American Equity Strategist, TD Wealth

We’re happy to announce that the quarterly U.S. Equity Strategy report has been enhanced to now include investment strategy for the Canadian equity market. The new and improved North American Equity Strategy report will include EPS and price target forecasts for the S&P/TSX Composite and S&P 500 indices, Canadian and U.S. sector recommendations and rationale, along with key investment and economic trends within the North American equity markets. As always, we welcome any feedback you may have. Highlights of today’s North American strategy report include:

• Q3/13 was another solid quarter for U.S. equities, with the S&P 500 Index (S&P 500) up 4.7%, pushing the year-to-date (YTD) return to 17.9%. Small-cap stocks continued to outperform large-caps, with the Russell 2000 Index up 9.9%, and 26.4% YTD. The S&P/TSX Composite Index (S&P/TSX), which has significantly lagged the S&P 500 this year, had a solid quarter up 5.4%, pushing the S&P/TSX into positive territory for the year.

• All eyes are on Washington as the U.S. approaches its debt limit date. As at the time of writing, the most recent proposal was for a bill to extend the borrowing authority to February, giving the two parties time to work out broader budgetary differences. While this would be a positive development, taking the U.S. economy off the proverbial ledge for now, it does not resolve the budget impasse and the partial government shutdown, nor the future debt limit battle, which would likely intensify in the weeks leading up to the potential February debt limit date. We continue to expect an 11th hour resolution of the fiscal issues.

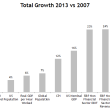

• Strong YTD gains for the S&P 500 have been driven by multiple expansion. With the U.S. Federal Reserve (Fed) likely to “taper” its asset purchases in H1/14, valuation support could wane, making earnings growth necessary for further upside. With our expectation for improving economic momentum in 2014, we could see earnings grow at 6-7%, which could help push the stock market higher, despite the fact that the 56-month rally is now in-line with the average length of previous bull markets.

• Despite the occasional pullbacks and increase in volatility due to intensified macro issues, the S&P 500 remains in a confirmed uptrend. Only a break below key support of 1,565 to 1,575 would alter our bullish technical stance on the S&P 500.

• Our base case view is for economic momentum to improve as we move into 2014. This should provide a supportive backdrop for cyclical sectors, with our preferred sectors being the industrials, financials and information technology. Given our view that interest rates will slowly grind higher as economic momentum improves, the interest-sensitive utilities and telecommunications sectors should underperform.

You may read or download of copy this entire report from Ryan Lewenza, TD Portfolio Advice & Investment Research in the slide deck below: