Submitted by Tim Price via Sovereign Man blog,

Despite nearly $17 trillion reasons, there are investors stupid enough to believe that debt issued by the world’s largest debtor country (i.e. US Treasuries) should be treated as a risk-free asset.

This is even more astounding given that the possibility of formal default is only a matter of days away.

Treasury bond defenders will no doubt point out that in a fiat currency world where the central bank has the freedom to print ex nihilo money to its heart’s content, the very idea of default is absurd.

But that is to confuse nominal returns with real ones.

Yes, the Fed can expand its balance sheet indefinitely beyond the $3 trillion they have already conjured out of nowhere. The world need not fear a shortage of dollars.

But in real terms, that’s precisely the point. The Fed can control the supply of dollars, but it cannot control their value on the foreign exchanges.

The only reason that US QE hasn’t led to a dramatic erosion in the value of the dollar is that every other major economic bloc is up to the same tricks. This makes the rational analysis of international investments virtually impossible.

It is also why we own gold – because it is a currency that cannot be printed by the Fed or anybody else.

On the topic of gold, the indefatigable Ronni Stoeferle of Incrementum in Liechtenstein has published his latest magisterial gold chartbook.

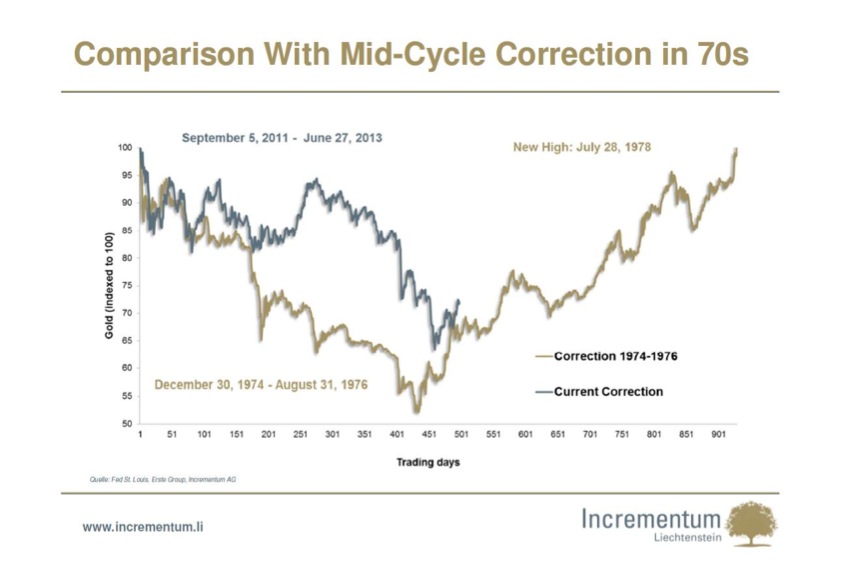

Set against the correction in the gold price 1974-1976, the current sell-off (September 2011 – TBD) is nothing new. The question is really whether financial and debt circumstances today are better than they were in the 1970s.

We would suggest that debt fundamentals are objectively worse.

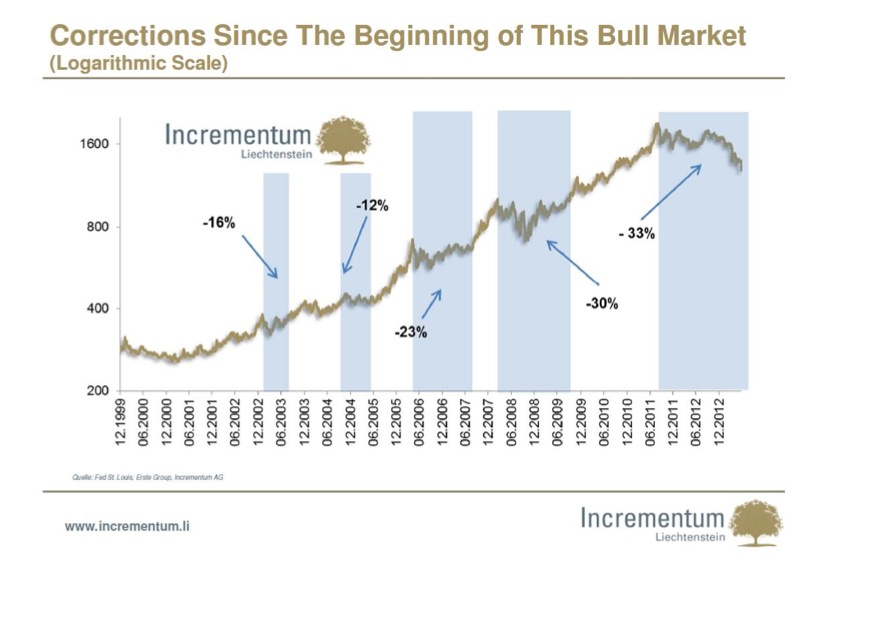

Trying to establish a fair price for gold is obviously difficult, but treating it as a commodity like any other suggests that the current sell-off is not markedly different from any previous correction during its bull run:

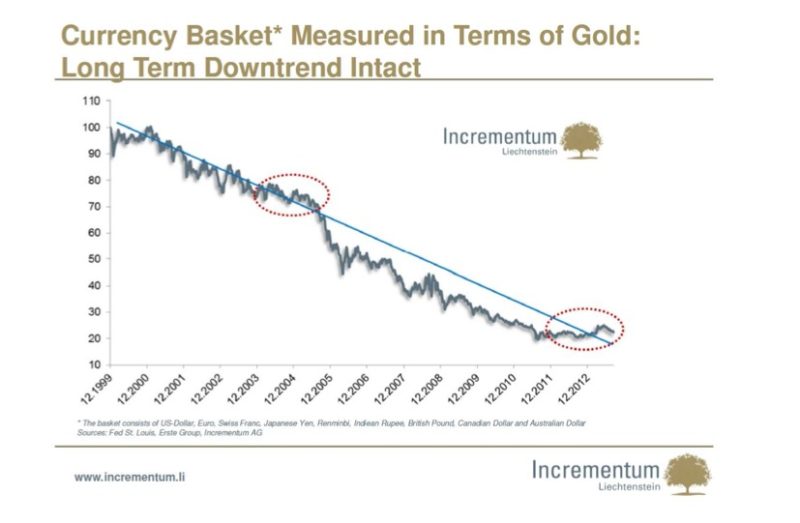

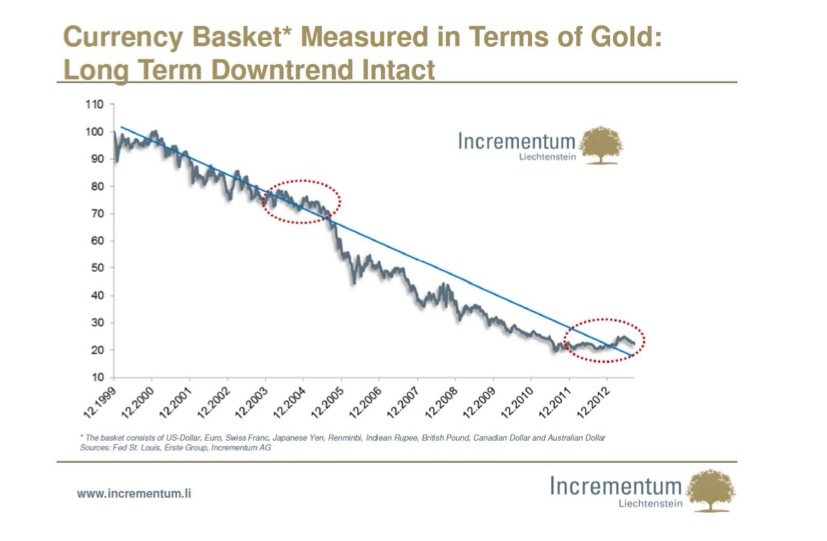

To cut to the chase, it makes sense to own gold because currencies are being printed to destruction; the long-term downtrend in paper money (as expressed in terms of gold) remains absolutely intact:

And we cannot discuss the merits of gold as money insurance over the medium term without acknowledging the scale of the problem in (US) government debt, now closing in on $17 trillion.

Whatever happens in the absurd and increasingly dangerous debate over raising the US debt ceiling, the fundamental problem remains throughout the western economic system.

The piper must, at some point, be paid. And someone must pay him.

As to whom? This is the foundation of western economic policy, distilled into just four words: the unborn cannot vote.

Governments have lived beyond their means for decades and must tighten their belts. Taxes are certain to rise, and welfare systems certain to contract… especially for future generations.

Even if western governments manage to rein in their morbidly obese consumption patterns without a disorderly market crisis, their legacy will be felt by generations yet to come.

The debt mountain cannot and will not resolve itself. And this, again, is why we own gold; because we think there is a non-trivial chance of a gigantic financial system reset.

Copyright © Sovereign Man