by Seth J. Masters (pictured), Daniel J. Loewy and Martin Atkin, AllianceBernstein

Below-average expected returns will make it difficult for most investors to achieve their goals with traditional portfolios unless they increase stock exposure dramatically.There is a better way.

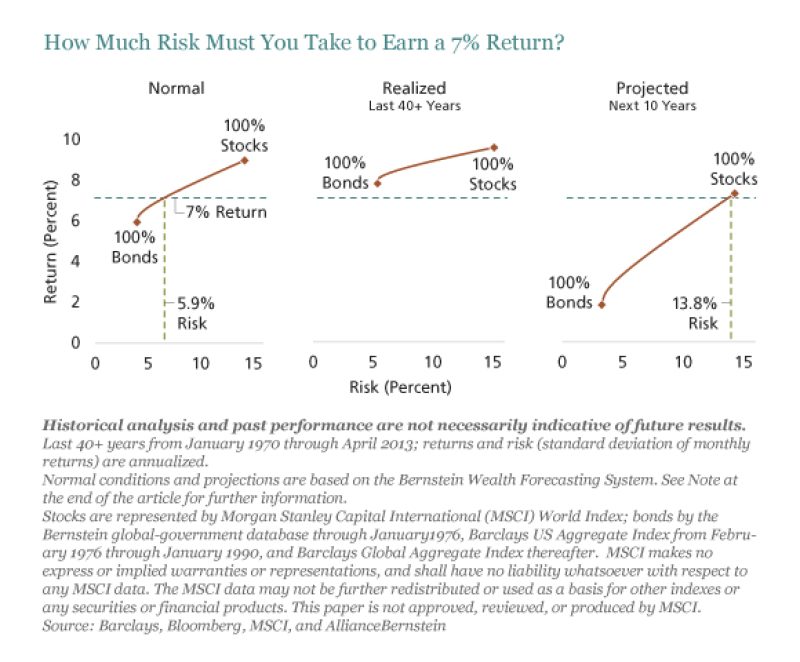

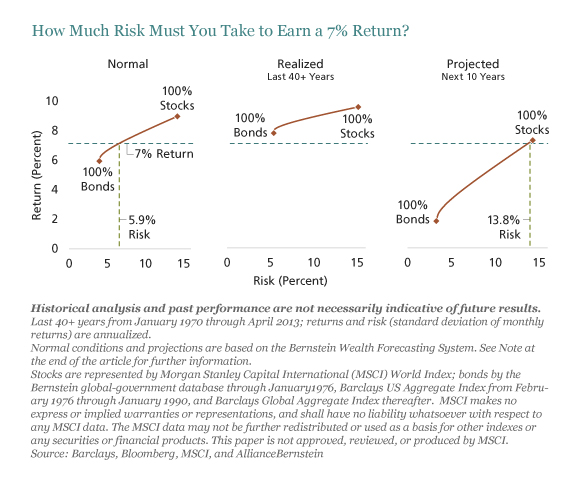

Traditionally, investors have relied on stocks for growth and on bonds for risk control. Today, that’s still a useful—but overly simplistic—model. Let’s say that an investor targeted a 7% annualized return from a stock/bond mix to meet a 5% annual spending budget and keep pace with a 2% inflation rate. How much risk would she have to take to meet her goals?

Tougher Markets Ahead

We estimate that in normal environments the investor could expect to achieve her return goal with annualized risk of about 6%, which we’d expect from a bond-tilted portfolio (display). Over the past four decades of falling interest rates and strong returns, the investor would have done even better: she could have beaten her return target by one or more percentage points a year with any asset mix, including 100% fixed income.

In our view, those days are gone for the foreseeable future. Given the muted returns we expect from stocks and especially bonds, it would take more than twice the volatility norm to clear the 7% return hurdle. Even an all-stock portfolio would barely make it.

In our view, those days are gone for the foreseeable future. Given the muted returns we expect from stocks and especially bonds, it would take more than twice the volatility norm to clear the 7% return hurdle. Even an all-stock portfolio would barely make it.

A Holistic Approach to Risk Control

What’s an investor to do? She could simply accept the unusually high risk of a stock-heavy portfolio. In our experience, however, most investors can’t tolerate the large short-term declines in returns they would likely experience, or the possibility of another lost decade for stocks—like the 2000s, when the S&P 500 was down by almost 1% per year.

She could cut back on her spending, but that might not be a viable option and it certainly isn’t appealing.

Or she could embrace a third path—one that offers better trade-offs. It’s not ideal, but it’s more acceptable and practical.

This third option involves adopting a well-defined, holistic approach to risk control that is calibrated for the potential to do well in both the long and short term. The approach integrates three key aspects of risk management:

- Diversification, for meeting long-term return objectives

- “Insurance” via put options, for minimizing large short-term losses

- Tactical asset adjustments, for mitigating portfolio volatility

Diversification is about the long run; the other two strategies address shorter-term risk. Defensive hedges commonly referred to as “insurance” can be valuable when the stock market drops dramatically in a very short time, as happened in the Black Monday crash of 1987. Tactically adjusting asset exposure might be a good tool for managing periods of market volatility—for example, from 2000 to 2003.

Most important, all three strategies can be designed to work together, offering the possibility of a different investing experience—perhaps one with fewer exhilarating moments, but also one with fewer discouraging downturns.

However, each of these strategies is complex and subtle. Implementing them requires both a systematic approach to portfolio management and fundamental and quantitative research, and a combination of flexibility and conviction.

It’s not an easy prescription. In our next blog post, we’ll discuss each of these three risk-mitigating strategies in more detail. We also expand on these ideas in a September 2013 article in The CPA Journal.

The Bernstein Wealth Forecasting SystemSM uses a Monte Carlo model that simulates 10,000 plausible paths of return for each asset class and rate of inflation, producing a probability distribution of outcomes; however, it goes beyond randomization by taking the prevailing market conditions into consideration and basing the forecasting on the building blocks of asset returns, such as inflation, yield spreads, stock earnings and price multiples. The analysis incorporates the linkages that exist among the returns of the various asset classes and factors in a reasonable degree of randomness and unpredictability.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Seth J. Masters is Chief Investment Officer of Bernstein Global Wealth Management, a unit of AllianceBernstein, Daniel J. Loewy is Chief Investment Officer of Multi-Asset Solutions, and Martin Atkin is Investment Director of Dynamic Asset Allocation, both at AllianceBernstein.

Copyright © AllianceBernstein