With International Equity recently moving in to the second spot in the SIA Asset Allocation Model, the questions have now arisen about whether advisors should be focusing in more on Developed or Emerging Markets. For this weeks SIA Equity Leaders Weekly we are going to look at a comparison chart between the two markets, and also look at the top ranked ETF from the stronger market right now.

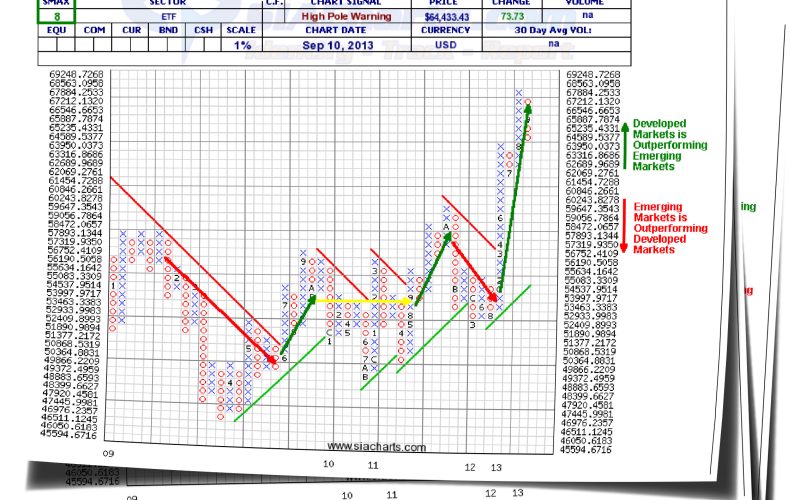

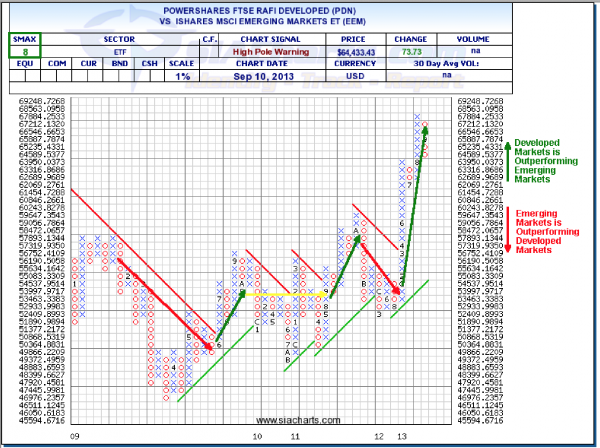

PowerShares FTSE RAFI Developed vs. iShares MSCI Emerging Markets (PDN^EEM)

Looking at the chart, we can see that there was a lot of back and forth between Developed and Emerging Markets going back to 2009, but in March and April of this year, Developed Markets broke through the downtrend line and really began to assert its strength. There has been a recent short-term pullback in favor of Emerging, but overall Developed is still winning the long-term battle. The comparison SMAX score of 8 is still strongly in favor of the Developed Markets.

Click on Image to Enlarge

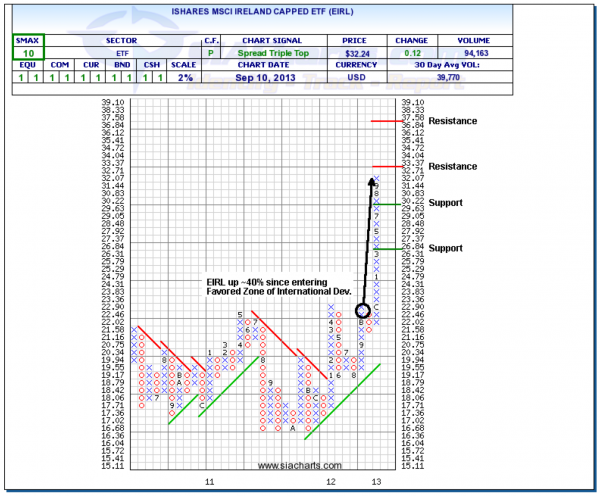

iShares MSCI Ireland Capped ETF (EIRL)

Currently sitting in the number 1 spot in the SIA International Equity Developed Markets ETF Report, EIRL most recently moved in to the Favored zone of the report back in early October 2012 at a price of $23.29. Since that time this ETF has moved to the number 1 spot and as of the time of this writing it was at $32.24, returning almost 40% in that time (since hitting number 1 in the report on June 6th of this year, EIRL is up over 9%, while both the S&P 500 Index and the TSX Composite Index are up under 4%).

From the chart we can see that EIRL currently has some room to move if it pushes through its next resistance at $33.37. Support is now $29.63 at and again at $26.31. With the SMAX at 10, EIRL is showing short term strength across all asset classes.

Further investigation into both the SIA International Equity Developed Markets and the SIA International Equity Emerging Markets Reports have shown us that there have been some strong ETFs in both categories, but overall we are still seeing strength in the Developed Markets ETFs at this time.

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.