by Enis Taner, Risk Reversal

Emerging markets are increasingly looking like submerging markets. Overnight, the Indoesian equity market fell 5.5%, making a new low for the year. The Thai equity market fell 3.5% and India fell around 1.5%. Meanwhile, the Indonesian rupiah and the Indian rupee both fell to their lowest level vs. the dollar this year (4 year low for the Indonesian currency, all-time low for the Indian rupee).

Emerging market stocks, bonds, and currencies have been at the forefront of risk-off movements so far in 2013. EEM, the most widely followed emerging market ETF, is down more than 10% in 2013, despite the strong rise in equities in the U.S., Japan, and even Europe. EMB, an emerging market bond ETF, is down almost 15% in 2013, a huge move for an ETF that has not moved more than 10% in either direction since 2009.

But the moves in emerging market currencies are perhaps the most worrying sign for risky assets going forward. Though U.S. stocks have not been bothered by the move lower in emerging market currencies so far in 2013, history suggests that stocks are at risk of a more significant decline.

The link between emerging market currencies and stocks boils down to the tight relationship between risk appetite and the search for yield. Emerging market currencies offer higher yields than developed market currencies (though that differential is much less in the past year, and likely a major reason for the outflow from emerging markets in 2013). So when investors globally have their rose-colored glasses on, emerging markets are generally appreciating along with stocks.

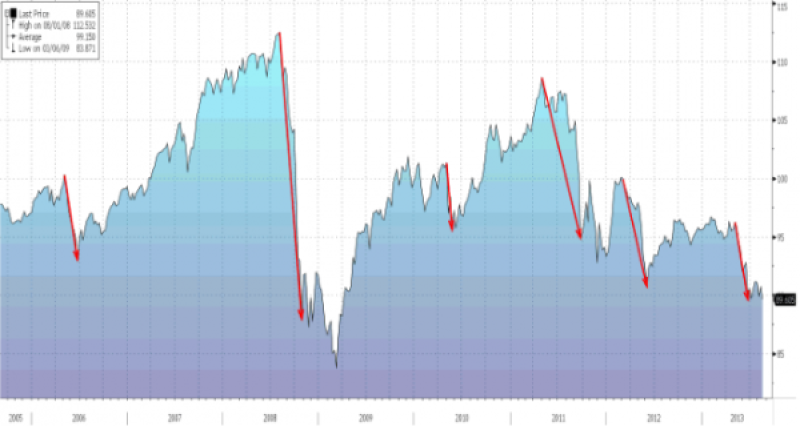

Here is the chart of the JP Morgan Emerging Market Currency Index over the last 8 years:

JP Morgan Emerging Market Currency Index, Courtesy of Bloomberg

I’ve drawn with a red arrow every 5%+ selloff in the index in that period. They were as follows:

- Emerging market scare in May 2006

- Financial crisis in Fall 2008

- Flash Crash in May 2010

- European bond yield / U.S. debt ceiling crisis in 2011

- Broad risk-off move in Spring 2012 (headlines again Euro-centric)

- Global bond selloff in May/June 2013

In the first 5 cases, the S&P 500 index also fell at least 7.5% as emerging market currencies sold off. But the relationship has broken down in 2013. Despite the continued weakness in emerging market currencies, the S&P 500 is only 3% from its all-time highs, and is in fact higher than where it was in early May when the emerging market selloff was initially sparked.

The Indian rupee is at an all-time low vs. the U.S. dollar. The Turkish lira is at an all-time low. The Brazilian real is down more than 15% in 2013. The South African rand is down almost 20% in 2013. These are huge moves, and indicative of a world that is much more jittery than a simple look at U.S. stocks would suggest.

In short, ignore the continued weakness in EM currencies at your own risk. This risk barometer has an admirable track record, and for good intuitive reasons. U.S. equity investors might be at risk of having ear plugs on, listening to the party track, and ignoring the sound of thunder lurking in the background.

Copyright © Risk Reversal