The bloodbath in the bond markets has led some 'greatly rotating' commentators to see this as the end of the long bull market (and the beginning of a lost decade for Treasuries); in fact, as SocGen's Albert Edwards notes, the financial wreckage left in the wake of Bernanke's taper talk has generated a lot of interesting commentary. But, he asks (and answers eloquently in this far-reaching anatomy of all-the-world's-views-on-what-the-Fed-is-doing) what if (as we have noted) tapering has nothing to do with the US economy having reached a sustainable take-off velocity? From Janjuah to Rosenberg, and from Wolf to Faber, Edwards explains how his Ice-Age thesis (lower lows and lower highs for nominal economic quantities in each cycle... with each recovery bringing a partial reversal to the process and each recessionary phase taking us to shocking new lows, both in bond yields and in equity multiples) is very much still in play; and governments will take the path of least resistance, which is to print their way out of this looming fiscal catastrophe. Marc Faber is right. QE99 here we come.

Exceprted from SocGen's Albert Edwards' "Is The Ice-Age Over?",

On the lost decade for bonds:

...the dramatic sell-off in bonds began right at the start of May when T-Note yields bottomed at 1.63%, well ahead of Bernanke's speech last week.

...Indeed, let?s put the recent bond sell-off into a longer term context. Bond yields at 2.5% still remain locked in a technically well-established bull trend that will not be broken until yields spike above 3.5%.

The Fed was considerably more dovish than many considered...

Our US Economist Aneta Markowska... describes the US economic data as merely "lukewarm" and not responsible for the run-up in yields prior to the speech. Instead she believes that the Fed had previously introduced uncertainty as to their intentions on tapering. But despite Bernanke having removed much of that uncertainly, the bond markets (and much else besides) certainly did not like what they heard. Indeed the bond rout occurred despite some commentators describing Bernanke's speech as rather dovish in making clear very robust economic prerequisites for tapering.

And data is not providing the hawks with the ammo they need to see taper coming anytime soon...

Indeed, although the economic data has perked up a tad in the last week or so, most notably with durable goods orders, house prices and the Philly Fed manufacturing survey, more generally data has remained lukewarm over the last few months. But what will happen now is that with the Fed projecting a stronger economy and the markets having reacted to that projection, economic data will be framed in that context, even if it is still as tepid as before.

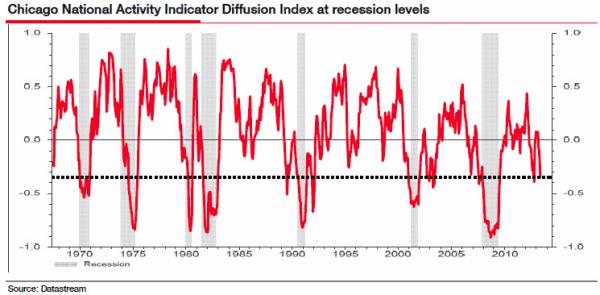

So, for example, the market ignored the weak May Chicago Fed National Activity Index (CFNAI). This data gives us an indication of overall US activity on a monthly basis. On the CFNAI?s preferred measure (using a 3-month mav), activity slipped to its lowest level since October 2012.

...

The Chicago Fed itself says that this is the level normally consistent with an economy on the edge of recession... the economy at present simply cannot be described as anything but lacklustre.

So why was the Fed so keen to deliver a message to the markets that it was prepared to slow its $85bn per month injection of liquidity. To answer that Edwards turns to Bob Janjuah...

"Tapering is going to happen. It will be gentle, it will be well telegraphed, and the key will be to avoid a major shock to the real economy. But the Fed is NOT going to taper because the economy is too strong or because we have sustained core (wage) inflation, or because we have full employment - none of these conditions will be seen for some years to come.

Rather, I feel that the Fed is going to taper because it is getting very fearful that it is creating a number of significant and dangerous leverage driven speculative bubbles that could threaten the financial stability of the US. In central bank speak, the Fed has likely come to the point where it feels the costs now outweigh the benefits of more policy."

Indeed this was the general thrust of what Edwards calls "an extraordinary broadside against excessive QE" that the the Bank of international Settlements (BIS) launched in its annual report.

Central banks cannot repair the balance sheets of households and financial institutions. Central banks cannot ensure the sustainability of fiscal finances. And, most of all, central banks cannot enact the structural economic and financial reforms needed to return economies to the real growth paths authorities and their publics both want and expect.

What central bank accommodation has done during the recovery is to borrow time – time for balance sheet repair, time for fiscal consolidation, and time for reforms to restore productivity growth. But the time has not been well used, as continued low interest rates and unconventional policies have made it easy for the private sector to postpone deleveraging, easy for the government to finance deficits, and easy for the authorities to delay needed reforms in the real economy and in the financial system.

After all, cheap money makes it easier to borrow than to save, easier to spend than to tax, easier to remain the same than to change.

So merely kicking the can...

All QE is doing here is kicking the can down the road and in the process inflating asset bubbles to reduce the need for deleveraging. I can see both sides of the argument and wouldn't categorize myself as either an Austrian or a Krugmanite, but I do strongly believe that QE will ultimately make things worse in the long run rather than better.

Recent economic history is replete with examples of well intentioned central bank interventions causing unpredicted increased volatility further down the road.

Which makes perfect sense - but, Edwards explains, the problem is that for a man holding a hammer, everything is a nail...

Ben Bernanke's whole academic career led him to the over-riding conclusion that the Great Depression was 'caused' by the Fed being too tight. And remember, he promised Milton Friedman, the high priest of monetarism, that the Fed wouldn't make the same mistake again. So if QE1 didn't work to produce a self-sustaining recovery the solution is simple; print more and more and more until it does work.

And therein lies the problem -? loose money has created financial bubbles that when they burst will send the economy into deep recession exactly like 2008 ? this is the very risk Bob Janjuah thinks the Fed is worrying about now. Maybe, just maybe, some members of the Fed have learnt the lessons of the past (incidentally China also seems to have gone down this same path but we will discuss this another time).

Just because the Fed forecasts robust growth ahead and a sharp decline in unemployment as the backdrop to withdrawing from QE, do not believe that that will be the actual economic outturn. Indeed, I seem to remember similar forecasts of exit velocity having been achieved when both QE1 and QE2 were ended.

But Edwards explains,

we remain one short recession away from outright deflation especially if Bernanke is wrong in his view that core inflation has dipped way below target due to temporary factors such as the effect of seques ration on hospital payments.

Which leaves the Ice Age thesis very much still in play...

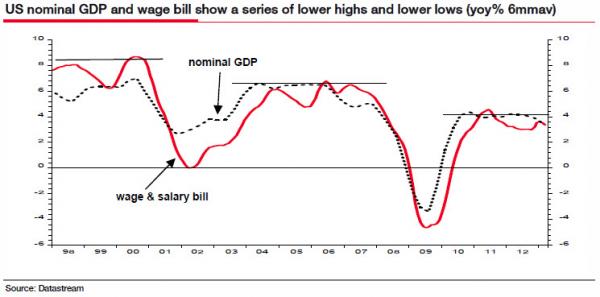

It is worth repeating the very simple point that an integral part of the Ice Age thesis is lower lows and lower highs for nominal economic quantities in each cycle. So, for example, in the chart below we see progressive steps down in each cycle ? almost unnoticed unless you take the longer view.

It is this process that drives the Ice Age re-rating of government bonds and the de-rating of equities - ?each recovery bringing a partial reversal to the process and each recessionary phase taking us to shocking new lows, both in bond yields and in equity multiples.

I do not believe this process is complete, especially as I do not see the economy as reaching exit velocity of GDP in excess of 3%. Indeed, growth is still anaemic and vulnerable.

We note that, amid the carnage in the government bond market, implied inflation not only remains subdued but has fallen decisively. Maybe that reflects an acknowledgement that the economy is indeed nowhere near exit velocity. Certainly the divergence between the ISM and inflation expectations has been unusual and history suggests it is inflation expectations that eventually catch up with the economic reality. And with events unfolding in emerging markets as they are, I see a good chance of a repeat of 1998 where a deflationary wave of manufactured goods washed up from Asia.

Deflation risks remain high.

We note that, amid the carnage in the government bond market, implied inflation not only remains subdued but has fallen decisively. Maybe that reflects an acknowledgement that the economy is indeed nowhere near exit velocity.

So where does that leave us in terms of QE. Edwards fully concurs with the legendary Marc Faber who, when asked during a Bloomberg TV interview if Bernanke meant what he said on starting to taper sooner rather than later, responded...

"If you say that if he means what he says, then you believe in Father Christmas. He said if the economy does not meet the expectations of the Fed in one years' time, they will consider additional measures. In other words, if the economy has not fully recovered by mid-2014, more QE will be forthcoming.

As I said already three years ago, we are going to go with the Fed to QE99."

Edwards concludes:

I tend to agree with that view. The economic reality in the West will force further rounds of QE. And in addition do not forget one over-riding structural trend towards fiscal insolvency and unlimited money printing.

[Governments] will take the path of least resistance, which is to print their way out of this looming fiscal catastrophe. Marc Faber is right. QE99 here we come.