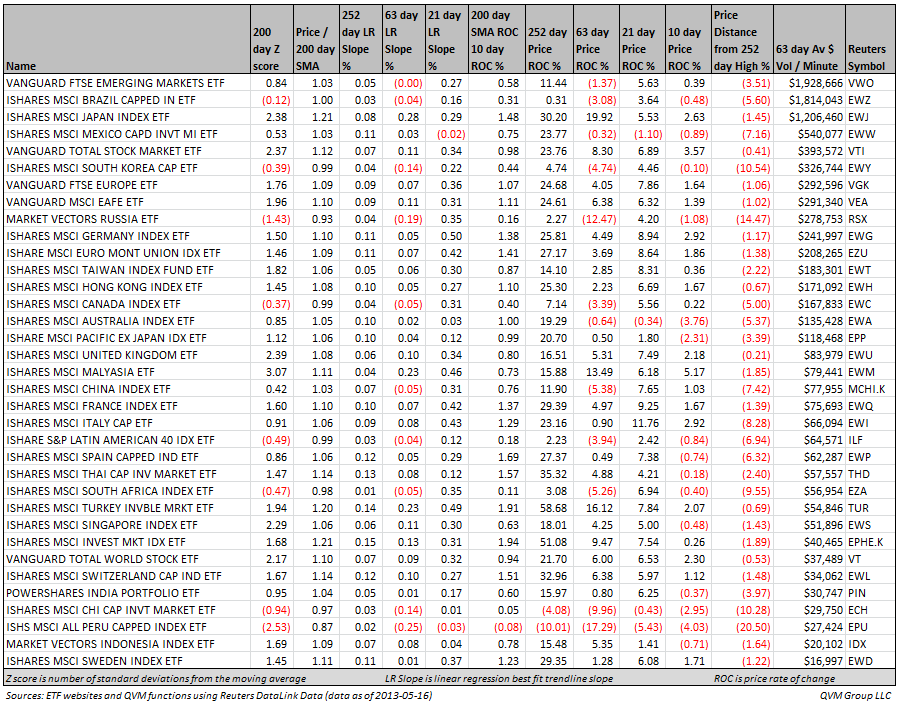

(click image to enlarge)

Related Posts

DayMAX™: Turning Daily Market Moves Into Income Opportunities

If you’ve ever wished your portfolio could earn income more often than once a month, Hamilton ETFs might…

India’s Headlines Got Worse. The Investment Case Got Better.

by Christopher Gannatti, CFA, Global Head of Research, & Ayush Babel, Director, Quantitative Research, WisdomTree Key Takeaways Despite…

Power, Property, and Preferreds

by Sandy Liang, CFA, Head of Fixed Income, Purpose Investment Partners As we move through the second half…

Fear, greed and the myth of stock market highs

Markets are driven by fear and greed, with recent fears centered on the perceived perils of investing when markets have just reached an all-time high. Fundamental Equities Global CIO Tony DeSpirito suggests this concern may be overblown, with historical patterns showing that investing at market highs has had little to no impact on longer-run performance outcomes.

BMO ETFs Welcomes Back a Familiar Force: Alain Desbiens Returns as Vice Chair

Sometimes, in finance, a familiar face stepping back into the spotlight can shift the whole conversation.

A 20,000-Foot Perspective: Can Bonds and Equities Both be Right?

by Maya Bhandari, Chief Investment Officer, Multi Asset Strategies - EME, Neuberger Berman The combination of stagflation concerns…

How Smart Money Is Quietly Stacking Gold & Bitcoin with ReSolve's Mike Philbrick

Listen on The Move In a world where inflation, currency debasement, and geopolitical shocks threaten portfolios, what if…

The Low Beta Boom: Sidestepping The Dotcom Bust

by Michael Lebowitz, RIA Following the release of our article The High Beta Melt Up- Echoes of 1999,…