by Seth J. Masters, AllianceBernstein

Adding other sources of diversification could significantly reduce the risk from increasing stock exposure, our research suggests.

As I explained in a recent article, we think many investors with bond-heavy portfolios run a higher-than-usual risk of running out of money because bond yields are extremely low—while many investors with stock-heavy portfolios have a higher-than-usual risk of large losses, for two reasons. First, there are likely to be more episodes than usual of high volatility in response to any adverse macroeconomic development. Second, with yields so low, bonds can’t rally as much if the stock market drops. That is, low yields reduce bonds’ diversification benefit.

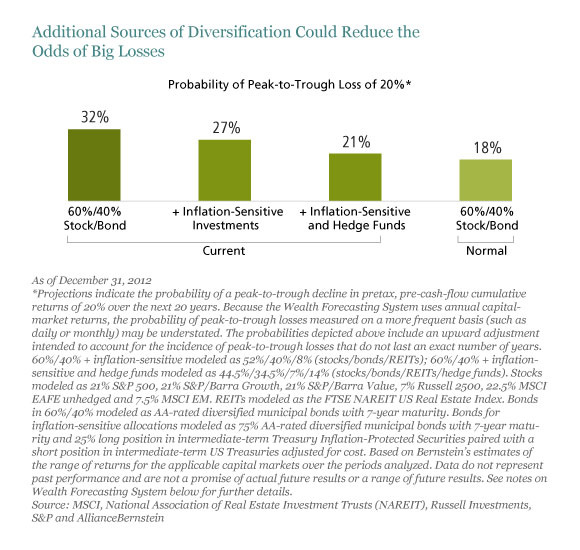

But a modest allocation to inflation-sensitive assets (sourced proportionally from both stocks and bonds) would significantly reduce the risk of large short-term losses for a portfolio with a 60% allocation to globally diversified stocks and a 40% allocation to diversified intermediate-term municipal bonds, the display below shows.

An additional modest allocation to a diversified group of hedge funds (also sourced proportionally from stocks and bonds) would reduce the risk of large losses even more—to only slightly above our estimate of the risk of large losses for a 60%/40% portfolio in more normal times.

An additional modest allocation to a diversified group of hedge funds (also sourced proportionally from stocks and bonds) would reduce the risk of large losses even more—to only slightly above our estimate of the risk of large losses for a 60%/40% portfolio in more normal times.

Of course, hedge funds aren’t appropriate for or available to all investors, and they pose liquidity constraints and other risks that investors should carefully consider. Whether any investor would benefit from adding to stocks and to other higher-risk, albeit diversifying, assets, such as hedge funds and real assets, depends on the investor’s circumstances and current allocation. But in challenging times like these, it makes sense to consider as many ways as possible to diversify both short-term and long-term risk.

For more on our research into the role that hedge funds can play in investor portfolios, see “Hedge Funds: Separating Fact from Hype” and “How Much Hedge Fund Exposure Makes Sense?”

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio managers.

The AllianceBernstein Wealth Forecasting System uses a Monte Carlo model that simulates 10,000 plausible paths of return for each asset class and inflation rate, and produces a probability distribution of outcomes. The model does not draw randomly from a set of historical returns to produce estimates for the future. Instead, the forecasts (1) are based on the building blocks of asset returns, such as inflation, yields, yield spreads, stock earnings and price multiples; (2) incorporate the linkages that exist among the returns of various asset classes; (3) take into account current market conditions at the beginning of the analysis; and (4) factor in a reasonable degree of randomness and unpredictability.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

Seth J. Masters is Chief Investment Officer of Bernstein Global Wealth Management, a unit of AllianceBernstein, and Chief Investment Officer of Defined Contribution Investments and Asset Allocation at AllianceBernstein.

Copyright © AllianceBernstein