From an op-ed by George Melloan, posted in the WSJ, and can be read in full here

The Fed's Asset-Inflation Machine

Asset inflation often produces something called "wealth illusion," the belief that pricier asset holdings necessarily make one permanently richer. Illusions are dangerous. Eventually, painful reality intervenes.

* * *

President Obama and Mr. Bernanke worsened the effects of the 2008 crash by adopting the same Keynesian antirecession measures—fiscal and monetary "stimulus"—that had failed before, most dramatically in the 1970s. Stanford economist and former Treasury official John Taylor recently argued persuasively on these pages that "stimulus" measures had retarded rather than speeded recovery.

Mr. Bernanke will have great difficulty letting go of the near-zero interest rate policy without severe consequences for both the Fed and the economy. The Fed's own economists recently warned that the Fed itself could lose as much as $100 billion on its vast portfolio when bond prices finally fall from their artificially elevated levels. Meanwhile, higher interest rates will cause the cost of financing government debt to skyrocket.

The Fed policy of quantitative easing is designed to rebuild the asset inflation edifice that collapsed in 2008. German banker and economist Kurt Richebächer provided some of the earliest warnings of the dangers. In his April 2005 newsletter, he wrote that "there is always one and the same cause of [asset inflation], and that is credit creation in excess of current saving leading to demand growth in excess of output."

Richebächer added that "a credit expansion in the United States of close to $10 trillion—in relation to nominal GDP growth of barely $2 trillion over the last four years since 2000—definitely represents more than the usual dose of inflationary credit excess. This is really hyperinflation in terms of credit creation." Richebächer died a year before the debacle of 2008. The crash that surprised so many bright people wouldn't have surprised him at all.

The rising Dow is of course good news for savers, who have been forced into equities to try to find a decent return on investment. Thanks to Fed policy, "safe" 10-year Treasury bonds yield a near-zero or negative return, depending on whether you measure price inflation at the official rate or at higher private estimates.

Winners on stocks or land holdings should happily accept their gains as the best to be expected in a very unsettled financial environment. But they should also remember the 2000s, when so many people thought their newfound riches were real and cashed them in for yet more debt, such as home-equity loans.

They later had a rude awakening. The "wealth illusion" of asset inflation is seductive, which is why central banks in charge of a fiat currency and subject to no external disciplines so often drift in that direction. Politicians smile in satisfaction and powerful Washington lobbies cry for more.

But an economy built on an illusion is hardly a sound structure. We may be doomed to learn that lesson once again before long.

* * *

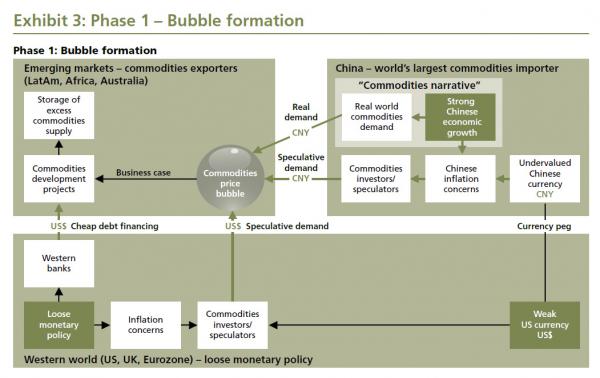

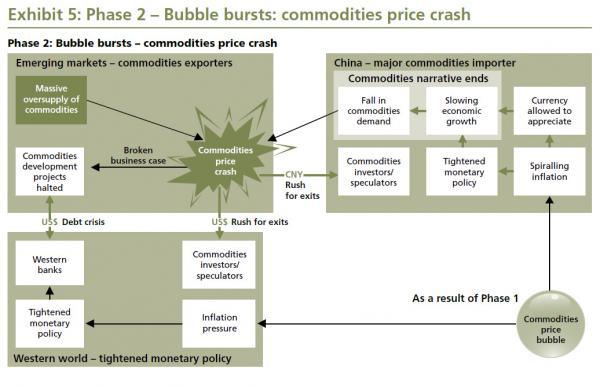

And visually:

Copyright © WSJ.com