Upcoming US Events for Today:

- Weekly Crude Inventories will be released at 10:30am.

Upcoming International Events for Today:

- German Manufacturer’s Orders for December will be released at 6:00am EST. The market expects a year-over-year decline of 0.7% versus a decline of 1.0% previous.

- Canadian Ivey PMI for January will be released at 10:00am EST. The market expects 53.8 versus 43.1 previous.

- Japan Machine Orders for December will be released at 6:50pm EST. The market expects a year-over-year decline of 3.8%, consistent with the previous report.

- Australia Labour Force Survey for January will be released at 7:30pm EST. The market expects the unemployment rate to remain stable at 5.4%. Employment is expected to increase by 8,000 versus a decline of 5,500 previous.

The Markets

Due to a prior obligation, comments will be brief today.

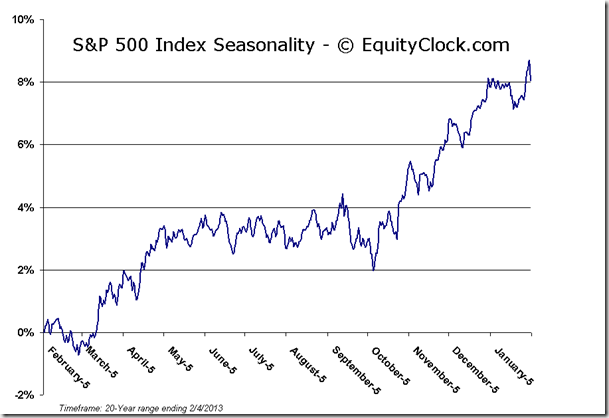

Markets rallied back on Tuesday, erasing much of the losses realized on Monday, which amounted to the largest one day decline for the major US Equity indices so far this year. For the second time in three sessions, the S&P 500 Index hit resistance at 1515, declining from this peak into the close. Support remains apparent around 1496. A break below 1496 could open the door for a retest of recent breakout levels between 1450 to 1475.

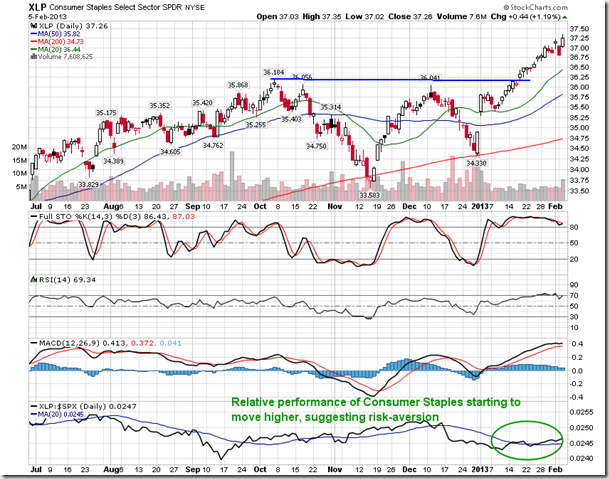

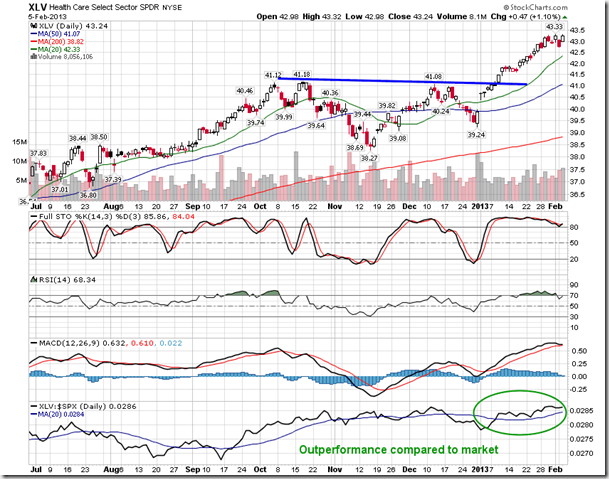

Underlying what seemed to be strong momentum on the session was strength in the defensive sectors. The Consumer Staples and Health Care sectors topped the leader-board, outperforming cyclical sectors (Materials, Industrials, Energy, Financials), which posted returns below that of the S&P 500. A trend of outperformance is becoming apparent in defensive equities as investors show signs of risk aversion. This is typically a warning sign for equity market weakness ahead as investors prepare for the much anticipated pullback. Longer-term momentum and risk sentiment suggest that any dips presented within equity markets will offer buying opportunities to investors that missed the substantial surge to start the year.

Sentiment on Tuesday, as gauged by the put-call ratio, ended close to neutral at 0.95.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.41 (up 1.06%)

- Closing NAV/Unit: $13.39 (up 0.67%)

Performance*

| 2013 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 5.27% | 33.9% |

* performance calculated on Closing NAV/Unit as provided by custodian

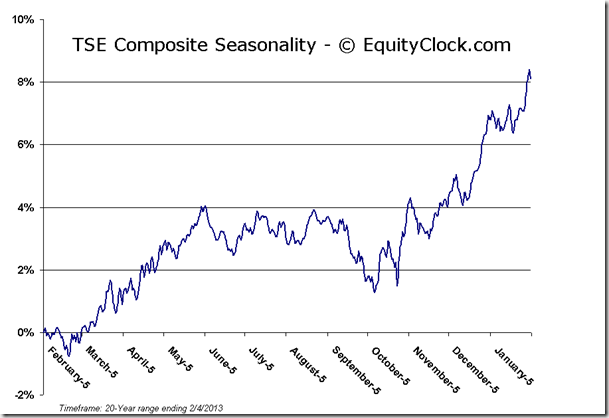

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.