The Glidepath Illusion

by Robert Arnott, Research Affiliates

Young adults should buy stocks; mature adults should favor bonds. Or so we’re taught. It makes intuitive sense. Young people have modest savings and lots of time to recover losses from any bear markets. People approaching retirement have more to lose and less time to recover from bear markets. Typically, they want greater certainty as to how much they can safely spend in retirement and less risk that a decline in the value of their investments will demolish their retirement plans.

This type of logic has spawned a huge retirement planning industry, with a wide array of target-date strategies whose Glidepath mechanisms systematically ramp down portfolio risk as an investor approaches retirement. These products are, for many people, the default option in their 401(k) and other defined contribution pension portfolios. Shockingly, the basic premise upon which these billions are invested is flawed.

This type of logic has spawned a huge retirement planning industry, with a wide array of target-date strategies whose Glidepath mechanisms systematically ramp down portfolio risk as an investor approaches retirement. These products are, for many people, the default option in their 401(k) and other defined contribution pension portfolios. Shockingly, the basic premise upon which these billions are invested is flawed.

Does a Glidepath Lead to Retirement Bliss?

Glidepaths feature equity-centric allocations for younger investors transitioning to bond-centric allocations for retired participants. The basic premise of a Glidepath approach is that a systematic increase in the allocation to bonds over time leads to less risk in our planned spending power in retirement. But does it?

To test the Glidepath premise, we simulate how the approach would have worked in the past. Of course, we do not think it wise to plan for the future by extrapolating the past, but it can be illustrative, particularly on the risk side. We use the 141 years of stock and bond market returns from 1871 to 2011, so our first breadwinner starts working in 1871 and retires at the end of 1911 and our last starts in 1971 and retires at the end of 2011. This gives us 101 worker bees with 101 different investment experiences.1

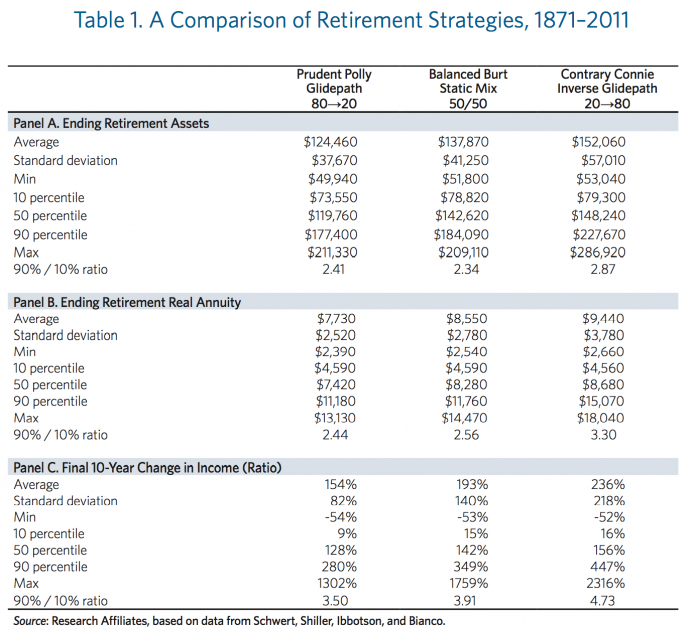

Consider an investor, Prudent Polly, who plans to save for retirement by investing in a standard Glidepath portfolio. Prudent Polly starts working, fresh out of college, at age 22 and plans to retire at age 63, after working for 41 years. Polly saves $1,000 a year in real terms for each of the 41 years, ramping up contributions with inflation. The first panel of Table 1 shows the ending retirement assets for each option. With classic Glidepath investing, Polly finishes with an average portfolio of $124,460, better than three times the $41,000 that she actually set aside. Because these numbers are adjusted for inflation, Polly has tripled the real purchasing power of her investments. But, there’s a range of outcomes, as evidenced by the $37,670 standard deviation in the results. The standard deviation doesn’t begin to cover the potential range: Polly could have finished with as little as $49,940—scant reward for foregoing $41,000 of spending over her working life—or as much as $211,330. The same savings program gives us a range which offers us 2.4 times more wealth at the 90th percentile than at the 10th percentile.

Because actuaries tell us that Polly should live 20 additional years from age 63, it’s much more important to know how large a lifetime inflation-indexed annuity she can buy than to know the size of her nest egg. The second panel of Table 1 shows the average Ending Retirement Real Annuity—an important measure of Polly’s success. On average, by saving $1,000 per year, indexed to inflation, history suggests that she should expect to have a retirement portfolio that will pay her $7,730 per year for life, also indexed to inflation. Sounds anemic... but then again she was only saving $1,000 per year. Unfortunately, again, there’s a big range. Over the past 141 years, she and her counterparts from past generations could have retired on anywhere from $2,390 to $13,130 per year.

If the Glidepath doesn’t lead to greater retirement assets, perhaps it at least provides Polly with more “visibility” into her likely retirement income, a few years before she retires, because the allocation is becoming far less aggressive (another argument advanced in favor of a Glidepath solution). If this transparency were true, people could plan their retirements with greater confidence. Looking at the last panel of Table 1, we can see that Polly’s annuity at age 63 is 154% larger than it would have been at 53. This is partly because the portfolio nearly doubles in size in that last decade and because she can buy a richer annuity with 20 years’ life expectancy than with 30 years. Unfortunately for Polly, the higher expected annuity is associated with considerable variability around that outcome. Her annuity at age 63 could be 54% less or 1302% greater at 53; the 10th percentile shows almost no change from age 53. This is basically the situation for those who turned 63 in 2011; they could have retired with roughly the same lifetime inflation indexed annuity at age 53 as they would now be able to buy at age 63. Sad, but true.2

What’s the Alternative?

So, the Glidepath strategy gives us a pretty uncertain retirement nest egg after 40 years of careful savings, with a pretty uncertain spending stream. Even as retirement looms near, it doesn’t give us much confidence about our retirement prospects or lifestyle. So what? Markets are uncertain. At least we can have more confidence and a safer outcome by ramping down our risk late in life than by any other plan, right? Not true.

Consider another investor, Balanced Burt, who is uncomfortable choosing between equities and bonds and thus decides to maintain a steady course at 50/50, for life. Looking at Table 1, we see that Burt winds up with an average outcome that is 10% better than Polly’s, with an average portfolio of $137,870 (versus $124,460) and an average annuity of $8,550 (versus $7,730). In addition, his worst case is better than hers, as is his 10th percentile outcome, and median outcome; only the single best outcome doesn’t improve in portfolio value, but even that outcome improves in the annuity that he can buy. It is no surprise that Burt’s final 10-year change in retirement income becomes less stable than Polly’s; he is finishing his career with more money in the riskier market. The ratio between 10th and 90th percentile outcome jumps from a 3.5 ratio for Polly to a 3.9 ratio for Burt. This improvement happens entirely from the best outcomes getting better; the worst outcomes do not get worse!

Now consider another investor, Contrary Connie, who is skeptical of the standard retirement strategies—either a balanced portfolio or a Glidepath approach. Connie rationalizes that if a static 50/50 strategy is better than a Glidepath strategy, an Inverse-Glidepath strategy might be more appropriate for meeting her goals than either of the “standard” options. It should come as no surprise that this counterintuitive strategy beats a static 50/50 portfolio by essentially the same margin that static 50/50 beats Glidepath. Contrary Connie beats Prudent Polly by ramping up her risk late in life when the portfolio is already large. Connie finishes with an average portfolio of $152,060, versus Polly’s $124,460. Connie’s worst, median, and best outcomes all trump Polly’s. Connie has to accept more uncertainty late in life as to how much she can spend in retirement—but it’s upside uncertainty!

Now consider another investor, Contrary Connie, who is skeptical of the standard retirement strategies—either a balanced portfolio or a Glidepath approach. Connie rationalizes that if a static 50/50 strategy is better than a Glidepath strategy, an Inverse-Glidepath strategy might be more appropriate for meeting her goals than either of the “standard” options. It should come as no surprise that this counterintuitive strategy beats a static 50/50 portfolio by essentially the same margin that static 50/50 beats Glidepath. Contrary Connie beats Prudent Polly by ramping up her risk late in life when the portfolio is already large. Connie finishes with an average portfolio of $152,060, versus Polly’s $124,460. Connie’s worst, median, and best outcomes all trump Polly’s. Connie has to accept more uncertainty late in life as to how much she can spend in retirement—but it’s upside uncertainty!

Critics may argue—correctly—that past is not prologue. This outcome is presumably due to higher real returns for stocks and bonds later in the 141-year period (for example, during the immense bull market from 1982 through 1999), leading to a slight tendency for investors to benefit from ramping up risk later rather than earlier in life. To address this criticism, we put the 141-year history into a lottery, with each year’s returns randomly drawn. It delivers the same relative ranking for the merits of Glidepath versus static 50/50 versus Inverse-Glidepath. The inverse finishes on top again!3

Note, if we systematically replace equities with bonds every year so that we are a 50/50 investor at the midpoint of our career, our returns will fall into the same return distribution, over time, whichever path we pursue. Our average allocation will be 50/50 in all three cases! Markets certainly don’t care about our Glidepath, so we’re as likely to have our best stock market returns late in our career as early. If the best stock market returns come early, it’s self-evident that we’ll finish richer with a Glidepath strategy. And, if the best stock market returns come late in our career, we’ll do well to ramp our risk up as our career evolves. But, in our 20s, how can we know whether stock returns will be better early or late in our careers?

Past is Not Prologue

We’ve written extensively about the “3-D Hurricane” that’s bearing down on us, about the importance of ratcheting down return expectations in a world of lower yields, and about the perils of extrapolating the past in order to shape future expectations. Much of this work has proven to be very relevant to investors in recent years. Can we transform this historically rooted test of various formulaic approaches to retirement planning into something that might be relevant today? We probably can.

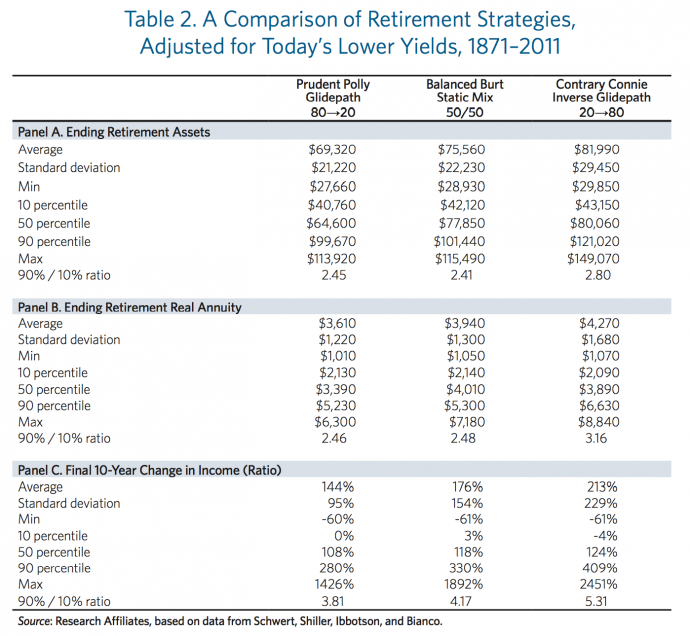

Rather than hoping for a repeat of the past, with substantial returns earned on a foundation of far higher yields than today’s yields, we should probably shape expectations based on the current outlook. Table 2 seeks to transform the “What if past is prologue?” scenarios of Table 1 to answer a different question: “What if risk in the future resembles risk in the past, but returns in the future are lower to the extent that yields are currently lower than the past norms?” It’s a subtle question, but it’s awfully useful to anyone thinking about setting aside reserves for some future retirement.

Accordingly, we make the following adjustments to the data, before we drop it into our lottery tumbler:

- Cut the average annual historical notional bond return by 2.0% to 1.9%. Long bonds have had an average duration of 15 years. Multiplying the 15 years by the 180 bps yield difference—the gap between the past average and the current real yield—gives us 27% of price appreciation, embedded in the 141 years of history, about 20 bps per annum. This means that bond returns over the last 141 years enjoyed both 180 bps of higher real yield and 20 bps of capital gain from falling yields.

- Cut the average annual stock return by 2.9% to 5.4%. Stocks have seen dividend yields tumble from an average of 4.5% to 2.1%. This corresponds to a 114% rise in valuation levels. Even though this rise largely occurred over the past 30 years, let’s spread it out over the full 141 years, which gives us 0.5% per year. This means that stock returns over the past 141 years enjoyed both 240 bps of higher dividend yield and 50 bps of capital gain from rising valuation multiples.

- Cut the real bond yield, which forms the basis for pricing our real annuities, by 180 bps to 90 bps. We hope this doesn’t hold true, because it means that the retirement annuities will be more expensive and our annuities skinnier as a result. But it is the naïve “random walk” assumption from current real TIPS yields.

Some might consider these results bleak. We consider them realistic. We can see in Table 2 that today’s newly minted college graduate, choosing to invest on Prudent Polly’s Glidepath, saving $1,000 per year for 41 years, seems likely to deliver a retirement annuity of $2,130 to $5,230. On Contrary Connie’s Inverse-Glidepath, our college grad can plausibly expect a retirement annuity between $2,090 to $6,630, with some slight hope for better results and some small risk of worse.

For those weighing a choice of retiring today versus funding their nest egg for 10 additional years, there’s little difference from the evidence: If we work for a decade longer, we can expect to retire on twice the annuity that we could buy today, give or take a wide range. And there’s less than a 10% likelihood that markets will be so bad in the next 10 years that we’re likely to retire poorer than we could today.

Conclusion

The late economic historian and consultant Peter Bernstein was fascinated by the distinct difference between risk and uncertainty. Risk is, to borrow from former U.S. Secretary of Defense Donald Rumsfeld’s decision tree, the “known unknowns.” Uncertainty is the “unknown unknowns,” the black swans, the fundamental changes that can’t be anticipated. The dispersion in outcomes in Tables 1 or 2, the spread between best and worst outcomes, exemplifies risk. We can quantify it; we can predict the breadth of the range; we cannot predict where, within the range, our own experience may lie.

For most investors, the difference between Table 1 and Table 2 exemplifies uncertainty. The implications of a structural change in our starting yield are just too jolting to bear thoughtful consideration. Today’s world of negative real yields is, for most of us, a black swan, an “unknown unknown.” We want to draw our lottery samples from the past, rather than to think about the implications of a starkly different world. But a world of lower yields—and negative real yields on “riskless” assets—is neither risk nor uncertainty. It simply is our current reality. We can choose to accept this new reality, and accept that Table 2 more accurately spans our current reasonable return expectations in a low-yielding world, or we can choose to pretend that the investing world hasn’t changed in this profound way. For investors who prefer to pretend that the old norms have not changed, this “new normal” will feel like a black swan, and they will suffer accordingly.

Our message remains largely unchanged. Investors who are prepared to save aggressively, spend cautiously, and work a few years longer (because we’re living longer), will be fine. Those who do not follow this course are likely to suffer perhaps grievous disappointment. Glidepath—with less risk taken late in our working lives—is inferior to its counterintuitive inverse. But it is entirely secondary whether we choose a Glidepath strategy, an Inverse-Glidepath, or a simple 50/50 rebalanced blend. No strategy can make up for inadequate savings or premature retirement.

As always, please don’t shoot the messenger.

Endnote:

1. During this period, stocks averaged an annual 8.3% return and bonds 3.9%.

2. This example is based solely on investment returns, paired with a program of regular contributions, over the 41 years.

3. Results available on request.

Copyright © Research Affiliates