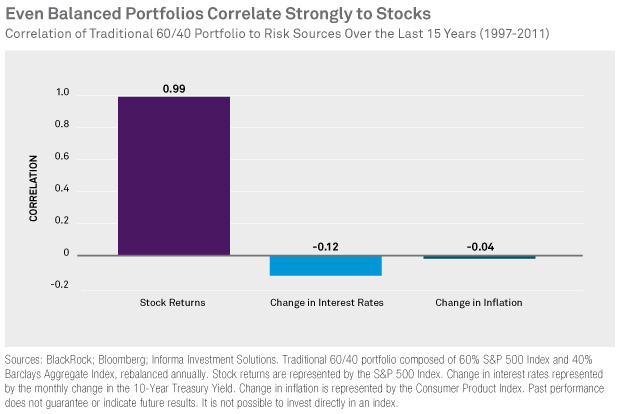

Although the following commentary from Dorsey Wright Money Management is pointed, it draws an interesting conclusion that a 60/40 balanced portfolio is by no means a fully diversified portfolio, given that its correlation to the S&P 500 has been 0.99 for the past 15 years. Their presentation (for advisors only) worth a look.

via Dorsey Wright Asset Management, Systematic Relative Strength

Those investors looking to build a portfolio with low correlation to the stock market are going to have to do more than just add bonds. BlackRock points out that the correlation of a 60/40 balanced portfolio and a 100% equity portfolio has been 0.99 over the past 15 years!

It is important for investors to understand the sources of risks in their portfolios. Take the traditional 60/40 portfolio as an example. Even though 40% of this portfolio is invested in bonds, almost all of the risk in the portfolio is equity risk. This chart shows that over the last 15 years, the correlation of returns between a 60/40 portfolio and a 100% equity portfolio was 0.99, meaning that they were almost perfectly correlated. Even a portfolio that is exceptionally overweight bonds shows a similar trend. A 30% stock/70% bond portfolio had a 0.82 correlation to a 100% stock portfolio. To us, that says that a long-only stock and bond portfolio isn’t full diversification.

However, when you also add commodities, currencies, and real estate into the portfolio it is a different story. Click here to learn how we incorporate a broad range of asset classes into our Global Macro portfolio (financial advisors only).

To receive the brochure for our Global Macro strategy, click here. For information about the Arrow DWA Tactical Fund (DWTFX), click here.

Click here and here for disclosures. Past performance is no guarantee of future returns.