by Sober Look

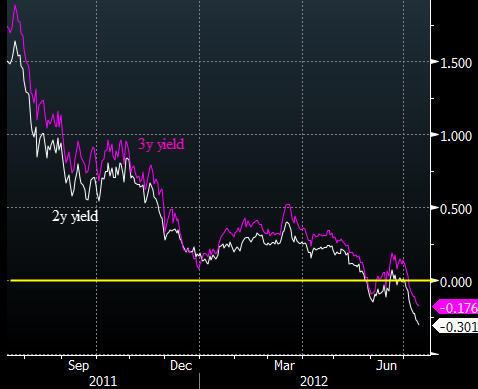

Would you pay Denmark's government 0.6% to hold your money for two years? Sounds strange, but that's exactly what investors are now doing. Denmark's government paper yields just hit new lows. And it's not only the short-term bills with the negative yield (short term bills sometimes go negative when investors seek immediate liquidity). The 2 and 3-year notes are now also comfortably in the negative territory as Eurozone's investors simply can't get enough.

Denmark's 2 and 3-year government yields

Why do the Eurozone investors love Demark's bonds so much that they are willing to lock in negative yields for 2-3 years? Here are 3 key reasons:

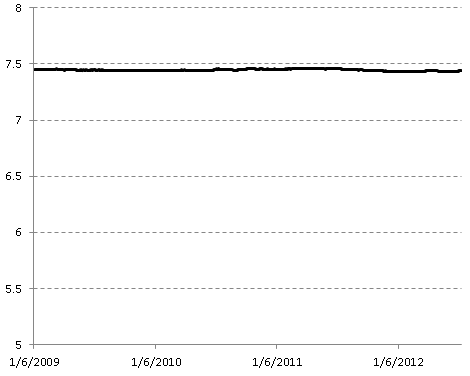

1. Eurozone based investors are not taking much FX risk because Denmark keeps EUR-DKK exchange rate tightly pegged.

DKK per 1 euro

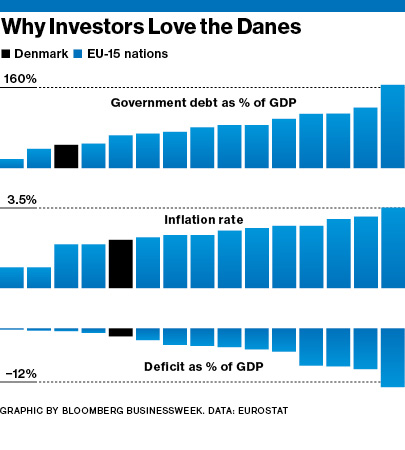

2. Investors love Denmark's economic fundamentals, particularly the relatively low government debt and deficit.

Source: Bloomberg/BW

3. Keeping funds outside the Eurozone may provide a hedge against potential problems associated with the monetary union's stability.

Bloomberg/BW: - If the euro crisis worsens, foreign capital may keep pouring in, negative rates or no. Says Ian Stannard, chief European currency strategist at Morgan Stanley in London: “For an international investor with euro zone exposure, buying Danish assets can be a hedge against the extreme scenario of the euro breaking up.”