by Peter Tchir, TF Market Advisors

How Much Worse Would Our Budget Problems be Without the Fed?

The biggest difference between what is going on in Europe and what is happening here, is the ability of the Fed to get rates where they want them across the entire curve. For all the talk about Spain and Italy not being “sustainable” at today’s rates, where would the U.S. be?

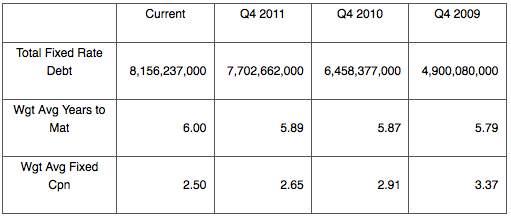

Starting with just our fixed rate debt look at what the Fed has done. Since Q4 2009, the Treasury department has extended the average maturity out from 5.8 year to 6 years. At the same time, they have managed to get the average coupon down from 3.37% to 2.5%. That is a huge cost savings to the government. If we were paying 3.37% on the $8.2 trillion of bonds, our annual interest expense would be $275 billion instead of “only” $204 billion. That is huge difference and is largely a result of the Fed’s treasury purchase programs. Keeping rates low and buying up the long end of the curve has resulted in substantial savings for the government. This is something Europe hasn’t figured out how to do, yet.

The more you think about it, the more impressive it is what the Fed has been able to help treasury do. They have allowed massive new issuance, at a longer average maturity, while driving the rates paid down significantly.

The Fed has been even more supportive than that. The Fed gives back their “profits” to treasury, so all of the coupon income the Fed earns, goes right back to the treasury department, further reducing the annual deficit. Assuming 20% of the bonds are held by the Fed, that would be an extra $40 billion cut off the annual expense. So instead of paying at least $275 billion if the Fed wasn’t involved, the current government is only spending $165 billion or so. The Fed is “enabling” the government to overspend by $100 billion a year.

Low rates aren’t so much for the consumer, but for the biggest debtor nation on the planet.

I don’t know whether Europe and the ECB will ever be able to match the Fed and the U.S. government in terms of being able to control rates, but assuming they can’t or won’t come close is dangerous, especially as they continue to take steps, albeit baby steps, in that direction.

Americans think Politicians Outside of the U.S. are Different

We get a Supreme Court ruling and every party is a winner. It doesn’t matter who you talk to, their party won. The spin is out of control, but we accept it. The U.S. has only two parties and has regularly scheduled elections, making it one of the easiest political situations to navigate. Everyone understand that. Everyone understands politicians say what they want.

Yet, somehow we believe European politicians tell the truth. That Merkel says what she actually plans to do? That Rajoy actually believes he won? Every comment from European leaders is viewed as a clear signal of dissent and that the deal will fall apart. Maybe, just maybe, investors need to pay attention to the actions and steps the leaders have taken, and less of the rhetoric they are selling their voters.

Could you imagine Romney saying the SCOTUS decision was a stunning defeat because he thought the decision would be much stronger? Or Obama admitting that calling it a tax is a horrible thing? Probably not, so why would you expect Merkel and Rajoy to go home and focus on what they gave up, rather than what they gained?

Ignore some of the noise coming out of Europe. It is leaders trying to placate their voters. They are politicians the same as ours. Watch and see if actions occur. In spite of the talk, the German government ratified the treaties and ESM. Yes, we have to see if their court upholds the law, but they are doing what they said, so far. It is scary that it is beginning to look like the hodge podge of European leaders may actually be able to implement programs to help their people while the U.S. politicians go out of their way to avoid accomplishing anything in their effort to get a couple more years in office.

The Economy Is What Matters

One key theme I keep reading is that Merkel won’t give in because people in Germany no longer support the programs. Merkel will do what she thinks will have the best results for the German economy. If you think, as I do, that a Greek Exit would lead to a collapse in Spain and Italy causing a devastating drop in the German economy, you would find it easy to see why she would change her attitude. Her best hope of getting re-elected is having a strong German economy. How she achieves that goal is of secondary importance. Many of the governments in Europe that were toppled, were doing what their people wanted, but it didn’t matter when the economy declined.

Ultimately, this is where Europe and the U.S. are the same. In spite of all the other issues, the election will likely be decided based on the economy at the time of the election. Right now, that is bad for Democrats as every indication is that the economy here is slowing. It also won’t help if Europe starts pointing at the U.S. to get its house in order. Without the Fed, our deficit would be much worse and the EU knows this. There is typically no better way to get a disparate group of people to work together than to find a common “enemy”. I expect that as European leaders continue to take incremental steps on their debt problem, that they will focus attention to the U.S. to divert some internal scrutiny. I have no idea what that will do for markets, but should throw another dynamic into global markets.

Will Short Covering turn into a Reach for Yield?

So far, this rally is one that even a mother can’t love. Friday morning, virtually everything I read was negative. More positive comments came out, and today I finally see them as being balanced. I see the number of table pounding bulls about equal to the number of red-faced bears.

We are still in the “short covering” phase as far as I can tell. We are getting little moves up and down, as people adjust their positions, but for the rally to gain momentum, it has to be driven by a reach for yield or risk rather than just short covering. From Saturday, here is why I think we could see a reach for yield trade. So far Spanish and Italian bonds are still slightly better again after Friday’s monster move, and CDS indices are all grinding tighter.

A Data Intensive Week

ISM just missed by a lot. Though how long before someone points out that prices paid dropped even more? Is anyone that prepared to bet that the EU, ECB, Fed, and PBOC will do nothing? Look for the market to bounce back from this weak data.

On NFP, the best possible outcome for the Fed is a job number close to the 90k expected, but for a nice uptick in the unemployment rate due to people entering the workforce. At least to the extent they are looking for excuses to act, while hoping the economy hasn’t truly derailed.