Why Invest in Asian Credit?

by Showbhik Kalra, PIMCO

- Asian sovereign and corporate credit offer more attractive yields than a number of other global fixed income sectors as investors take on additional risk.

- Given Asian markets’ diversity and the global macroeconomic environment, investors may wish to consider investment managers with a strong global macro process coupled with strong relationships with local stakeholders and experience in local portfolio management and markets.

- PIMCO believes in the resilience of emerging Asian countries and that leads us to be open to adding exposure in sovereign credit and high quality corporate credits as attractive opportunities arise.

In the current environment, growth in Asia is one of the most talked about macroeconomic trends. After all, the region is expected to contribute around half of global GDP growth and makes up a significant and growing share of global GDP output. Asian central banks collectively hold around half of the world’s foreign exchange reserves and a number of these countries hold a record amount of reserves. In contrast to the developed economies, which have increasing government debt-to-GDP ratios, strong initial conditions and a rapid return to strong growth have facilitated stability in debt levels (with much lower absolute levels) across the major Asian economies. Over the last few years these fundamental improvements have been well recognized and sovereign ratings upgrades have outpaced downgrades consistently since 1999.

How do we take advantage of the growth in Asia?

Unfortunately, investment managers cannot invest directly in a country’s GDP growth or its expected level of foreign exchange reserves. Instead, one can invest in sovereign debt and corporate credit in Asia as a way to take advantage of the region’s growth. Corporate issuers in the emerging Asia markets are either serving the increasingly affluent and growing local consumer base or exporting goods overseas and, as a result, becoming regional and in some cases global powerhouses. Asian currencies are also attractive as many are undervalued by numerous purchasing power metrics. Authorities are also more open to letting their currencies appreciate as a way to deal with inflation and to rebalance their economies to be more consumption driven, rather than investment driven as in the past few years.

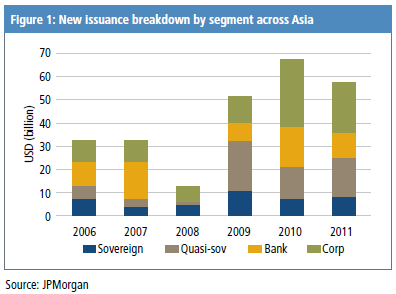

The first pan-Asia credit benchmark was created following the Asian financial crisis in the late ‘90s, marking the first step toward establishing Asian credit as an asset class. The Asian U.S. dollar denominated bond market today, as measured by the market capitalization of the JP Morgan Asia Credit Index (JACI), has grown from $50 billion dollars around a decade ago to over $300 billion dollars in June 2011. This index includes sovereign, quasi-sovereign (entities majority-owned by the state) and corporate credit (see Figure 1 for recent issuance). In recent years, the asset class has expanded progressively to cover 14 fast growing countries in Asia with sovereign ratings from S&P ranging from AAA to B-, as countries and corporates across the region looked to broaden their sources of financing. The typical size of investment grade issuances has increased over time, to average deal sizes of $1 billion currently. These larger issues contribute to the overall asset class as they tend to help boost secondary market liquidity.

Investing in growth

A notable development in the Asian credit space is the advent of high yield corporate issuers. The high yield corporate sector is dominated by China and Indonesia, but also includes issuers in Korea, the Philippines and Singapore. The high yield portion of the index has also grown substantially over the years from 30% of the index at the end of 2006 to 40% at the end of 2011. However, following recent upgrades to Indonesia, the high yield portion of the index has moved back down to 30% of the index.

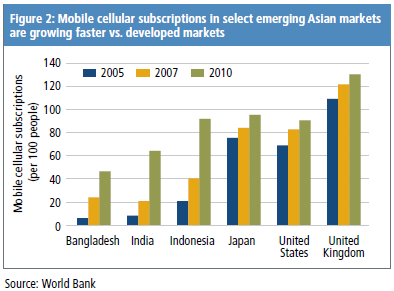

For example, take a deeper look at Indonesia. Robust commodity demand from China and India has been a boon for the resource-rich country, particularly its coal producers. Sustaining industrial production in Indonesia also requires significant capacity expansion in basic infrastructure. Because Indonesia is the world’s fourth most populous country but still has a low penetration rate for wireless connection, cell phone demand will likely remain robust in the medium term. Indonesia’s rate of electrification is about 65% which means around 90 million people still do not have access to electricity. Not surprisingly, commodity, utility and telecommunication companies have dominated Indonesia’s high yield corporate issuance. Compared to the developed world, companies in these sectors across the region are still experiencing strong growth (Figures 2 and 3 illustrate growing demand for the telecommunications and utilities sectors). Note that particularly across emerging Asia there is a trend towards using multi-SIM cellular phones and mobile cellular subscriptions understate the true growth potential.

Attractive yields and greater stability

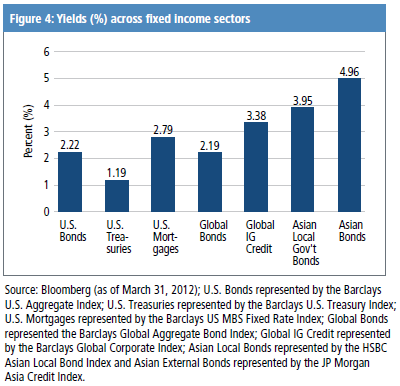

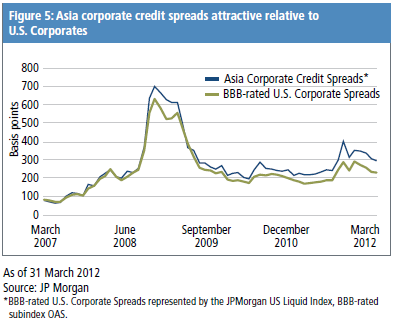

Asian sovereign and corporate credit is also attractive from a yield perspective. They offer significantly more attractive yields than a number of other global fixed income sectors (Figure 4) as investors take on additional emerging market sovereign and credit risk. What about the relative value comparison between Asian corporate bonds and developed country corporate bonds? A look at the historical credit spreads (over comparable maturity U.S. swaps) of Asian corporate credit compared to those of BBB rated U.S. corporates provides a strong argument. Figure 5 shows that spreads on Asian corporate bonds have consistently been higher than comparably rated U.S. corporate bonds during the past five years. The gap widened to as much as 134 basis points during the post-Lehman Brothers crisis, and recently was 87 basis points as at the end of March 2012 (the gap was close to zero prior to the Lehman crisis). A big reason for this gap is likely higher sovereign spreads embedded in Asian corporate bond spreads. We expect this gap to narrow as markets continue to revalue Asian sovereign risk to reflect stronger balance sheets and economic growth prospects.

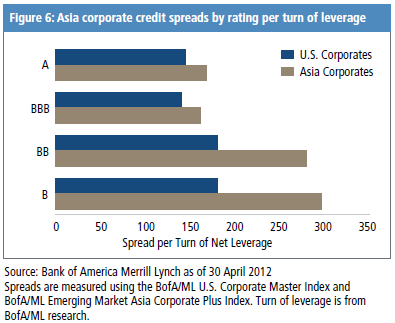

In addition to indicating financial health, debt ratios can help uncover value in corporate bonds. One way involves looking at the ratio between debt and one-year earnings before interest, taxes, depreciation and amortization (EBITDA). A one-to-one ratio between debt and EBITDA can be thought of as a single “turn of leverage”. Figure 6 shows corporate bonds from Asia tend to have higher spreads (over comparable maturity U.S. swaps) per turn of net leverage on compared to corporate bonds from the U.S. By this metric, the yield from Asian corporates is potentially more attractive.

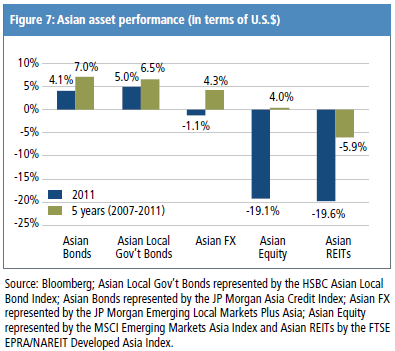

Despite a challenging year for risk assets in 2011, including the downgrade of the U.S. and trouble brewing in the eurozone, the JACI index stayed in positive territory and returned 4.12%. The investment grade rated portion (61% of the index) returned 4.92% and the sub-investment grade rated portion (39% of the index) returned 2.85%. The index has returned 7% on an annualized based in the five years from 2007 to 2011. Figure 7 shows how some different liquid Asian assets performed over the last five years and in 2011.

We must be mindful that Asia is not a homogeneous region and countries across Asia cannot be painted with the same brushstroke. India has fiscal challenges to deal with, China is going through a political transition and Vietnam is struggling to sustain growth while containing high inflation. Countries must make further progress on improving the quality of institutional frameworks, regulatory bodies and bankruptcy regimes. Given this backdrop and the global macroeconomic environment, investors may wish to consider investment managers that have a solid global macro investment process, strong relationships with local stakeholders and experience in local markets. PIMCO believes in the resilience of emerging Asian countries and that leads us to be open to adding exposure in sovereign credit and high quality corporate credits across portfolios as attractive opportunities arise.

Past performance is not a guarantee or a reliable indicator of future results.

Investing in the bond market issubject to certain risks including market, interest-rate, issuer, credit, and inflation risk; investments may be worth more or less than the original cost when redeemed. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Sovereign securities are generally backed by the issuing government; portfolios that invest in such securities are not guaranteed and will fluctuate in value. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio.

There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. The Barclays U.S. Treasury Index is a measure of the public obligations of the U.S. Treasury. The Barclays U.S. Fixed Rate Mortgage-Backed Securities Index is composed of all fixed-rate securitized mortgage pools by GNMA, FNMA, and the FHLMC, including GNMA Graduated Payment Mortgages. Barclays Global Aggregate (USD Hedged) Index provides a broad-based measure of the global investment-grade fixed income markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The index also includes Eurodollar and Euro-Yen corporate bonds, Canadian Government securities, and USD investment grade 144A securities The Barclays Global Aggregate Credit Index is the credit component of the Barclays Aggregate Index. The Barclays Aggregate Index is a subset of the Global Aggregate Index, and contains investment grade credit securities from the U.S. Aggregate, Pan-European Aggregate, Asian-Pacific Aggregate, Eurodollar, 144A and Euro-Yen indices. The HSBC Asian Local Bond Index (ALBI) tracks the total return of local currency denominated, high quality, and liquid bond in Asia ex-Japan. The index returns for each country-based sub-index are calculated in the respective local currencies and the return for the overall ALBI index is measured in US dollars. The J.P. Morgan Asia Credit Index (JACI) tracks total return performance of the Asia fixed-rate dollar bond market. JACI is a market cap-weighted index comprising sovereign, quasi-sovereign and corporate bonds and it is partitioned by country, sector and credit rating. It is not possible to invest directly in an unmanaged index.

This material contains the current opinions of the author but not necessarily those of PIMCO and such opinions are subject to change without notice. This material is distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Pacific Investment Management Company LLC.

Copyright © 2012, PIMCO.