It took the market several weeks to fool the last momos going long this market. We are seeing the biggest daily drop this year in todays session. Over the past weeks people have been buying equities, selling vol, and all agreeing “volatility is dead”.

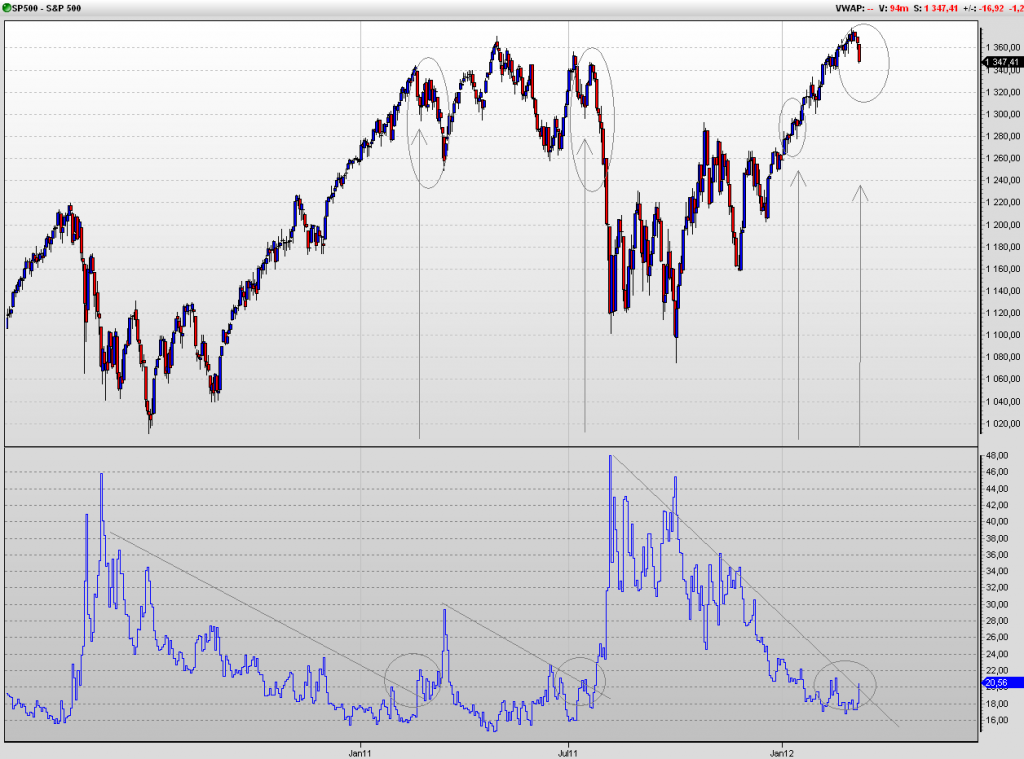

Well, reality is back, vol is spiking, and the confident investors is scratching his head. Below is a chart of SPX and the VIX. Note what has happened when market crosses these “magical” levels. Last time VIX traded at these levels (for more than a day or two), SPX was at 1300. The other times VIX crossed these levels in a similar fashion, markets collapsed. What’s next?

Maybe not the big collapse, but this Crash of 1929 video is definitely worth reviewing, just in case....