The Enduring Popularity of Gold

By Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investors

The World Gold Council (WGC) reaffirmed the power of the Love Trade in its 2011 Gold Demand Trends report released this week. Gold demand grew 0.4 percent in 2011 despite a 28 percent year-over-year increase in bullion’s average price.

After flirting with the top spot for some time, China emerged as the world’s largest gold market for jewelry and investment during the fourth quarter of 2011 as demand in India weakened. This is the first time China’s demand outpaced India’s in 11 quarters. However, India did retain the gold demand crown for the entire year, purchasing 933 tons compared to China’s demand of 770 tons.

I always say the trend is your friend, and I believe China’s increasing demand for gold is one trend that is just getting started. Although gold imports from Hong Kong were cut in half in December, HSBC Global Research reports that overall gold imports from Hong Kong were 10 times the historical average from January through November 2011. HSBC expects a continued rise in Chinese incomes will keep demand at a robust pace. The WGC sees domestic demand for gold jewelry and investment driving 20 percent growth in Chinese gold demand during 2012.

China should consider its leadership as the No. 1 gold market a short-term position, though. While China’s presence in the bullion market is strong and growing for jewelry and investment, India’s ancient relationship with the yellow metal is such that “domestic drivers of demand are largely independent of outside forces,” says the WGC. The WGC does not see India’s role in the gold market diminishing over the long term.

Ajay Mitra, the WGC’s managing director for the Middle East and India, recently expressed India’s strong ties with gold in a 60 Minutes feature. Gold has always been a part of India’s history, culture and tradition. I have witnessed firsthand the strength of this bond many times over the years. As the famous saying goes, “no gold, no wedding.”

Don’t Forget About the Fear Trade

The Fear Trade was also recently reaffirmed by the Federal Reserve when it publicly stated its intention to keep inflation at “exceptionally low levels” through 2014. Inflation is the kryptonite to the Fed’s monetary efforts and it’s likely the Fed will take any measures necessary to prevent inflation spikes.

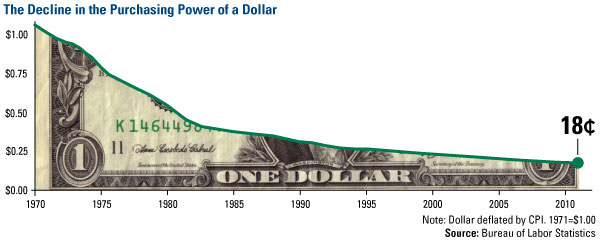

The Fed has targeted a 2 percent inflation rate, which means the U.S. dollar will lose 33 percent of its value over the next 20 years, says The Daily Reckoning’s Charles Kadlec. In the next four years alone, nearly 10 percent of the “value of Americans’ hard earned savings” will be destroyed, says Charles.

Put another way, Charles estimates that it will take $150 in the year 2032 to purchase the same amount of goods you could get for $100 in 2012.

Charles isn’t the only one opposed to the Fed’s “monetary manipulation.” In his latest letter to shareholders, Warren Buffett faults the government and its “systemic forces” for destroying the purchasing power of investors. He argues stock investments offer the best long-term investment opportunity because interest rate levels don’t offset the loss of purchasing power due to inflation.

However, there is one group that benefits from the low interest rate environment—borrowers. This means the largest borrowers in the world, developed world governments, will be able to service their enormous amounts of debt more easily. This year alone, the U.S., Japan and Europe will roll over $8 trillion in federal debt.

CIBC World Markets sees the secular bull market in gold continuing for “several years,” as the firm believes debt in major economies have reached a point “where financial and economic pressures will manifest themselves in ways that have up until now only been dreamed about.” With these manifestations, Ian McAvity equates gold to insurance. He suggests to readers that they wouldn’t cancel fire insurance because their house hasn’t had a fire. “Gold proffers the best ability to protect long-term purchasing power against deliberate devaluation of the paper alternatives,” he concludes.

For evidence of this, one needs to look no further than the significant gold purchases by central banks over the past few years. Emerging markets’ central banks have been the strongest buyers, experiencing a record increase in gold purchases last year. After building up their reserves during most of the post-World War II period, central banks’ gold holdings remained stable. Following the end of the cold war, they began a selling spree, helping to “explain bullion’s profound price weakness” during the 1990s, says HSBC Global Research.

The trend started to reverse about the same time the Fed cut interest rates in 2007, says Adrian Ash from Bullionvault. Now, total gold holdings sit at a six-year high with the total current amount of gold reserves sitting around 31,000 tons. In 2011 alone, the WGC says central banks had a net purchase of 440 tons, the highest figure since 1964.

The WGC says central banks are concerned about the creditworthiness and low yields of their existing reserve assets held in dollars and the euro. Their solution: diversify with gold.

Value is in the Eye of the Beholder

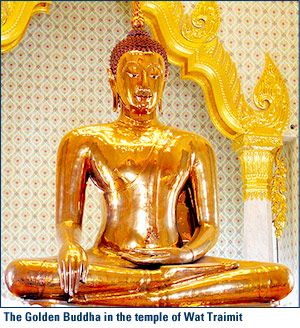

In Bangkok Thailand, the Buddhist temple Wat Traimit is home to the largest golden Buddha in the world. In its lotus position, the statue is over 15 feet tall and weighs five tons; if it were solid gold, it would account for 3 percent of the world’s mined gold.

For two centuries, the statue was thought to be worthless because it was covered in plaster to protect the figure from a Burmese attack.

As the story goes, when the Buddha was moved to a new temple in the 1950s, it slipped from the crane and fell. That night, a monk dreamed the statue was divinely inspired, which prompted him to visit the Buddha image. Through a crack in the plaster, he saw a glint of yellow and the statue’s true beauty was revealed. At today’s price of gold, the Buddha is worth more than $277 million.

Sometimes the true value of things isn’t always apparent. Like the Golden Buddha, the true value of gold miners has remained hidden while the price of bullion has shined. CIBC noted in its February report that gold equities have “undergone significant multiple compression and now trade well below historical averages.”

Here’s just one illustration of how cheap gold stocks appear compared to gold. The yellow line represents the number of gold and silver index units that can be purchased with one ounce of gold. While the historical ratio averaged 4.5, today an investor can buy more than 8 units of the XAU to one ounce of gold. In other words, shares of gold mining companies can be purchased at one of the cheapest levels in nearly 30 years.

Dave Rosenberg from Gluskin Sheff also favors gold equities. He particularly likes miners who can grow production and reserves while keeping costs under control. “Because input costs tend to be more positively correlated in the early years of a rally, history has shown that the equities tend to dramatically outperform the bullion in the later stages of a gold bull market.” He suggests buying undervalued gold mining stocks in politically safe areas with higher-grade projects and a relatively simple way of extracting the metal.

For thousands of years, pharaohs, explorers, rulers and investors have been attracted to gold, as the precious metal has been a vital tool in building and protecting wealth. While gold naysayers focus on the day-to-day fluctuations in price, I believe gold equities and bullion will continue to enjoy “maximum popularity,” as the Oracle of Omaha puts it, for years to come. The allure of gold—whether it is from Fear or Love—cannot be underestimated.

This commentary references the investment theory of an investment as insurance against a separate market event that could negatively affect performance of an investment. The reference does not guarantee performance or a safeguard from loss of principal by investing in that asset.