by Nelson Yu, Head—Equities, AllianceBernstein

As riskier stocks fuel global equity gains, investors should stay focused on durable businesses with staying power.

Global equities rose in the third quarter of 2025 as concerns about tariffs continued to recede and investors anticipated interest rate cuts from the US Federal Reserve. But have markets become too complacent? Even though markets seem to have broken free of recent fears, we think investors should position prudently for the challenges ahead.

US monetary easing is now under way after the Fed’s rate cut in September, and there could be more to come. Before the Fed exhausts its monetary dry powder, we think investors must distinguish between firms that can benefit from lower interest rates and those that were merely buoyed by a risk-on market rally of more speculative stocks.

Regional Returns Reflect Market Broadening

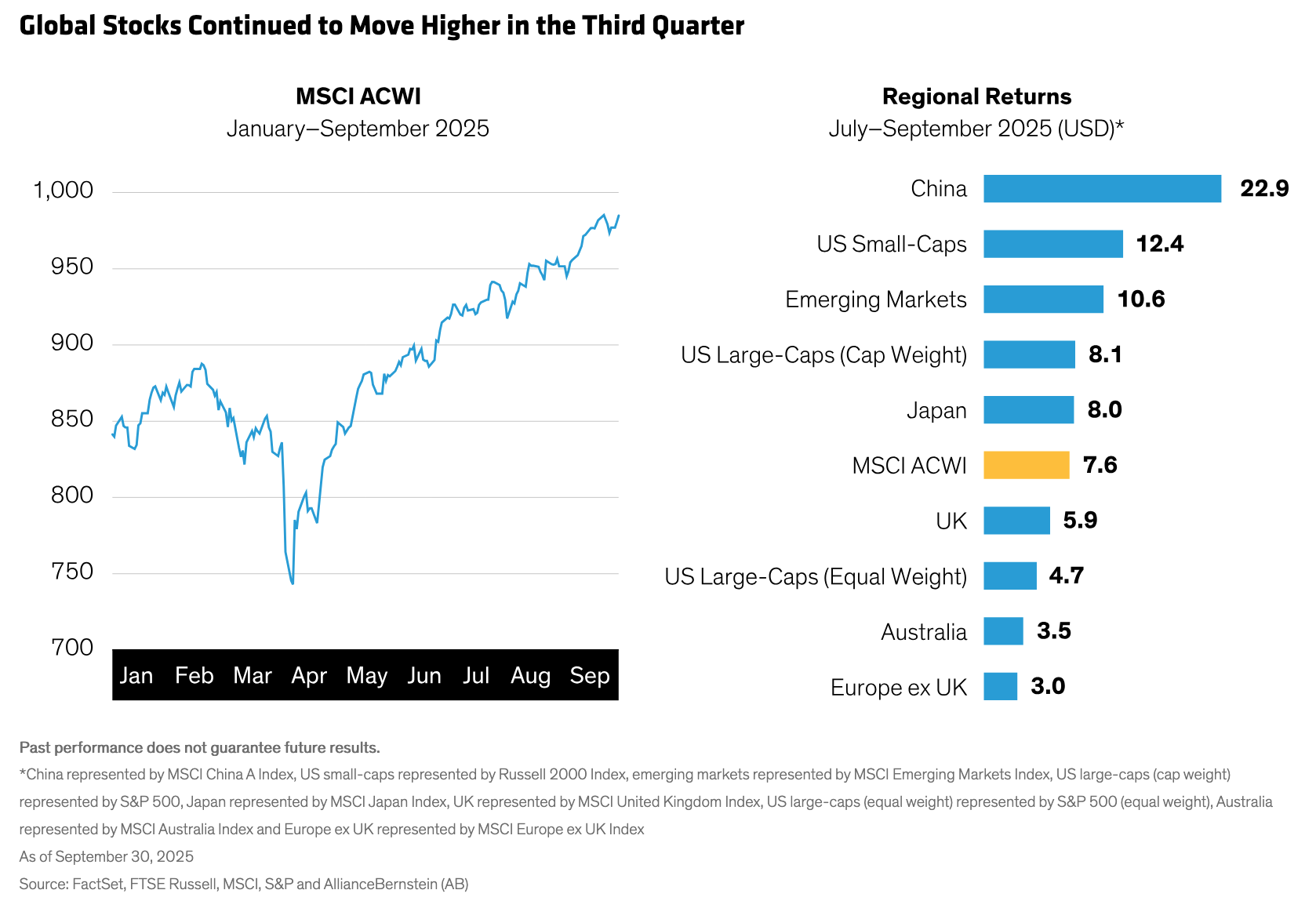

On the heels of a second-quarter rebound, the broad global market MSCI ACWI Index gained an additional 7.6% in US-dollar terms in the third quarter (Display), bringing its year-to-date return to 18.4%. Emerging-market stocks continued their turnaround, rising 10.6% as China surged more than 22% on the strength of government stimulus and strong retail flows. US small-caps outperformed US large-caps, which were slightly ahead of the global index. Japanese stocks also modestly outperformed the global benchmark, while European equities scratched out meager gains.

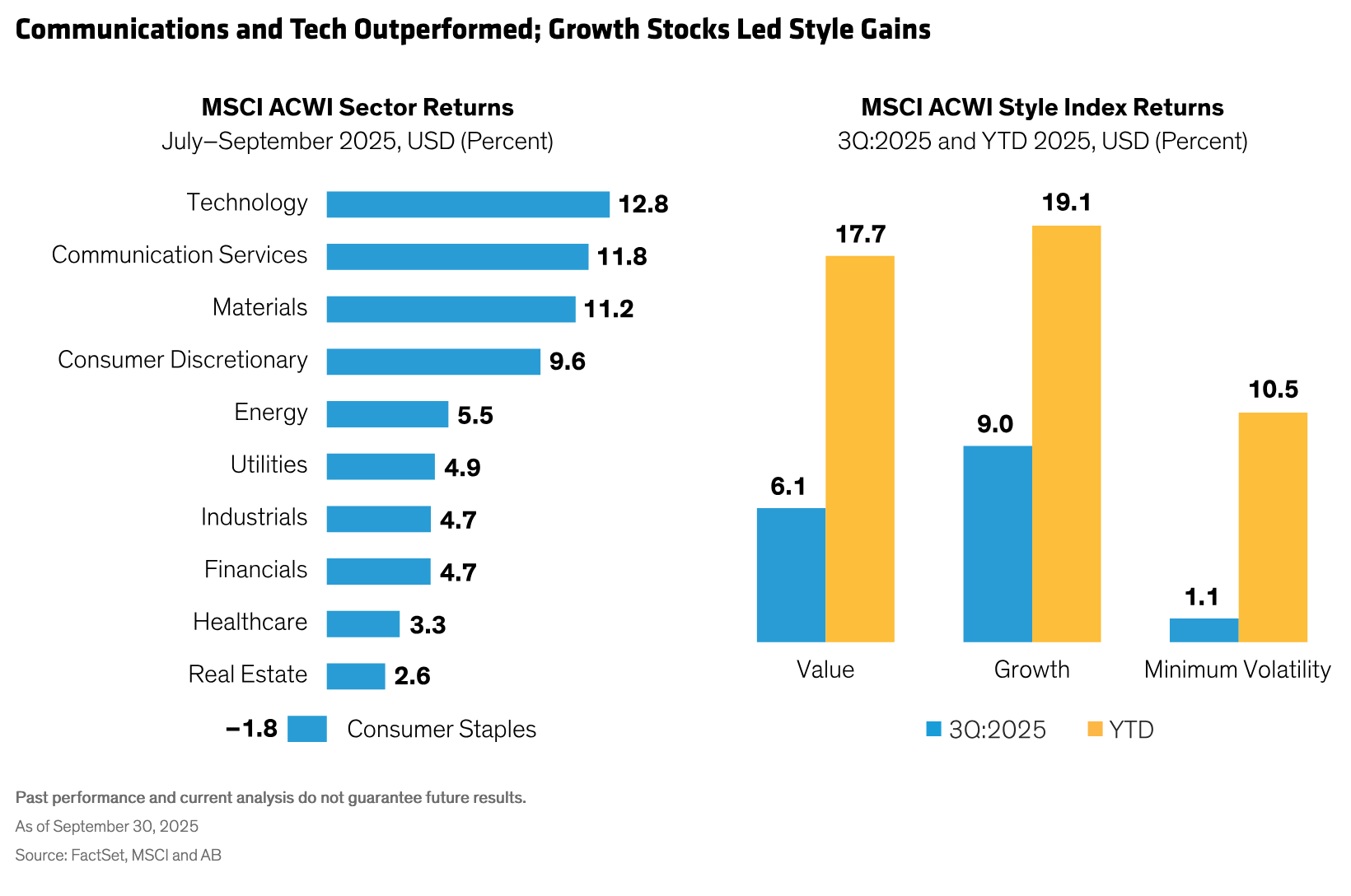

Some sector returns shifted in the third quarter (Display), with financials and industrials underperforming after a strong first half. However, communication services stocks extended their dominant performance from the first half, while technology stocks continued to bounce back from a weak start to the year.

Growth stocks outpaced value stocks during the quarter. In the year to date, the gap between growth and value is relatively small.

Are Warning Signs Being Ignored?

Upbeat markets may mask an unusual disconnect with the economy. In recent years, corporate earnings growth was weak, but economic activity remained healthy. Now, even as the US economy is showing clear signs of slowing, earnings are holding up nicely.

While strong earnings growth should bode well for equities, we believe expectations around lower interest rates and the promise of AI are prompting investors to assume more risk than is warranted. Put another way, investors may be chasing headlines while underpricing risk.

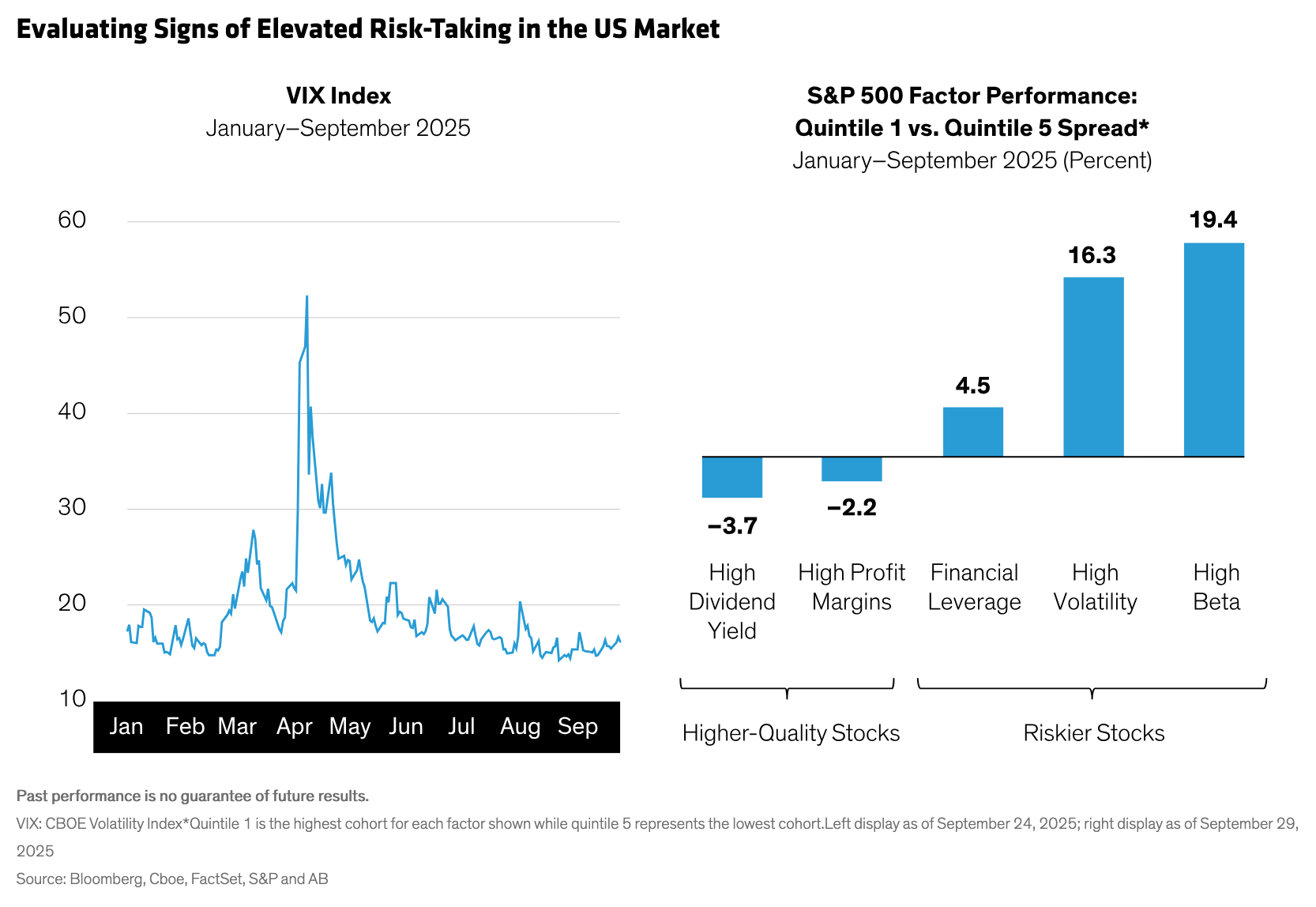

We see evidence of this in volatility expectations, as well as factor returns. Since April’s market correction, the Cboe Volatility Index (VIX)—an important gauge of expected US stock-market volatility—is down dramatically (Display). Meanwhile, global quality stocks have lagged behind speculative assets such as cryptocurrency and unprofitable technology stocks. And factor returns show that the highest quintile of high-beta, high-volatility and high-leverage stocks outperformed the lowest quintile of each cohort by a wide margin. By contrast, stocks with high dividend yield and high profit margins were largely left behind.

The market seems to think that the biggest risks have been taken off the table. Yet, the tariffs and trade issues that triggered extreme volatility in April have yet to be resolved. President Trump’s authority to unilaterally levy tariffs has been repeatedly challenged in the courts, and his use of executive orders to impose tariffs is still under judicial review.

Until there’s a resolution, the trade questions that previously weighed down markets remain a risk too big to ignore. Add to that slowing growth, a weak labor market, challenges to the Fed’s independence and continued geopolitical tensions, and we believe there are enough unknowns to warrant caution.

So where’s all the confidence coming from? Since April 8, sentiment has been shaped by upward earnings revisions, strong second-quarter results, the benefits of a weaker dollar for US companies and expectations of more tax breaks for US large-caps. In our view, the ensuing sugar rush may have prompted investors to project overly positive outcomes for the riskiest stocks, which may not be justified in the long term.

US Mega-Caps Diverge Despite Technology Surge

Risk-on sentiment has fueled US technology stocks, which surged by more than 50% since their April 8 lows. At the same time, the performance of the Magnificent Seven (Mag Seven) mega-caps has diverged, as investors have rewarded companies that are spending more on AI and are paying closer attention to their exposure to trade wars—and valuations. As their share price patterns continue to diverge, we think selectivity among the US mega-caps is paramount.

Beyond the Mag Seven, we think recent trends are creating opportunities in other market segments.

One sector that we believe warrants a second look is healthcare, which has underperformed of late but could be a source of stable growth in the coming years. Healthcare stocks typically rank high in quality metrics, and healthcare has seen some of the highest earnings growth rates of any sector over the past 20 years. AI could also be a new catalyst for growth in healthcare, with a wave of new applications in development that aim to improve patient outcomes.

Dividend growers and dividend-yield stocks could also be well positioned, especially against a backdrop of monetary easing. When rates come down, investors typically look for alternative sources of yield, which can drive demand for income-oriented equities. In our view, investors should cast a global net for income stocks, given that many US firms opt for share buybacks instead, owing to their greater tax efficiency.

Given myriad uncertainties, we believe defensive equities also deserve attention. Stocks that lose less in market downturns have less ground to regain when the market recovers. That means they’re better positioned to compound off higher returns in subsequent rallies. Over time, this smoother return pattern can deliver resilient returns, which helps keep investors in the market during bouts of turbulence.

Deglobalization Doesn’t Have to Mean Destabilization

As companies reshore supply chains amid trade tensions, a new era of deglobalization has begun. There are many benefits to an integrated global economy marked by free trade and low trade barriers. But deglobalization, too, can create opportunities for active investors.

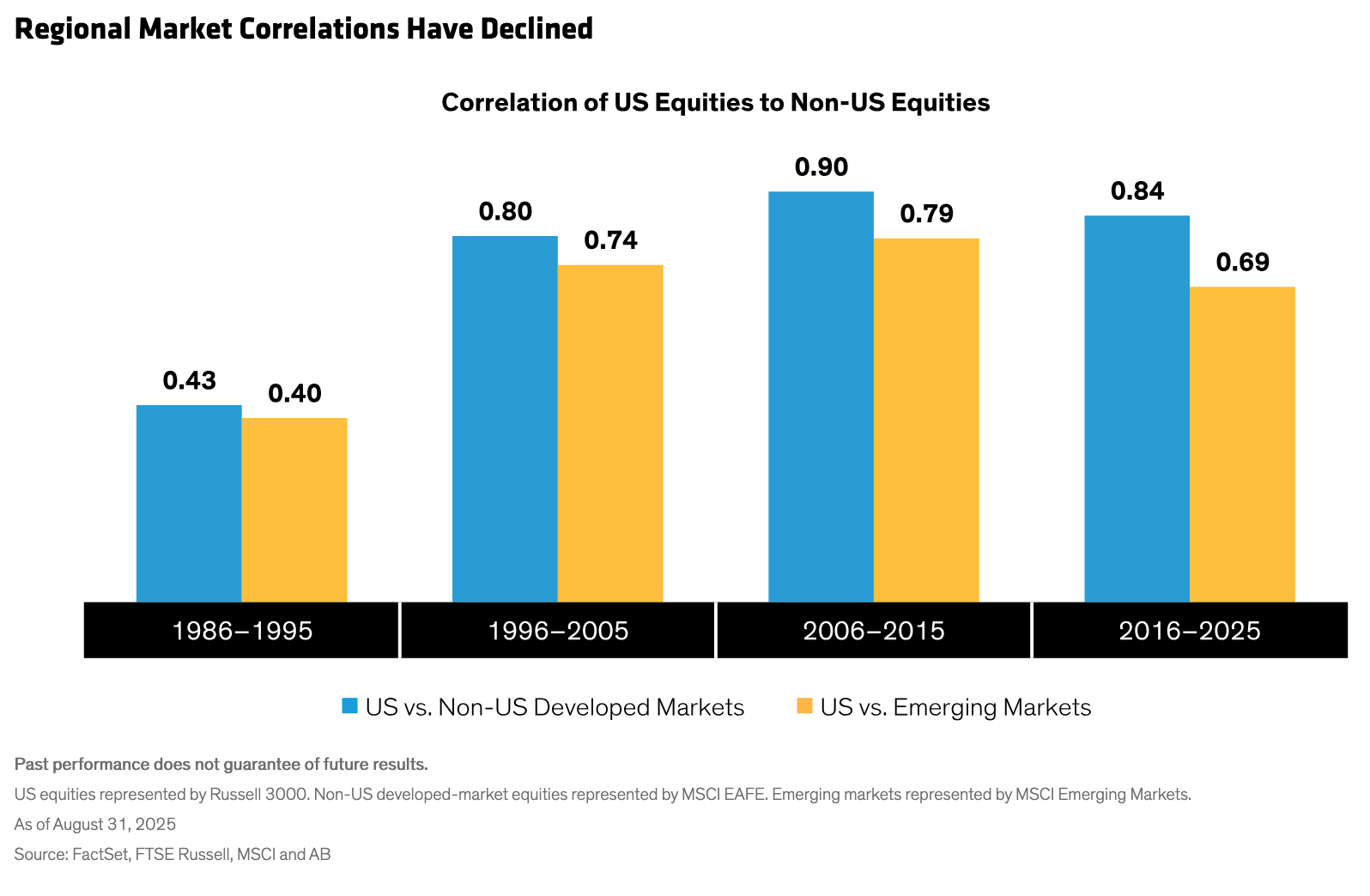

Regional market correlations tell an interesting story. From the mid-1990s through the early 2000s, correlations moved sharply higher, coinciding with peak globalization. That means markets in the US, Europe, Japan and emerging markets tended to move together with less variability in returns by region. But in recent years, regional market correlations have begun to fall (Display). If deglobalization continues unabated, correlations could revert closer to their long-term averages.

Deglobalization, coupled with the US dollar’s depreciation, makes a strong case for increased international diversification. China is a good example. The withdrawal of Western companies from Chinese markets could pave the way for more innovation in China, opening equity opportunities that might otherwise not have existed. And despite pressure from tariffs, China has increased its share of global exports thanks to growing sales to other emerging-market countries.

Similarly, reshoring US supply chains can boost demand for complementary businesses and logistics providers. Some global companies with US operations may even benefit from increased trade barriers, including electronics manufacturers and consumer goods companies with a large US manufacturing presence. We believe a dollar-hedged strategy can help US investors access international markets while reducing currency risk.

Taking a More Strategic Approach to Equity Investing

Equity markets have been playing headline roulette for a while now. On-and-off tariffs, Fed watching and AI enthusiasm have all competed for investors’ attention. But with some sectors overbought and others underpriced, we believe a strategic equity approach should actively target companies with competitive business models and consistent earnings streams, while searching for diversified sources of return potential.

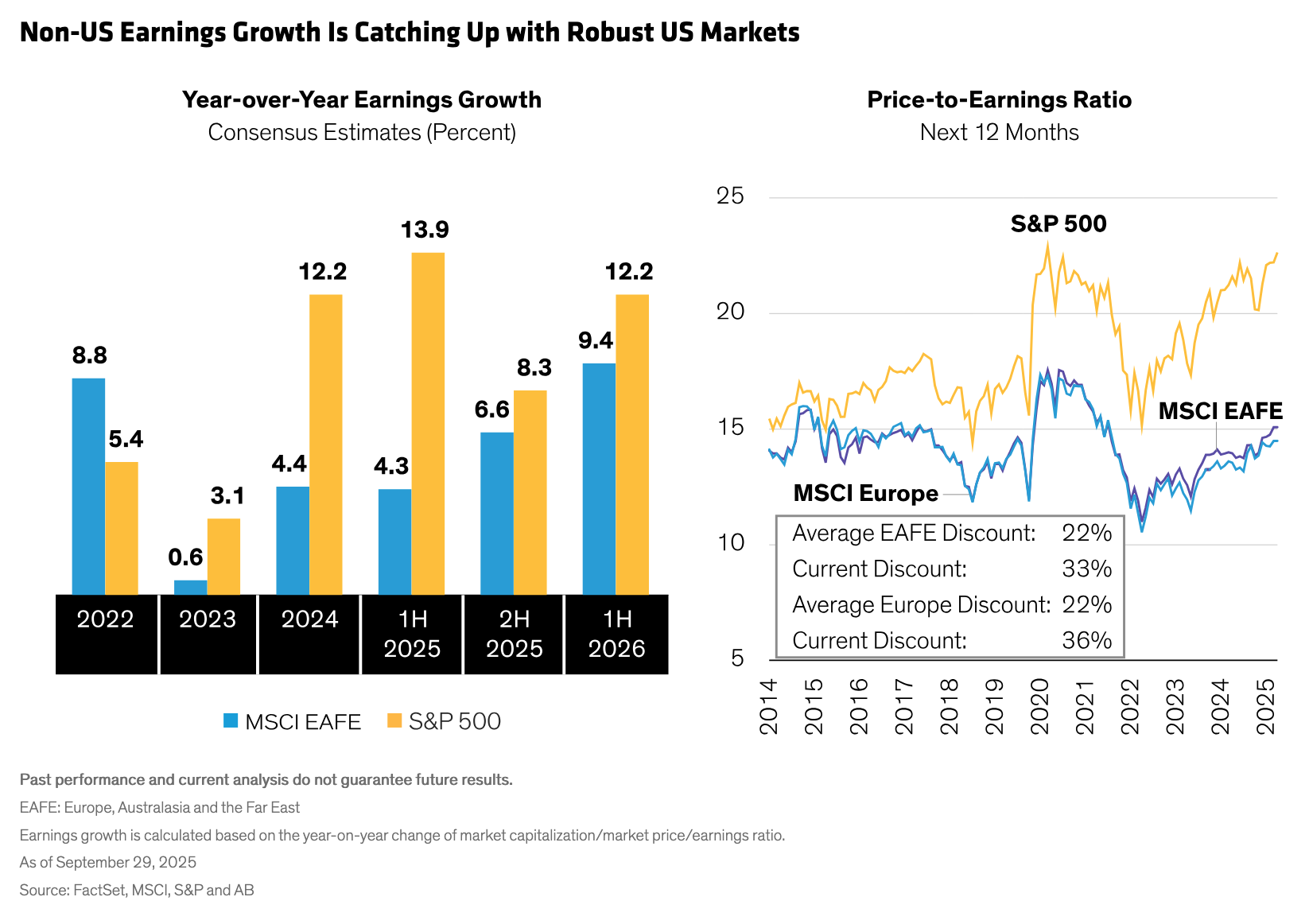

Earnings and valuation trends point to broadening opportunities. While US earnings growth has outpaced that of non-US companies by a wide margin in recent quarters, consensus estimates point to a shift. In fact, earnings growth outside the US is expected to start catching up with the US in the coming quarters (Display). At the same time, non-US stocks, represented by the MSCI EAFE Index, trade at a 32% discount to the S&P 500, much wider discount than average.

Over the coming months, active managers can uncover mispriced securities and opportunities in high-quality companies around the world that might be otherwise overlooked. By digging into business fundamentals, portfolios can be constructed to help clients thrive through the uncertainty ahead. With economic growth slowing and multiple risks looming, this is no time for complacency.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Copyright © AllianceBernstein