by Craig Basinger, Derek Benedet, & Brett Gustafson, Purpose Investments

We would never support criminality, even if it was just stealing some porridge from a few dumb bears that didn’t lock the door. B&E is B&E. But it may be that perfect temperature porridge that can help explain 2025.

There have been many things that have happened or escalated this year that are not market-friendly. It’s a rather scary list, and yet markets are not just resilient but thriving. That’s because, despite the dramatic headlines, the real drivers of markets are kind of middling – not too hot or too cold.

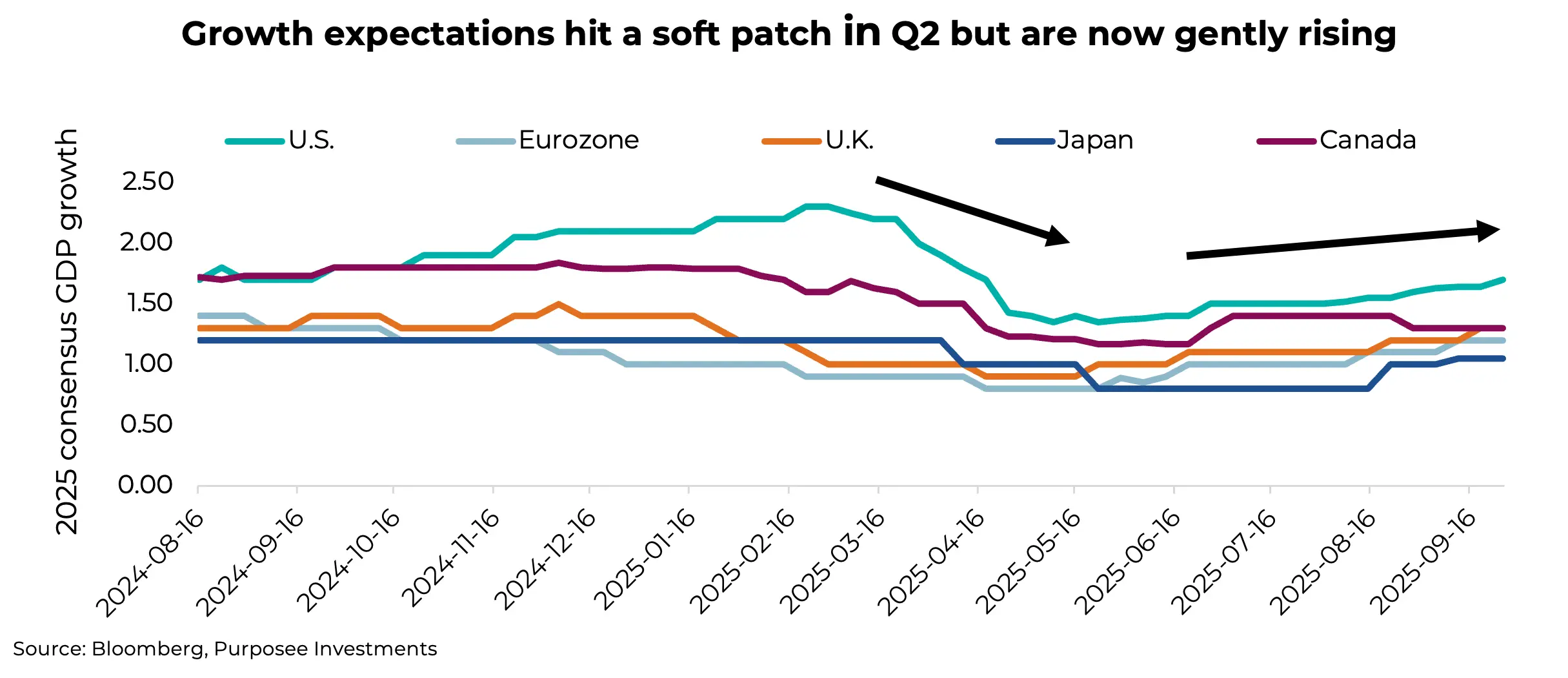

Let’s start with economic growth. Despite the implementation of tariffs, now running between 15-20% for many countries, and a good amount of uncertainty, the global economy has remained relatively resilient. We had thought these factors would manifest in a period of economic weakness, but so far, there’s limited evidence for this. Decent global fiscal spending has certainly countered these headwinds. And now economic growth forecasts, which had softened a bit, have firmed up. Not too fast to get people worried about inflation implications, but fast enough to ease growth concerns.

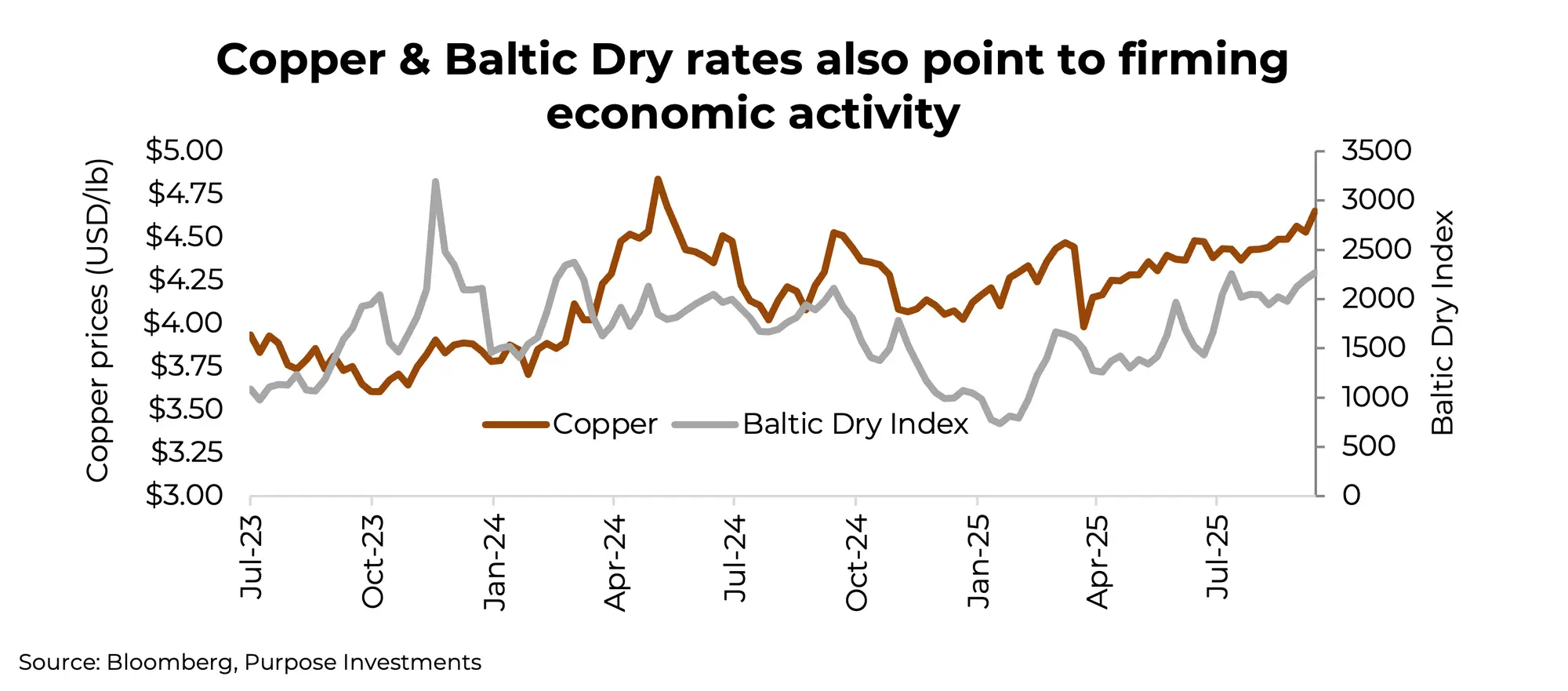

The path for 2026 forecasts follows a very similar pattern. Looking beyond the consensus view, other factors are encouraging for global economic growth. Citigroup Economic Surprise Indices have firmed up. Purchasing manager indicators have as well, signalling rising manufacturing activity. Two of our preferred market barometers for global economic growth, namely copper and shipping rates, also point to reasonably improving economic growth.

So here we have an economy that has proven resilient to headwinds. But the news gets a bit better, as the economy at the moment isn’t growing fast enough to push inflation back to being a problem. Inflation has been stickier than most would like, but it also hasn’t accelerated. It’s kind of middling as well.

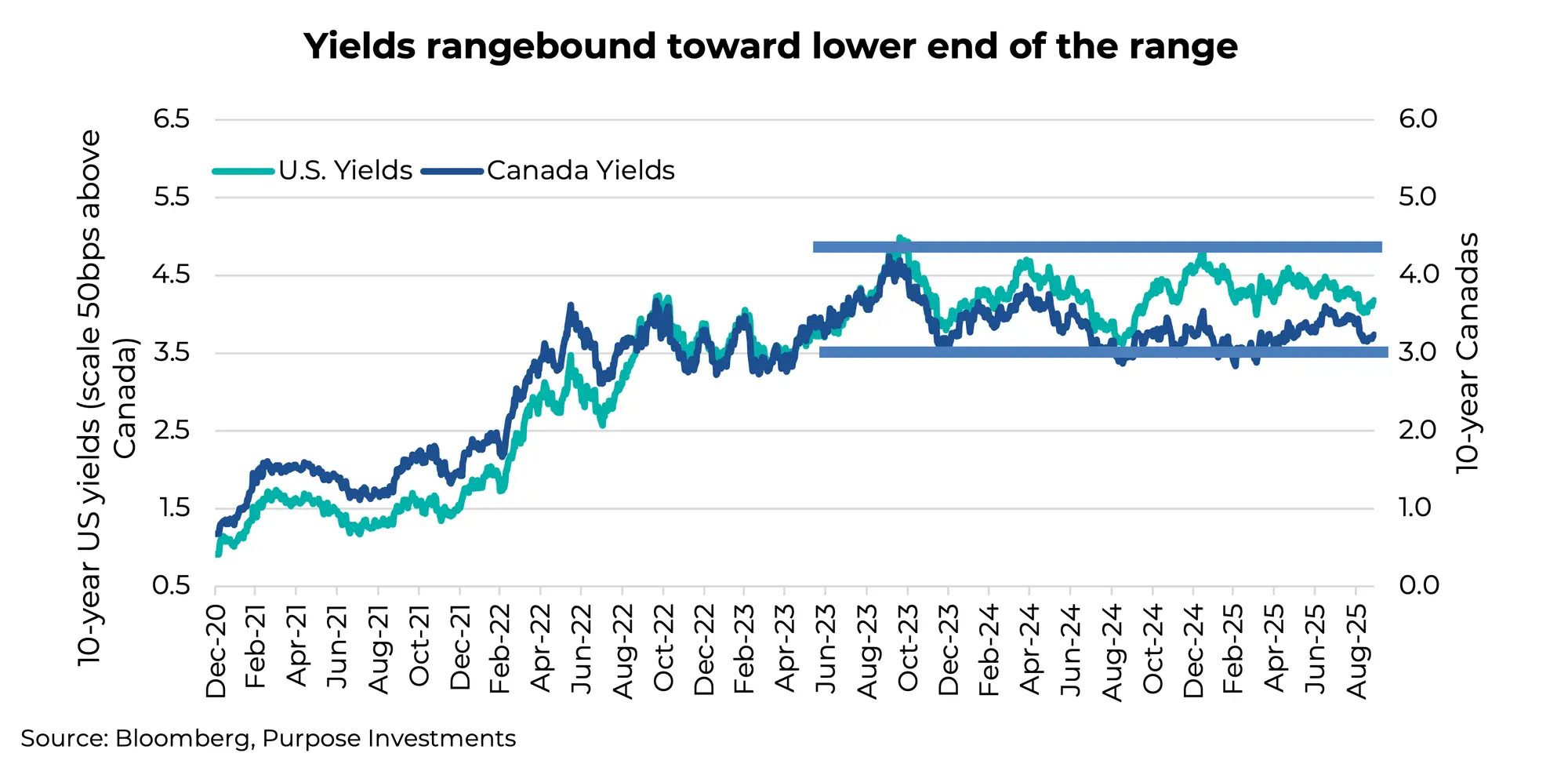

Please don’t jump to the conclusion that inflation is no longer a risk; we believe it’s quite the opposite. With short-term rates coming down, fiscal spending turning up, and a delayed impact of tariffs and changes in labour, inflation is one of our bigger concerns going forward. Especially with a still-absent economic growth slowdown, which would ease inflation. But for now, inflation has proven not too hot or cold. This has allowed bond yields to come down somewhat, which provides a tailwind for equities

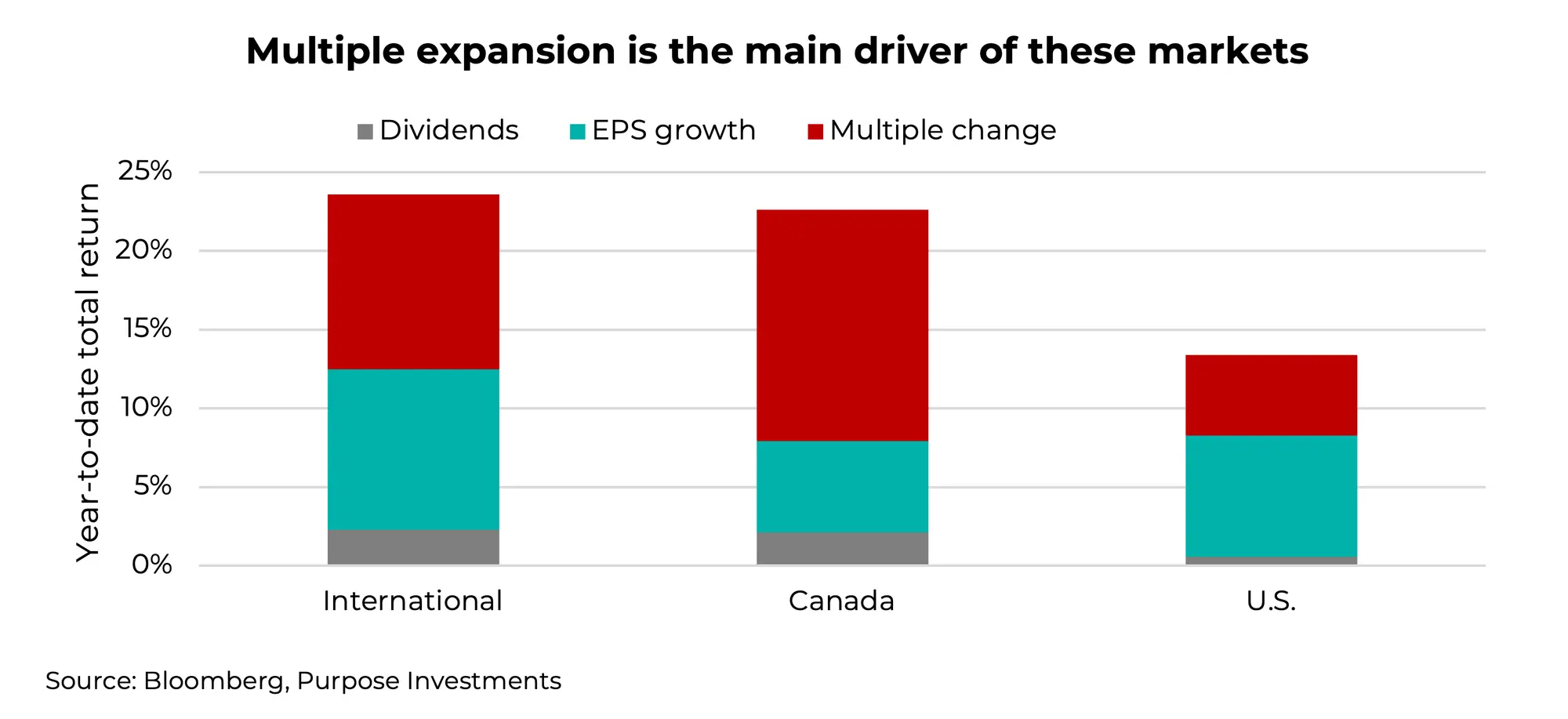

Add yields trending lower and credit following a similar path, and you get multiple expansion. At the fundamental level, equity markets move based on three factors: dividends – which are relatively stable – earnings growth, and multiple expansion/contraction. For the TSX, it has mainly been multiple expansion. International equities have been more balanced between multiple and earnings, while the U.S. has seen limited multiple expansion. Remember, international markets have not enjoyed strong earnings growth in previous years and started from a low valuation, so there’s clearly been some catch-up. The U.S. market was already expansive, so any further multiple expansion is likely hard to come by.

Final Thoughts

The simple fact is that economies, inflation, and yields that are neither too hot nor too cold lead to multiple expansion. Add in reasonable earnings growth, and you have a great combination for markets.

Have markets gone too far? Maybe. Leaning a bit more defensive after such a good year may be prudent. In 2025, international equities have gone from 13.5x to 15.5x, the TSX from 15x to 17x, and the U.S. from 22x to 22.5x price-to-earnings. That’s not crazy, but it’s no bargain.

This rally likely gets interrupted when one of those lukewarm porridges either gets too cold or too hot. Until then, bon appétit.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed; their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions, or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on them. Unless required by applicable law, it is not undertaken, and is specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events, or otherwise.

Copyright © Purpose Investments