by Brian Resnick, CFA, Director and Senior Investment Strategist—Alternatives, AllianceBernstein

How should investors think about integrating private credit into their portfolios?

Over the past 15 years, the retreat of traditional bank lending has opened the door for the rise of private credit—financing provided to businesses and consumers by nonbank lenders, typically outside of public capital markets. The private credit market totals $1.7 trillion today, making it bigger than the US high-yield bond market.

A second wave of asset-backed private credit is extending the market’s reach, solidifying it as a cornerstone of modern alternative investing. That status positions private credit for a key role as investors rethink portfolio construction in a changing macro environment. In our view, making room for private credit isn’t just timely—it could be transformative. But there’s more than one way to reslice the portfolio pie to open up space.

The Appeal of Private Credit…and Its Next Big Opportunity

A big reason for private credit’s allure is its potential to enhance income and returns while bolstering diversification. It offers higher yield premiums—extra yield to compensate investors for accepting less liquidity. And private lenders negotiate loan terms directly with borrowers, enabling them to include covenants and structural protections. These may help cushion the downside in case a loan defaults.

The private credit opportunity seems poised for even more growth today.

Banks continue to pull back from lending, unable to meet the borrowing needs of the real economy. As this happens, private lending opportunities are expanding beyond direct corporate lending to asset-based lending, enabling investors to tap into the massive consumer sector and lend against residential real estate, commercial real estate and hard assets. For investors looking to build a private credit allocation, a blend of corporate direct lending and asset-based lending seems like a good start.

Where to Make Room: The Portfolio-Sourcing Decision

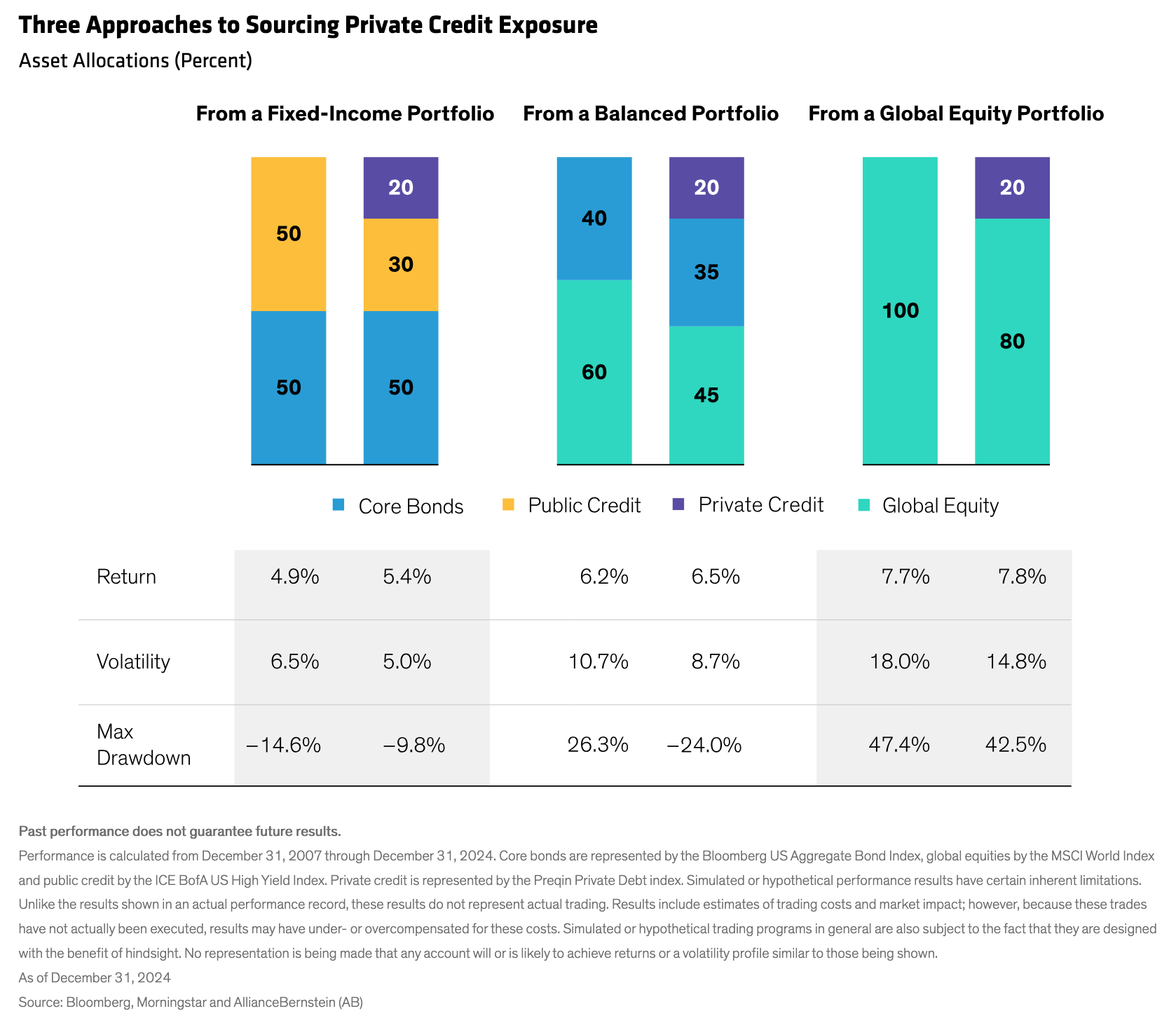

Then there’s the question of how to source the capital to include private credit in a portfolio. In other words, how should other allocations in the portfolio pie chart make room for a new slice? Because private credit has low duration, a modest beta to credit and strong risk/return characteristics, investors can incorporate it by sourcing capital from a diverse range of portfolio allocations (Display).

From a fixed-income portfolio: The simplest way to add a private credit allocation is to make room among high-yield and high-income strategies within an investor’s taxable bond allocation. This may enhance overall income, reduce drawdowns and improve diversification. But private markets’ limited liquidity can make it hard to rebalance portfolios frequently. Liquid credit can help by acting as a buffer to help keep the portfolio in line with its targeted allocations and managing rebalancing more effectively.

From a traditional balanced portfolio: Some investors may create a dedicated alternatives sleeve outside the traditional portfolio. The liquid portfolio is easier to rebalance in a standard way, while the illiquid sleeve can tolerate wider allocation changes before rebalancing and do it over longer timelines—an approach institutional investors often follow. By carving out part of a traditional portfolio for private credit, investors may enhance income, boost total return, and reduce volatility and drawdowns.

From a global equity portfolio: Because private credit has similar returns to equities but with less risk, some investors may use it as an equity surrogate, diversifying an equity portfolio and reducing volatility. One caveat: private credit derives its returns mainly from income, while equity returns are often tilted toward capital gains. This distinction may result in tax consequences, which is why many investors who take this path do so in qualified accounts, where tax consequences can be mitigated.

We think these approaches are good starting points when thinking about how to incorporate private credit in your portfolio. But someone has to manage the private credit strategies, and finding the best-equipped manager or managers requires homework. There are many dimensions to evaluate—from their track record and experience across market cycles to the specifics of their strategy and approach, and from their risk-management processes to their team and resources. As with all investments, a manager’s capability is a key factor in a portfolio’s ultimate outcomes.

From a big-picture lens, we think investors whose profile is suitable for private credit should explore a diversified allocation with targeted investments in direct corporate lending and asset-based lending. The funding can be sourced from a number of different portfolio segments, depending on your starting point. Reslicing the portfolio pie can make room for the potential of private credit.

**

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Copyright © AllianceBernstein