by Tony DeSpirito, Global CIO, BlackRock Fundamental Equities

Major U.S. stock indexes, including the S&P 500 and tech-heavy NASDAQ, hit new all-time highs in the second quarter, defying expectations after early-April tariff announcements sent stocks into a deep dive. While policy uncertainties and geopolitical clouds still loom, we are prudently optimistic for the second half.

Many of the variables that have been moving markets are sentiment driven rather than an outgrowth of weakening company fundamentals. This can be a difficult landscape to navigate and I address key questions on investors’ minds in our Q3 Equity Market Outlook.

Among those questions is a pressing one in the current moment as headlines continue to stoke volatility and markets dance around new highs: Why buy at a market high?

Emphasize time in (not timing) the market

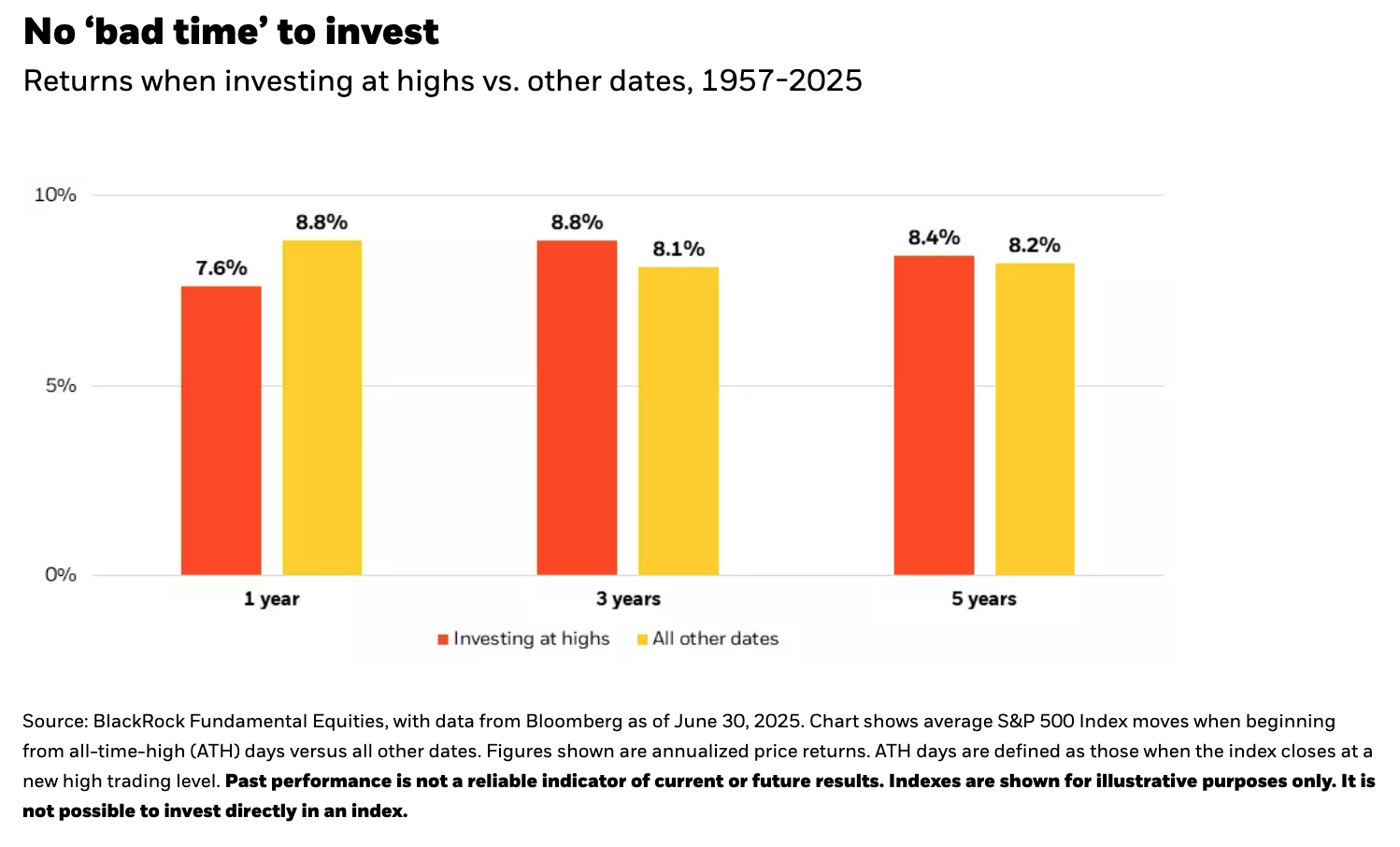

When markets are falling, investors fear “catching the falling knife” (i.e., being harmed by continued drawdown). When markets are up, they fear investing at the peak. Ultimately, there is no “right” time to enter the markets, and attempts at timing entries and exits are generally less fruitful than staying the course, particularly when fundamentals are solid as we believe they are today.

Despite popular perceptions, history shows that buying at local highs does little to affect subsequent one-, three- and five-year outcomes, as shown in the chart below. In fact, “new highs” are a regular feature of the market, with the S&P 500 Index making an average of 18 new highs per year since its inception in 1957.*

Calm fears with a focus on resilience

Adding elements of resilience to equity portfolios can be an antidote in times of uncertainty by offering some measure of stability amid broader market volatility. We focus on three key variables to up portfolio resilience:

1. Quality

A history of earnings stability is a hallmark of a quality company, in our view, and a prudent investment approach amid mixed macro signals. Quality companies generally have strong free cash flow, solid balance sheets and the brand strength and pricing power to maintain, or even grow, their market share relative to competitors in the case of an economic slowdown.

A record of dividend payments is another marker of quality. History shows dividends are less volatile than both stock prices and corporate earnings, as company managements are loath to cut a dividend and risk alarming markets. This imposes a fiscal discipline that historically has allowed dividend-paying stocks, and particularly dividend-growth stocks, to fare better in a downturn.

2. Valuation

In equity investing, price is what you pay and value is what you get. We find many fundamentally strong large-cap stocks priced at a discount to their earnings potential today, as the market has bypassed them to reward a handful of AI-leveraged super-earners.

Yet don’t disregard the mega-caps strictly on price. Not all growth companies carry equal risk. Most members of the “Magnificent 7,” for example, demonstrate quality characteristics (e.g., high profitability and free cash flow) that may earn them their higher price tag. Essentially, they may be good value for their price. This distinguishes them from more speculative high-growth, low-profitability companies that tend to expose investors to the risks of substantial drawdowns.

3. Diversification

The benefits of diversification can be more pronounced amid dramatic market reversals. Sectors and factors that were most battered in the April drawdown led the way on the rebound. Portfolios with a balance of traditionally defensive sectors such as healthcare and growth-oriented areas such as technology could be better positioned to weather sentiment-induced ups and downs than those with more similar risk exposures.

A strong innovation impulse in both of these sectors should accrue to long-term growth prospects, while both also offer elements of stability. Parts of today’s tech sector, such as software, could be considered the new “staples” ― essential to everyday life in the 21st century. We find that portions of healthcare outside of pharma, such as healthcare services and medical devices, exhibit key quality characteristics. They’re stable earners with good growth prospects and attractive valuations.

Volatility: Inevitable, uncomfortable, totally normal

Stock markets can be moved ― sometimes significantly ― by macro fears and investor reaction to them. Yet company fundamentals and earnings prowess, areas we emphasize as bottom-up stock pickers, are less erratic and historically have been shown to be the real drivers of long-run investment outcomes.

Volatility, and the new highs that often come with it, need not derail long-term investing aims. A focus on resilience can not only fortify portfolios but provide investors with the wherewithal to weather bumpy markets.

Copyright © BlackRock Fundamental Equities