The ETF market just wrapped up its best year ever—and PwC says the rocket fuel’s still burning. According to their latest global survey, ETFs 2029: The Path to $30 Trillion, the next five years could more than double global ETF assets under management (AuM). The industry is charging ahead on the back of innovation, regulation, and investor demand. And if the trends hold, ETFs are about to become the preferred investment wrapper for just about everyone.

Let’s break down what’s powering this transformation—and where it’s headed next.

$14.6 Trillion and Climbing

In 2024, ETF AuM surged by 27% to hit $14.6 trillion. Over the last five years, ETFs pulled in $5.2 trillion—far outpacing the $3.2 trillion that flowed into mutual funds. According to PwC, 60% of survey respondents believe ETF assets will reach at least $26 trillion by 2029. Nearly a third see the total topping $30 trillion.

Why the bullish outlook? Simple: investors want access, transparency, lower fees—and more flexibility. ETFs check every box.

Innovation Is the New Alpha

ETFs aren’t just growing—they’re evolving. As PwC puts it, “Innovation throughout the value chain is attracting new investors.” From AI-driven portfolios to tokenized private market access and slick mobile-first platforms, ETFs are getting smarter, faster, and more tailored to investor needs.

The “great wealth transfer” is also playing a massive role. With over $68 trillion expected to pass from boomers to their kids in the next decade, younger, tech-savvy investors are driving demand for digital-first investing experiences—and ETFs are primed to meet them there.

Regional Growth Snapshot: Four Markets, One Direction

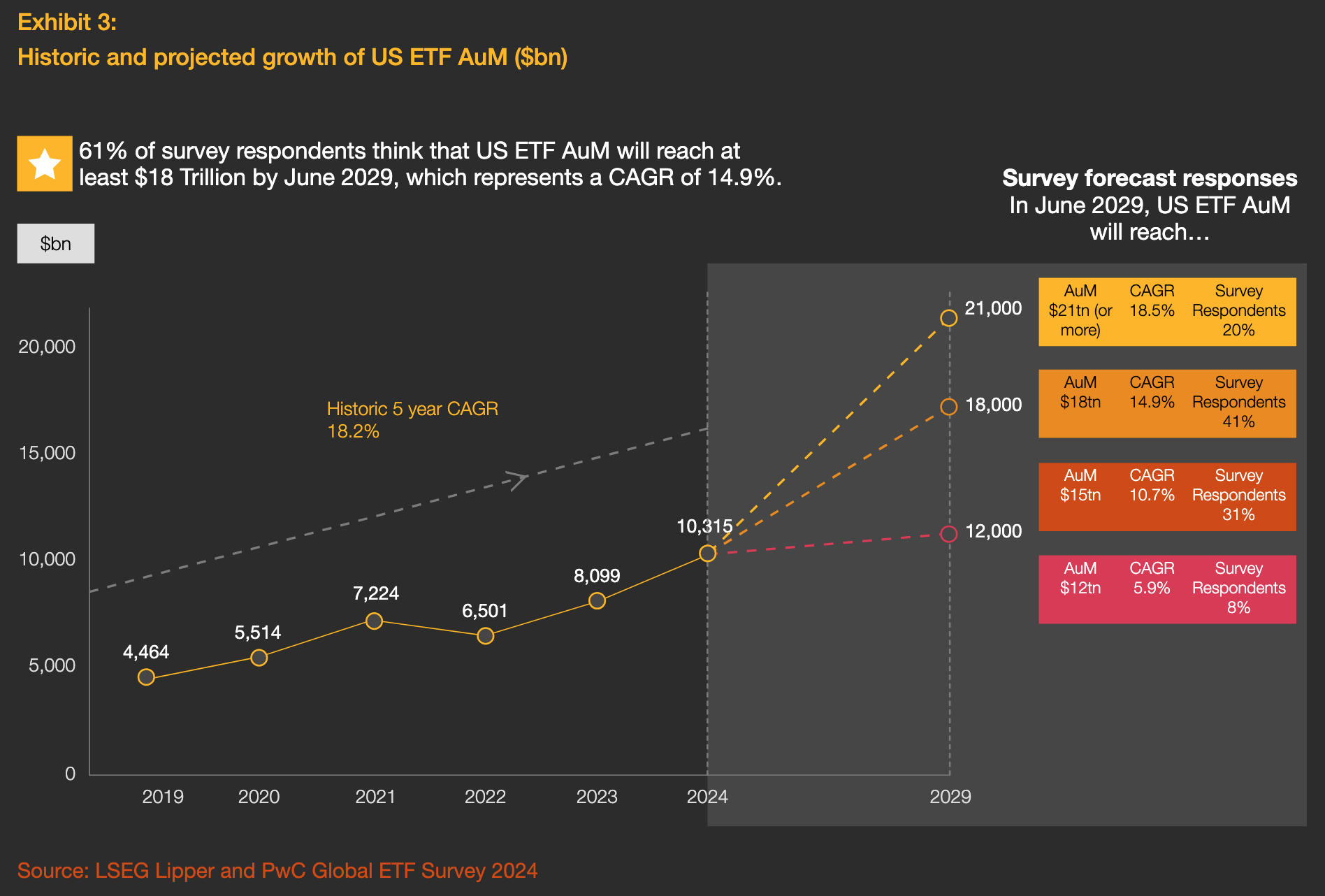

United States: Already sitting at $10.3 trillion in AuM, the U.S. ETF market could climb to $18–21 trillion by 2029. That includes $287 billion in active flows last year—and a fast-growing appetite for crypto ETFs.

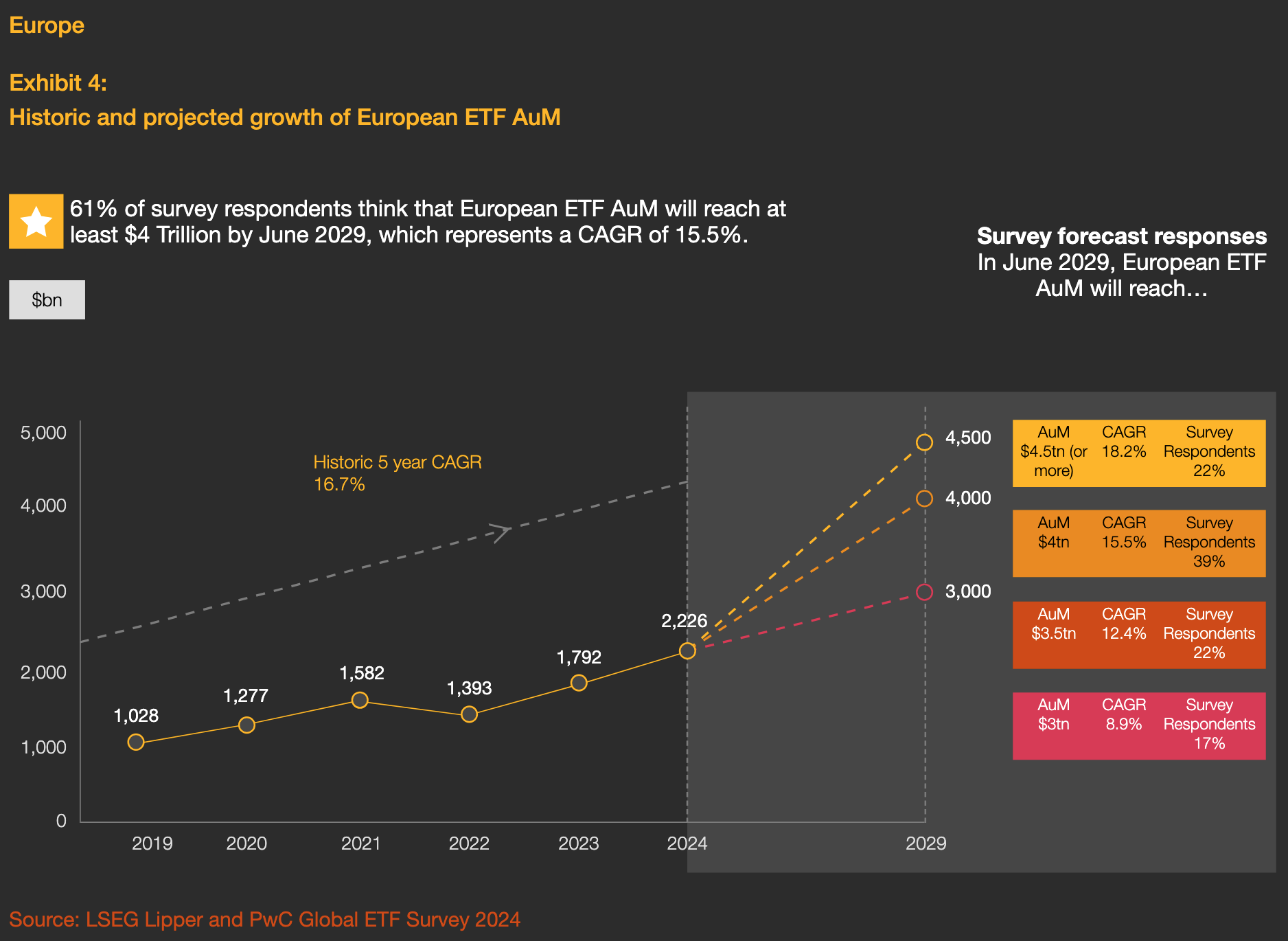

Europe: ETF assets in Europe reached $2.2 trillion in 2024, and are expected to double by 2029. Digital distribution, retail engagement, and regulatory momentum (like the EU’s Retail Investment Package) are setting the stage.

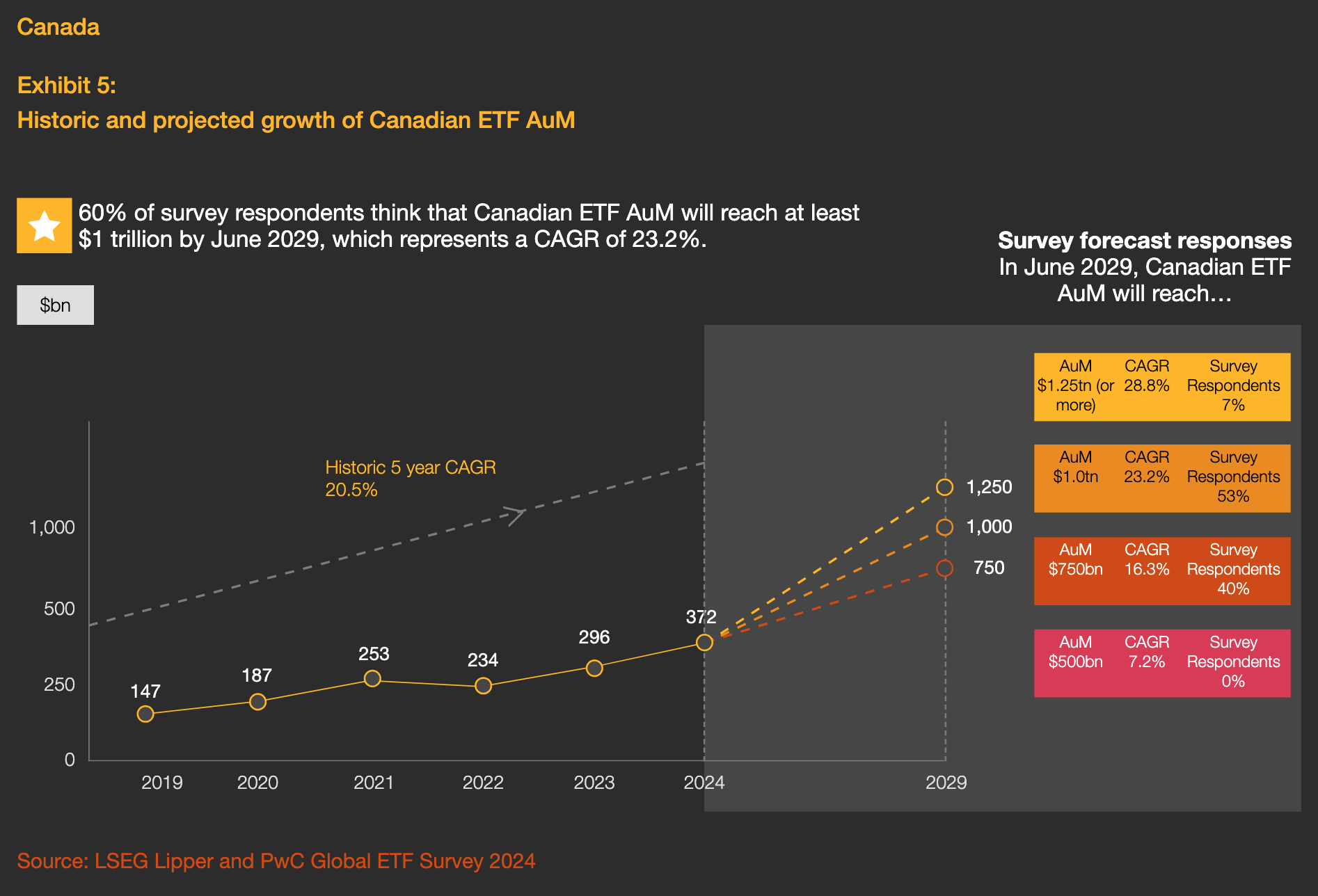

Canada: The most active ETF-friendly market outside the U.S., Canada’s ETF assets hit $372 billion and are on track to cross $1 trillion. PwC points to flexible rules that allow ETFs to be issued within mutual fund structures as a key enabler.

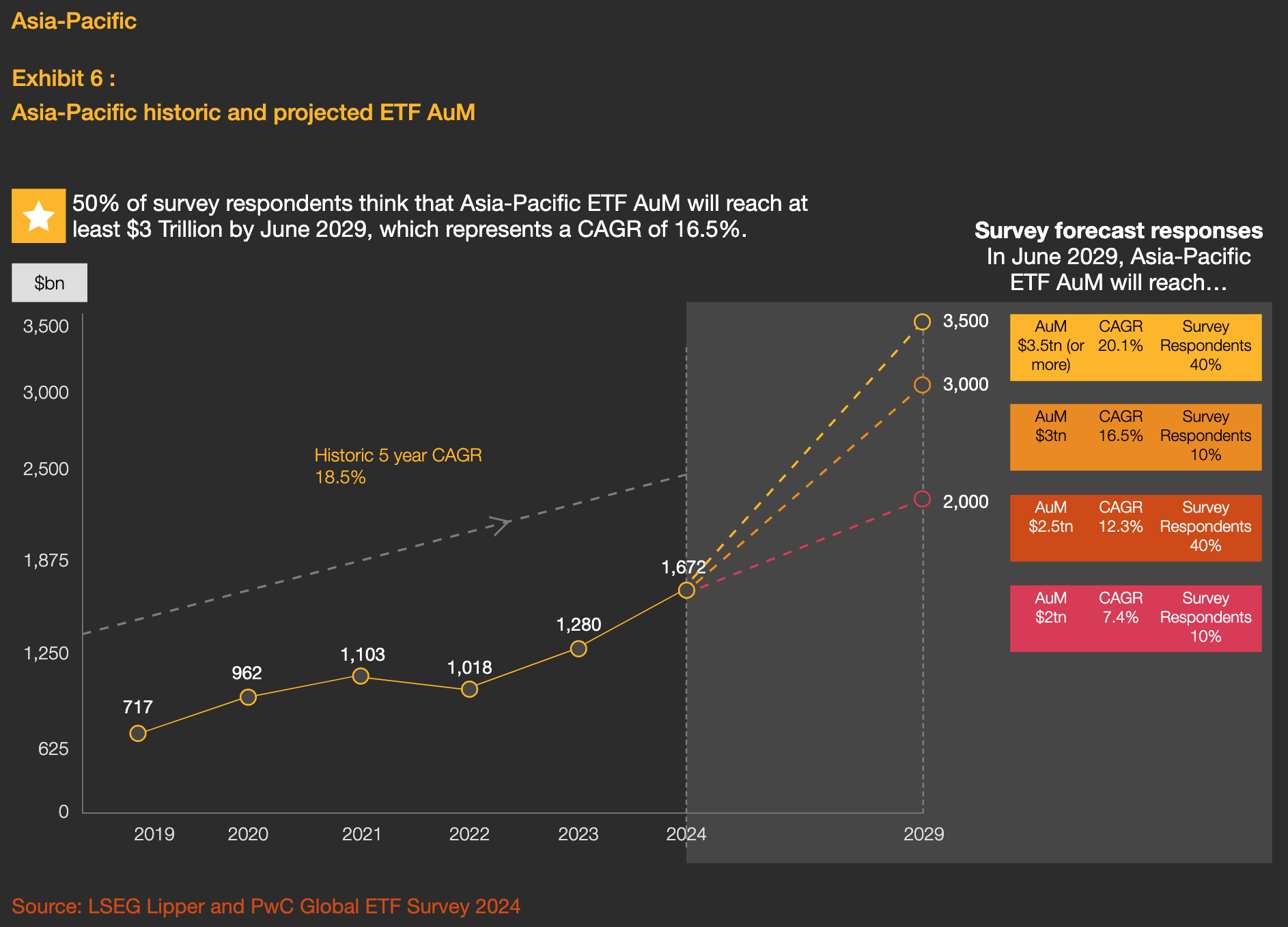

Asia-Pacific: Regional AuM jumped 31% in 2024 to $1.7 trillion. China and Japan lead, but Taiwan, Australia, and Korea are gaining ground. Half of local respondents expect the region to pass $3 trillion by 2029.

Active ETFs: No Longer a Niche

Remember when people thought active investing couldn’t work in an ETF? That debate is over. “By the end of 2024, active ETF AuM had grown by 52% to reach $1.03 trillion globally,” PwC notes. Two-thirds of survey participants believe that number will triple by 2029.

Why the surge? Active ETFs are becoming a go-to way to access hard-to-reach markets like private credit, CLOs, and even private equity—all with lower costs and more transparency.

Beyond Stocks and Bonds: The Next Product Wave

Regulatory shifts are opening the floodgates for innovation. In the U.S., crypto ETFs and private credit strategies got the green light. Europe’s playing catch-up, with Ireland allowing 100% CLO exposure and Luxembourg easing disclosure rules for actives.

And the products themselves? Getting more creative by the day. Think buffer ETFs, options overlays, and yield-focused strategies built to deliver customized risk-return profiles. As PwC says: “Strategic partnerships between ETF and private market managers” will be key in this next phase.

Digital Distribution: The New Battleground

As the ETF market gets more crowded, distribution becomes a competitive edge. PwC highlights how “investment apps, neo-broker platforms and other digital channels” are unlocking access—especially for retail investors in the U.S. and Canada.

In Europe, ETF savings plans (like those taking off in Germany) are gaining steam. And globally, model portfolios are rising fast as one of the most effective ways to deliver ETFs at scale.

Tokenization: The Next Big Disruptor?

Tokenization might still feel futuristic—but it’s coming fast. PwC sees massive potential in “borderless distribution, fractional ownership, and access to private markets” via tokenized ETFs. The ability to sidestep traditional intermediaries and bring private markets to everyday investors could be a game-changer.

Some managers are already looking to enter new markets—particularly in Asia-Pacific and Latin America—using tokenized offerings, white-label partnerships, and UCITS passporting.

Standing Out in the Crowd

With all this growth comes competition. PwC lays out four ways ETF issuers can stay ahead:

- Stand out through innovation – New asset classes. Custom strategies. Tailored risk profiles.

- Go deeper with active ETFs – Leaner models and broader access to complex exposures.

- Embrace disruptive tech – Use AI, automation, and tokenization to lower costs and boost reach.

- Be crypto-ready – Don’t wait for regulation—start preparing now.

Bottom Line

The ETF story is no longer about catching up—it’s about leading. PwC’s message is clear: “The faster the ETF sector grows, the more competitive it becomes.” The firms that thrive will be those that adapt fastest, think differently, and use technology to scale smarter.

In short: ETFs aren’t just winning—they’re rewriting the rules of asset management.

Footnotes:

1 PricewaterhouseCoopers. "https://www.pwc.com/gx/en/industries/financial-services/publications/etf-survey.html" PwC, 19 June 2025.